If you search “person with many tasks” on Google, you’ll get stock images of six-armed people juggling their to-do lists. They don’t seem happy. Being in the accounting space, we get it. If these hexapod humans still struggle to keep up, imagine how we manage with our standard-issued two arms and replenishing lists of (very real) tasks.

Fortunately, task management tools exist. While your accountants can’t grow extra arms, they can certainly get better at organising their work.

Benefits of Using Task Management Software for Accountants

There are several advantages to investing in task management software. Below, we list five:

Streamlined Workflow Management

Accounting project management software gives your firm a system that automatically organises and tracks project progress based on your predefined workflow. Your team receives alerts when due dates approach, ensuring they’re on track with client deliverables.

Related Reading: The Ultimate Guide to Accounting Workflows

Strengthened Quality Control

With clear and structured workflows, you establish standardised processes, allowing your firm to deliver consistent, high-quality client experience regardless of who's handling the project. You'll also maintain a clear trail of who did what and when, which is invaluable for compliance and risk management.

Better Resource Allocation

Having visibility into who’s working on what allows you to assess the capacity of your accounting team. It’s easier then to identify potential bottlenecks and redistribute work before it becomes a headache. Taken together, you have data to back up decisions about hiring and expanding your team.

Improved Client Service

With robust task management software, your client service gets an upgrade, too. You can share documents securely, provide automatic updates, and maintain a clear record of all interactions. This means fewer “What’s the status on this?” emails from clients and more time actually getting work done. A win for everyone!

Supported Business Scalability

Task management software helps accounting firms grow without sacrificing quality or organisation. For one, onboarding new clients becomes more efficient because you have systems to manage workload increases. Remote work is also more feasible since everyone can access what they need from anywhere. Most importantly, you have better control over resources and processes, helping preserve quality and profitability as your practice grows

10 Task Management Software Accountants Should Consider

If you’re sold on the value of accounting project management software but unsure what to choose, we’ve curated ten for you.

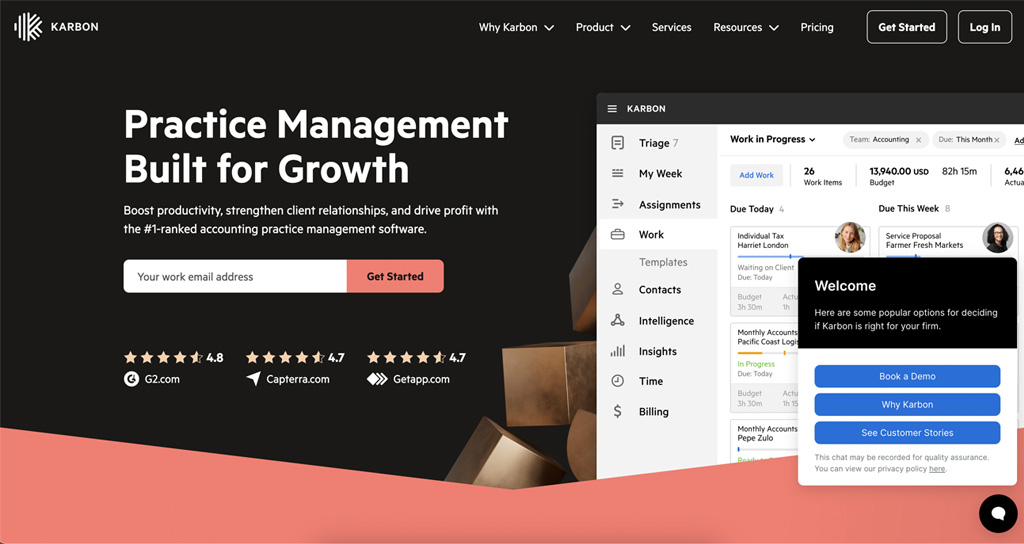

Karbon

Cloud-based Karbon is purpose-built for accounting and bookkeeping firms. It handles complex projects involving multiple members and extensive client collaboration. With Karbon, you won’t have to invest in separate platforms for communication, document management, and business analytics. The platform combines them all.

Karbon’s extensive library of accounting-specific workflow templates and real-time integrations make it particularly powerful. But there’s a trade-off: its robust features require more set-up and onboarding time, which may work for medium to large firms but not small ones.

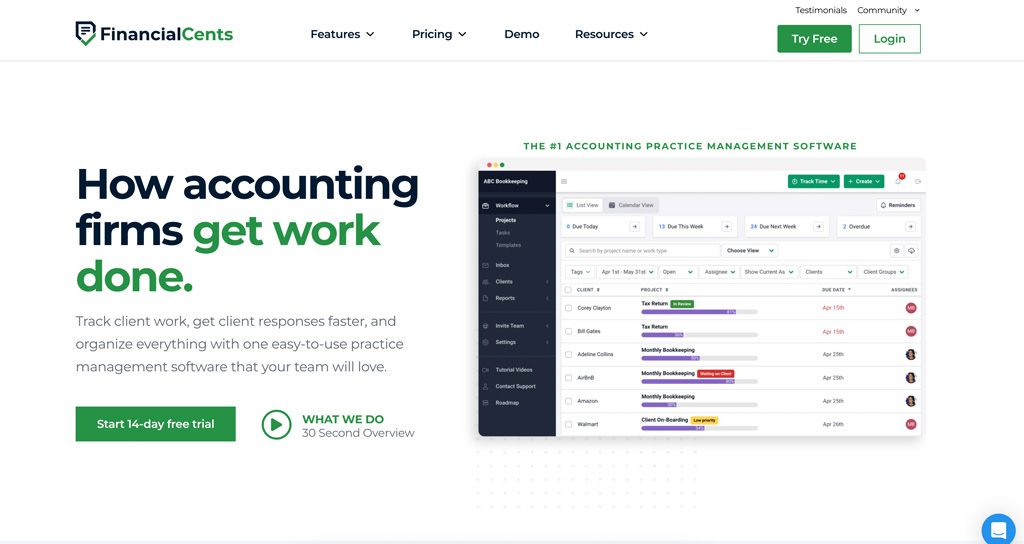

Financial Cents

Small accounting firms can look to Financial Cents for their task management needs. The software excels at standardising recurring tasks while offering client management capabilities, albeit limited.

