- Practice management software is essential for modern accounting firms—it centralizes tasks, client communication, documents, and deadlines into one streamlined system.

- When choosing a tool, focus on fit over features—consider your firm’s unique workflows, team size, budget, integration requirements, and growth plans.

- Small firms and solo practitioners benefit most from simple, affordable platforms with strong task automation.

- Mid-sized and large firms should prioritize scalability, advanced reporting, and collaboration features to handle complexity.

- The right software not only saves time and reduces errors, but also improves client experience and supports sustainable growth.

Running an accounting firm often feels like a constant juggling act—meeting client deadlines, ensuring compliance, and managing a team. Keeping everything under control can be overwhelming; that’s why a practice management software for accountants isn’t just a helpful tool; it’s a godsend solution, essential for optimizing workflows, enhancing collaboration, and driving growth.

Working with over 1,190 CPA firms (and counting), we’ve seen how the right tools can transform accounting firms’ operations. In this guide, we’ll explore the benefits of accounting practice management software, discuss how to choose the right platform, and highlight the leading solutions in the market.

In no specific order, here’s a quick overview of the top accounting firm practice management software accountants use to streamline workflows, improve collaboration, and deliver consistent client service.

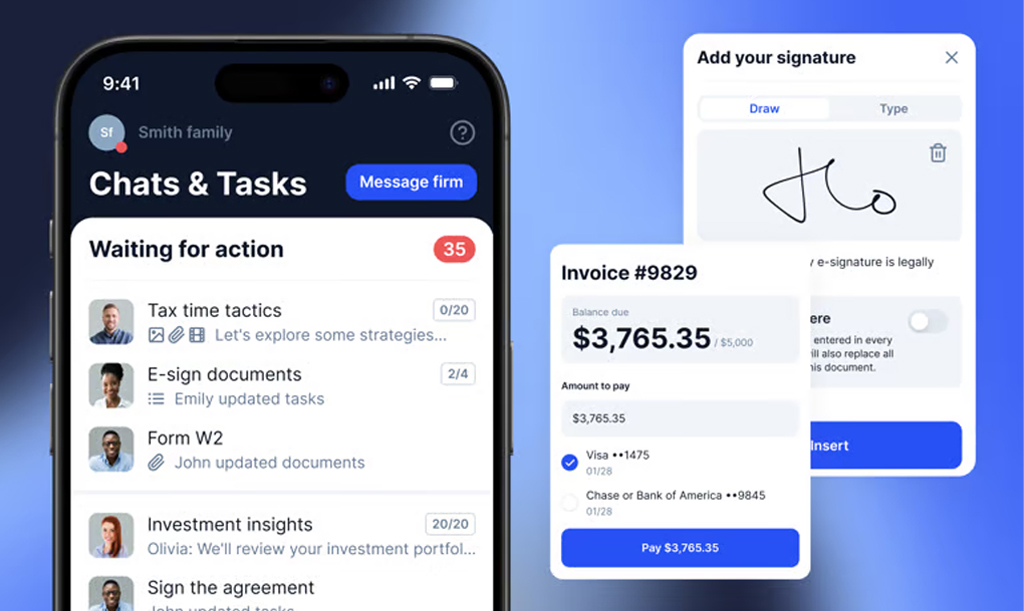

TaxDome

Financial Cents

Jetpack Workflow

Karbon

Canopy

Firm 360

Keeper

What Is Accounting Practice Management Software?

Accounting practice management software is the backbone of a modern accounting firm. It brings together the essential tools accountants need into one organized system:

- Task tracking

- Client communication

- Document management

- Deadline monitoring

Instead of switching between spreadsheets, email, and multiple apps, everything is centralized. That means you can see what needs to be done, who’s responsible, and whether deadlines are on track. Routine tasks, such as monthly reconciliations, payroll, and tax preparation, can be automated, while client reminders and compliance checks occur seamlessly in the background.

The real value is clarity and control. Teams can collaborate in real time, share files securely, and keep clients updated without chasing information. For firm owners, it means peace of mind knowing nothing is slipping through the cracks, and for clients, it means consistent, timely, professional service.

What Is Accounting Practice Management Software?

