There’s something satisfying about closing a book—the final chapter read, a story completed. In accounting, however, “closing the books” is rarely that calm.

The end of financial year process is intense, with countless transactions to review and tight deadlines to meet. But with proper planning, you can position your firm as a trusted partner in your clients’ financial success.

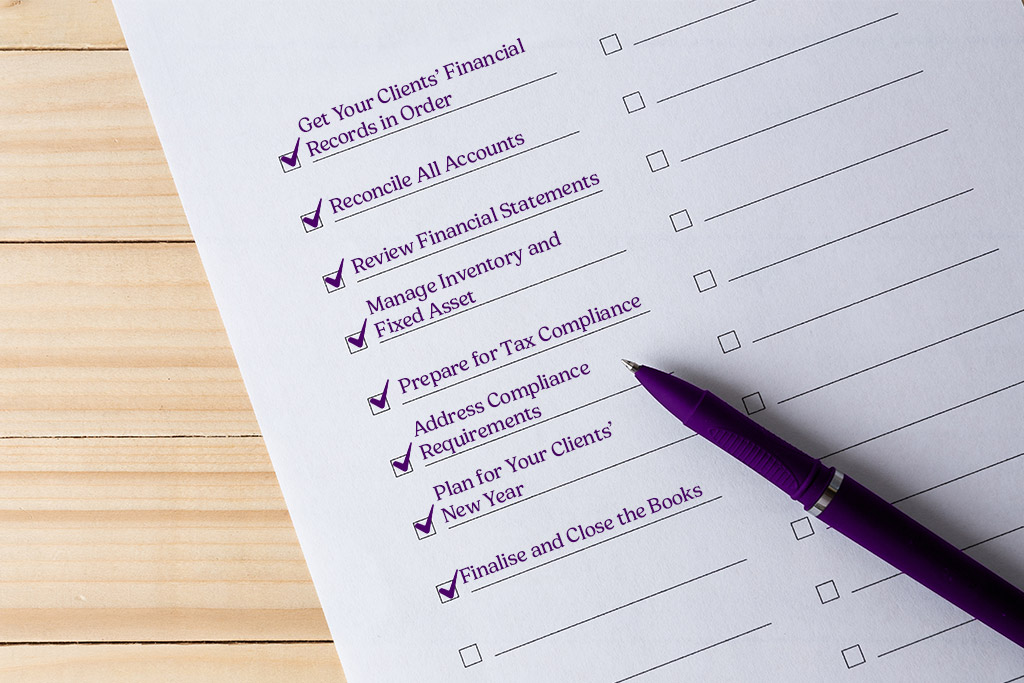

Below, we’ve put together a checklist to help you close your clients’ books by financial year end and provide them with the clarity they need to start a new one strong.

What is End of Financial Year in Accounting?

The end of financial year is the time to ensure every chapter in your clients’ financial story adds up. It involves reviewing and adjusting all transaction records from the past 12 months so that financial statements accurately reflect how the business performed.

Most businesses follow the July-to-June timeframe, but some may operate in different fiscal years. Timings aside, a thorough EOFY close process helps business owners ensure:

- A clean cut-off between accounting periods

- Proper recording of a company’s financial transactions in the correct period

- Adjustments of any errors or discrepancies

- Reliable financial data for timely tax filings and business analysis

8 Tasks That Should Be on Your EOFY Checklist

Get Your Clients’ Financial Records in Order

Before diving into complex analyses, make sure that your clients’ basic financial records are complete and accurate by:

- Gathering all financial documents, including income statements, cash flow statements, and balance sheets

- Updating your accounting software with all financial transactions, categorized as income or expenses, through 30 June

- Organising receipts and documentation for unusual or significant transactions

With everything on your accounting team's plate, it can be tempting to wait until the last quarter to tackle a potentially chaotic stack of documents. However, implementing a system for organising financial data—with clear naming conventions and regular backups —can save your accountants significant time and energy when preparing financial statements. This approach is especially important if you’re onboarded during the EOFY period with tight schedules.

Related Reading: Top Accounting Task Management Software for Modern Firms

Reconcile All Accounts

After document collection comes reconciliation. Review your client company’s transactions (credit card, invoices, receipts, and loan balances) and match them against their general ledger accounts. If you identify past due invoices or outstanding payables, be sure to develop a collection plan with your clients.