Financial Cents’ integration with QuickBooks Online allows users to track time spent on client work, supporting accurate invoicing. The platform’s straightforward features make it easy to implement, even for people who aren’t particularly tech-savvy.

Asana

Asana ranks among the best project management software on the market. Its intuitive interface and flexible customisation options let teams organise multiple projects however they prefer. List, Kanban board, timeline, dashboard—all four views are possible.

Additionally, the platform facilitates collaboration through commenting, file sharing, and over 200 third-party integrations.

Although Asana provides templates and workflow automation, it’s not specific to accounting. Firms must invest time in creating templates that suit their needs. Asana may be the right fit for solo accountants or small firms that are just beginning to implement project management systems.

TaxDome

TaxDome boasts an all-in-one approach to accounting practice management. Its task management features are integrated with its document management, payment processing, and e-signature capabilities.

Users receive access to a branded client portal and mobile app. These tools enable clients to securely manage all touchpoints with your firm without the need for constant back-and-forths.

The platform’s workflow automation tools particularly excel for tax preparation and compliance work, making TaxDome a compelling choice for tax-focused accounting firms.

Canopy

Canopy combines practice management with task tracking, helping firms streamline their daily operations. Accounting and tax professionals will appreciate being able to communicate with colleagues, tagging and mentioning them in comments, without switching to an external messaging platform.

Among its features, Canopy’s native tax resolution tools and document management stand out, though both are paid add-ons. In fact, the platform uses modular pricing, so accounting firms pay based on which specific features they need.

Jetpack Workflow

As its name suggests, Jetpack Workflow helps accounting firms organise and automate tasks using customisable templates designed for common tax and accounting workflows. The platform includes time-tracking capabilities and provides a dashboard to monitor project progress.

Jetpack, however, is limited beyond task management. Firms will need separate solutions for client engagement and document management.

Trello

Trello is another popular task management tool similar to Asana. It brings the concept of sticky notes on a wall into the digital realm through Kanban-style boards. Each board represents a project, with tasks organised into various columns indicative of different workflow stages.

Trello’s simplicity makes it ideal for smaller firms or those transitioning from manual systems. They can create templates for recurring tasks but should also adapt Trello’s general-purpose templates to their workflows, as the platform’s library isn’t tailored to accounting or bookkeeping.

Zoho Practice

The latest addition to the Zoho finance ecosystem, Zoho Practice offers custom modules for practice management, tax preparation, and financial statement generation.

Accountants can automate routine compliance tasks and manage practice-wide deadlines from a central dashboard. Its integration with Zoho Books allows financial data sharing without manual re-entry.

The platform works well for small to mid-sized accounting firms looking for industry-specific features rather than generic project management (i.e., Zoho Projects). While powerful, new users should expect a steep learning curve to utilise its full accounting capabilities.

Basecamp

Basecamp is a cloud-based project management tool that prioritises clear communication and in-team collaboration. Its centralised dashboard brings together all to-do lists and schedules in one place. Plus, its document sharing and client communication tools work for basic accounting workflow needs.

However, Basecamp lacks the industry-specific features found in dedicated accounting software. Firms handling more complex tasks might outgrow the platform relatively quickly.

Monday.com

Customisation is central to Monday.com. Using a color-coded interface, the platform helps teams track project progress and capacity effectively. Its automation features streamline routine tasks, though firms should expect to invest time in initial setup to create accounting-specific workflows.

Monday notably doesn’t offer many client customisation options. Accounting firms working with diverse clients won’t be able to create individualised client profiles within the platform.

Finding Your Firm’s Perfect Software Match

A universal “best” accounting project management software doesn’t exist, but there’s definitely at least one that speaks to your firm’s circumstances:

- Firm size: Your current structure might benefit from simpler, more affordable solutions (like Trello or Financial Cents) or require robust systems with advanced capabilities (like Karbon).

- Service offerings: Tax-focused practices need features different from those of accounting firms offering advisory services. Templates and workflows that match your service mix are key.

- Team tech comfort: Are your accountants and bookkeepers tech-savvy, or would they prefer options with tiered complexity?

- Budget considerations: Balance immediate costs against long-term value. Sometimes, investing more initially saves headaches down the road.

That said, evaluate a few matching options and test with a small team before locking in on your choice. With the right software in place, your firm will deliver better results for clients while making work more manageable for your team. They won’t even have to wish for more arms.

Optimise Your Workflow with Software and Staffing

While the right accounting project management software organises your workflow, TOA Global’s offshore staffing services provide the qualified staff to execute it flawlessly.

Our Australian-trained accounting professionals can help your firm deliver exceptional client service while managing repetitive tasks within your chosen software.

Experience our expertise firsthand. Book a chat with us today.