Accounting practice management software is the backbone of a modern accounting firm. It brings together the essential tools accountants need into one organized system:

- Task tracking

- Client communication

- Document management

- Deadline monitoring

Instead of switching between spreadsheets, email, and multiple apps, everything is centralized. That means you can see what needs to be done, who’s responsible, and whether deadlines are on track. Routine tasks, such as monthly reconciliations, payroll, and tax preparation, can be automated, while client reminders and compliance checks occur seamlessly in the background.

The real value is clarity and control. Teams can collaborate in real time, share files securely, and keep clients updated without chasing information. For firm owners, it means peace of mind knowing nothing is slipping through the cracks, and for clients, it means consistent, timely, professional service.

How to Choose the Right Accounting Practice Management Solution for Your Firm

Choosing the right practice management software for your accounting firm is not as easy as it seems. Your accounting practice management software will house all your firm’s tasks and clients’ sensitive data, and can also affect your service delivery. With so many options available, it’s natural to feel overwhelmed.

However, by breaking the process into clear, actionable steps, you can confidently decide to align with your firm’s unique needs. Below, I’ll guide you through a strategic approach to help you select the best tool for your business.

Identify Your Firm’s Unique Needs

Before exploring specific tools, analyze your team’s day-to-day challenges and needs. The correct CPA practice management tool should address these pain points directly.

- Recurring Workflows – A massive part of accounting is handling repetitive tasks, such as monthly reconciliations, payroll, tax prep, and client follow-ups. Ensure the software can automate these tasks or provide templates to standardize them.

- Team Collaboration – If your team struggles with miscommunication or missed deadlines, look for project management tools that integrate email with task management to keep everyone aligned.

- Deadline Management – Do missed deadlines or bottlenecks cause issues, especially during tax seasons? An accounting task management tool with visual project timelines can improve transparency.

- Regulatory Compliance – Many firms need tools to help track regulatory deadlines or secure sensitive financial data. Ensure the software complies with data privacy standards like SOC 2 or GDPR.

Create a list of must-have features versus those that are “nice to have.” This will help you evaluate tools more objectively in the future.

Consider Your Team Size and Budget

Accounting practice management tools can vary significantly in pricing and scalability, so your firm’s size and resources will heavily influence your choice.

- Small Firms or Solo Practitioners – Prioritize simplicity and affordability. Look for intuitive practice management tools that require minimal setup and offer essential features without daunting functionality.

- Mid-Sized Firms (10-50 Employees) – To manage growing complexity, consider practice management tools that handle multiple users, projects, and integrations.

- Large Firms (50+ Employees) – For enterprise-level firms, focus on scalability and advanced reporting features to accommodate multiple teams and high work volumes.

Don’t forget to account for long-term costs, such as subscription fees and any add-ons required for additional features or integrations. Balance your budget with the potential efficiency gains the accounting practice management solution can offer.

Evaluate User Experience (UX) and Ease of Use

No matter how powerful a CPA practice management tool is, it won’t be effective if your accounting team finds it confusing or time-consuming.

- Does the software have a user-friendly interface?

- How steep is the learning curve? Will your team need extensive training to use it effectively?

- Does the platform offer mobile accessibility, enabling team members to manage tasks or projects remotely?

Request demos or trial accounts to test how quickly your accountants can adopt the software. Gather feedback to ensure it meets their needs.

Look for Integration Capabilities

These days, accounting practices require a robust accounting tech stack, and your practice management tools should complement these systems, not disrupt them. Poor integration can result in a manual workaround, negating the software’s efficiency gains. Always confirm the compatibility of your current systems with the practice management tool.

Scalability and Flexibility

As your firm grows, your needs will evolve. Choosing a practice management software that can adapt to these changes ensures your investments remain valuable long-term.

- Additional Users – Look for platforms that simplify adding new accounting team members or clients without requiring a full system overhaul.

- Custom Workflows – As your firm grows and takes on new service lines or more complex client portfolios, you'll need adaptable practice management tools. Choose software with customizable workflows that can evolve alongside your processes.

- Advanced Reporting – As your firm scales, you must track team performance, billable hours, and client profitability. Ensure your accounting task management software provides advanced analytics to support data-driven decisions.

Assess Customer Support and Training Resource

Reliable customer support can save your firm significant time and frustration.

- What customer support options (e.g., live chat or phone) are available?