Discrepancies may surface during reconciliation. When they do, determine the cause and adjust entries as needed. These errors might point to missed transactions or indicate something more serious, like fraud. Whatever the case, don’t forget to document your reconciliation process thoroughly.

Review Financial Statements

Accurate financial statements offer insights into trends, anomalies, and opportunities not apparent in day-to-day accounting. As a trusted advisor, your role is to turn these numbers into actionable business intelligence your clients can use to make decisions.

Focus on these areas:

- Profit and loss statement: Compare revenue and expenses against previous fiscal years and budget

- Balance sheet: Verify the accuracy of assets, liabilities, and equity accounts for a clear picture of the company's financial position

- Cash flow statement: Assess the business's ability to generate and use cash

- Statement of retained earnings: Examine changes in equity position

Manage Inventory and Fixed Asset

Asset valuation directly impacts financial statements and potential tax deductions. Coordinate with your clients’ operations team to physically verify the condition of their assets.

Key tasks include:

- Conducting physical inventory counts and reconciling with accounting records

- Writing off obsolete or damaged inventory when necessary

- Updating fixed asset register with new purchases and disposals

- Calculating depreciation for all applicable assets, ensuring compliance with the Australian Taxation Office (ATO) or the Inland Revenue Department (IRD)

- Conducting impairment tests on high-value or long-term assets

Prepare for Tax Compliance

While taxes aren’t due until October of the new year, early preparation can reduce your clients’ tax liability—and stress. Start by gathering financial documents that help business owners claim tax deductions and credits. Also, track any PAYG/PAYE instalments made throughout the financial year.

Another good practice is to remind clients about payment summaries, Single Touch Payroll finalisation in Australia, or payday filing obligations in New Zealand.

With all financial data in hand, you can recommend tax advice tailored to each client’s situation.

Related Reading: Smart Tax Preparation: A Practical Guide to Automation

Address Compliance Requirements

The end of the year is the ideal time for comprehensive compliance reviews across all aspects of your clients' businesses. These reviews help spot potential issues early and keep your clients in good standing with current tax laws.

Some steps to take:

- Review business licenses and permits due for renewal

- Prepare for annual report filings with state agencies

- Check industry-specific compliance requirements

- Update corporate minutes and records for any major decisions

- Review insurance coverage to ensure policies are up to date

- Ensure timely lodgment of taxable payments annual report for industries required to report contractor payments

Plan for Your Clients’ New Year

Use your financial analyses as a basis for planning for a new financial year. Help your clients improve cash flow management, set realistic budgets, and align financial strategies with business goals.

Consider also opportunities to evaluate pricing strategies for profitability or recommend tech improvements to improve operational efficiency.

Regular financial planning discussions are an opportunity to deepen client engagement, potentially leading to service expansion.

Finalise and Close the Books

This is the culmination of all end-of-financial-year accounting activities. You’re ready to close your clients’ books once every account is properly balanced. This important step cannot be overstated; errors and omissions can cascade into the new year and snowball into other issues.

Provide confidence in your financial reporting by:

- Making final adjusting entries as needed

- Recording accruals and deferrals to match revenues and expenses properly

- Closing temporary accounts (revenue, expense, and dividend accounts)

- Backing up accounting data before creating the new year

- Locking the prior period in your accounting software to prevent changes

- Distributing finalised reports to appropriate stakeholders, including management, board members, and investors

- Obtaining client approval and sign-off on financial statements and tax filings to ensure accountability and transparency

Be a Trusted End of Year Accounting Partner

Far more than an administrative task, the end of financial year process drives informed decision-making and business growth. No matter how hectic work gets, performing accurate financial reporting and tax compliance will position your firm as a strategic partner for business owners looking to maximise their tax return outcomes.

Our EOFY checklist is a great place to start. Just as important is establishing firm-wide procedures with specific deadlines to keep your team aligned. And throughout it all, remember to be a proactive communicator—your clients will appreciate being kept in the loop on timelines, requirements, and next steps.

Looking to strengthen your year-end operations? TOA Global’s Australian-trained offshore accountants and bookkeepers provide expert support with precision and efficiency. They can integrate with your workflows and handle complex EOFY tasks, freeing your in-house staff to focus on client relationships.

Book a chat with us today.