- Does the project management software provider offer comprehensive training materials like video tutorials, webinars, or user guides?

- Is there an active user community or knowledge base where you can find answers to common issues?

Strong support and resources can save your firm time and ensure smooth adoption across your accounting team.

Best Practice Management Software for Accountants

Now that you understand how to pick the right practice management tool for your firm, below is a detailed breakdown of some of the best practice management software for accountants, including their standout key features and ideal use cases.

1. TaxDome

TaxDome sets itself apart by offering a true end-to-end platform with unlimited clients and unlimited document storage included in every plan. For growing firms, that means no surprise costs or scaling headaches, just predictable pricing as you add more clients. Combined with a polished, fully branded client portal and built-in IRS transcript integration, TaxDome delivers a level of scalability and professionalism many competitors find hard to match.

Key Features:

- All-in-One Operations – Manage CRM, workflows, billing, e-signatures, documents, and payments under one login.

- Unlimited Clients & Storage – Scale your practice without worrying about caps or hidden fees.

- Customizable Client Portal – White-labeled, mobile-friendly portals create a seamless client experience under your firm’s brand.

- Workflow Automation – Automate recurring pipelines and tasks to reduce manual follow-up and save hours each month.

- IRS Transcript Integration – Pull transcripts directly into the system, making it especially valuable for tax resolution work.

- Team Collaboration Tools – Internal chat, @mentions, access controls, and wikis keep teams aligned and accountable.

Ideal Firms for TaxDome

TaxDome is used by firms of all sizes, from solo practices to firms with 50+ staff, but it’s particularly useful for mid-sized firms that want to scale and need a platform that grows with them. It’s handy for firms handling high volumes of tax clients or IRS resolution cases, where unlimited storage, transcript integration, and branded portals deliver both efficiency and client confidence.

Pricing (as of 2025)

| Essentials | Pro | Business | |

|---|---|---|---|

| 1-year subscription | $800 per user/year | $1000 per user/year | $1200 per user/year |

| 2-year subscription | $750 per user/year | $950 per user/year | $1150 per user/year |

| 3-year subscription | $700 per user/year | $900 per user/year | $1100 per user/year |

| Free Trial? | 14-day free trial | ||

Reviews

Pros and Cons

- Ease of use

- Automation features

- Prompt and helpful customer support

- Client portal’s ease of use

- Document management system

- Steep learning curve

- It can be difficult and time-consuming to set up

- Some missing features (proposal sending and video file support)

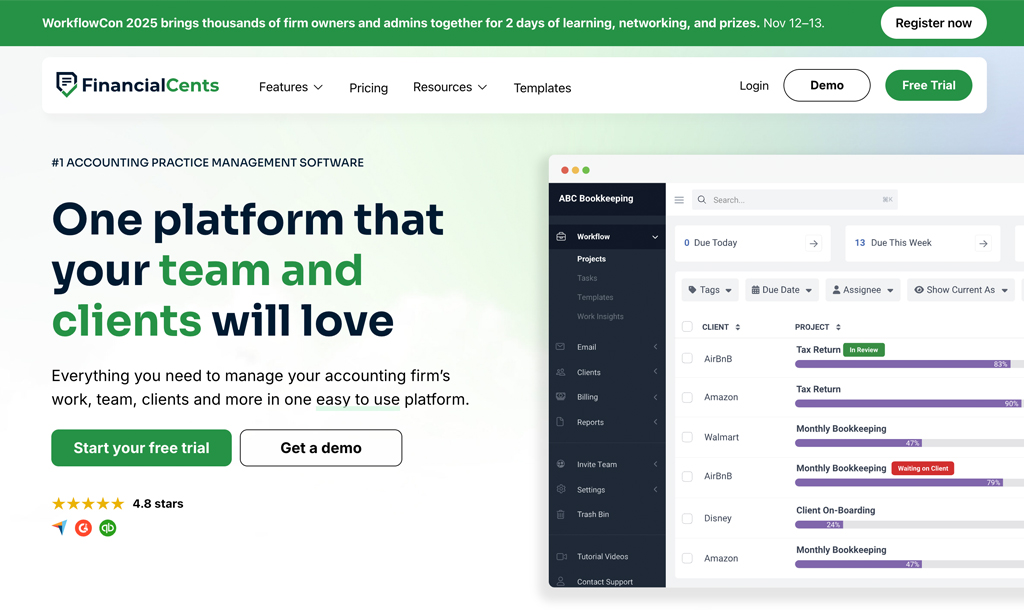

2. Financial Cents

If your firm still relies on spreadsheets or email chains to keep track of client deadlines, Financial Cents offers a refreshingly simple way to bring order to the chaos. Designed specifically for accounting and bookkeeping firms, this platform combines task management, client communication, and billing into a single, intuitive solution.

Its focus isn’t on cramming in every possible feature—it’s on giving small to mid-sized firms just the right amount of structure to run with consistency and confidence, finally.

Key Features:

- Workflow & Task Management – Create recurring workflows once and never worry about rebuilding them. Prebuilt templates tailored to accountants make it easy to standardize monthly bookkeeping, payroll, and tax prep.

- Client Portal & Communication – A secure client CRM with portals, e-signatures, and email-to-task conversion ensures conversations stay tied to the work at hand. No more digging through inboxes for missing documents.

- Billing & Payments – Automated invoice reminders and integrated payments mean you spend less time chasing collections and more time delivering value.

- Capacity Management – Real-time visibility into who’s overloaded helps balance workloads across the team and keeps deadlines under control.

- Integrations – Connect seamlessly with QuickBooks Online, Gmail, Outlook, Google Drive, OneDrive, SmartVault, and more, so your firm doesn’t have to rebuild its tech stack.

Ideal Firms for Financial Cents

Financial Cents is best suited for small to mid-sized accounting and bookkeeping firms that want to move beyond manual systems but don’t need the heavy, complex setup of enterprise software. It’s especially effective for firms juggling recurring client work where consistency, visibility, and communication are the difference between staying ahead of deadlines and falling behind.

Pricing (as of 2025)

| Per User/Month, Billed Annually | Per User/Month, Billed Monthly | ||

|---|---|---|---|

| Solo Plan | $19 | - | |

| Team Plan | $49 | $69 | |

| Scale Plan | $69 | $89 | |

| Enterprise | Custom | ||

| Free Trial? | 14-day free trial | ||

Reviews

Pros and Cons

- Ease of use

- Intuitive task management

- Easy integration with existing tech stacks

- Automation capabilities

- Efficiency improvement

- Some users find the ‘Scale’ plan expensive for the feature it offers

- Limited dashboard customization

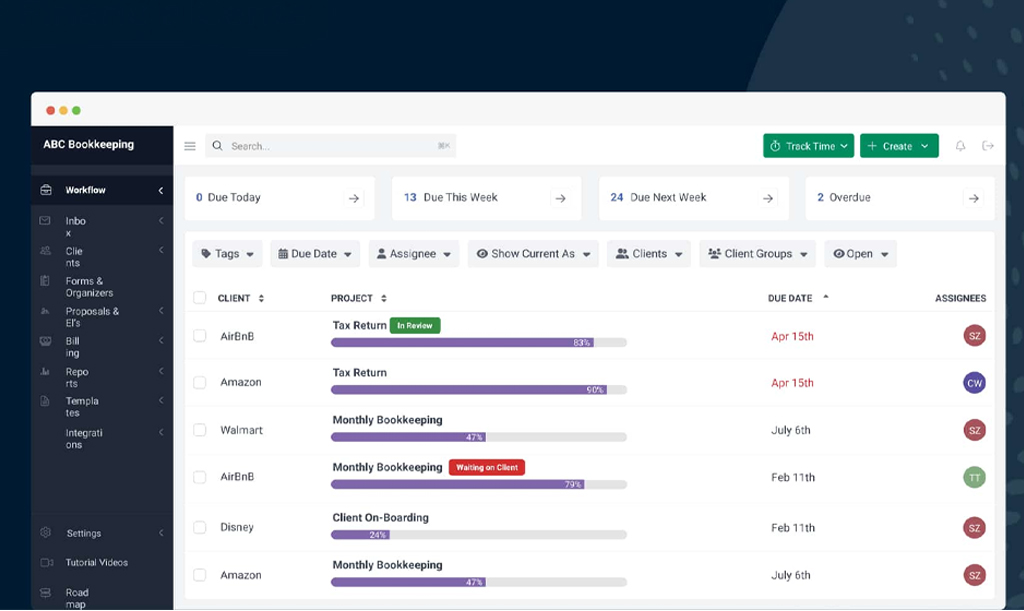

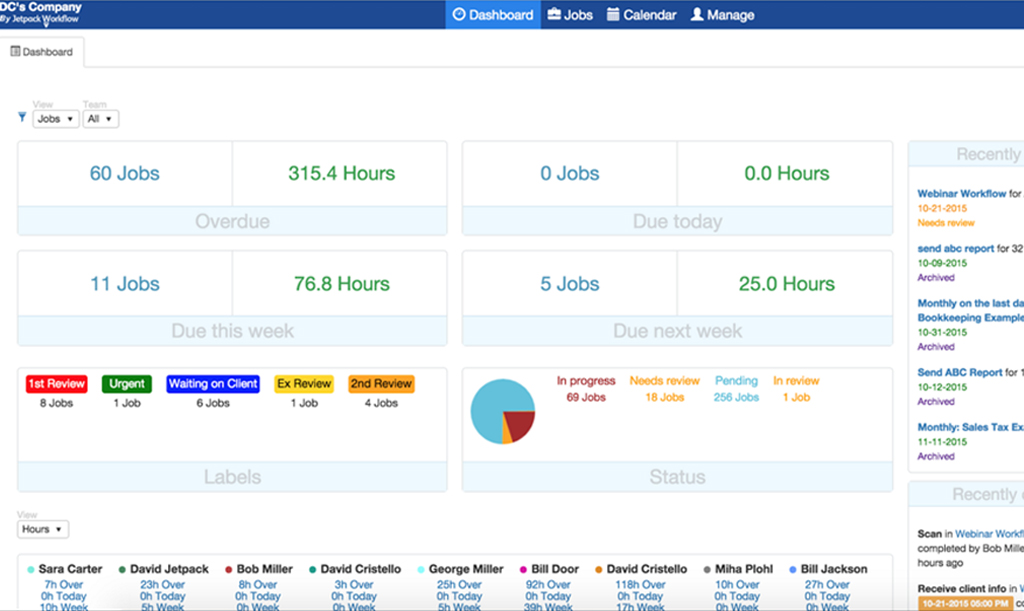

3. Jetpack Workflow

One of the biggest challenges for CPA firms is staying on top of recurring work. Whether it’s monthly bookkeeping, payroll, or tax deadlines, it only takes one missed task to create client frustration and compliance headaches.

Jetpack Workflow was built to make sure that never happens. It provides an organized and reliable way to schedule, track, and complete client work, allowing your team to focus on delivery instead of constantly double-checking spreadsheets or email chains.

Key Features:

- Recurring Workflows – Set up jobs once and let them auto-generate on schedule, ensuring nothing gets overlooked during busy cycles.

- Prebuilt Templates – Access 70+ accounting-specific templates or customize your own, so your team doesn’t have to reinvent processes every time.

- Dashboard View – A clear, real-time snapshot of overdue, current, and upcoming tasks gives you instant visibility into firm-wide progress.

- Workload Tracking – See where staff capacity is stretched and reassign work to keep the team balanced.

- Bulk Assignments – Apply tasks and projects across multiple clients at once, saving hours when onboarding or setting up seasonal work.

- Integrations – Connect with QuickBooks Online, Google Calendar, Outlook, and 2,000+ other apps through Zapier.

Ideal Firms for Jetpack Workflow

Jetpack Workflow is especially useful for small to mid-sized accounting and bookkeeping firms that manage a high volume of recurring client work. If your firm’s biggest challenge is keeping a consistent track of client deliverables, this software provides a dependable backbone. It’s not heavy on client-facing features like portals or invoicing, but it shines in helping teams stay organized and accountable internally.

Pricing (as of 2025)

| Per User/Month, Billed Annually | Per User/Month, Billed Monthly | ||

|---|---|---|---|

| Jetpack Starter | $30 | $45 | |

| Jetpack Organize | $45 | $56 | |

| Jetpack Scale | $49 | $63 | |

| Free Trial? | 14-day free trial | ||

Reviews

Pros and Cons

- Clean and straightforward UI

- Workflow customization

- Excellent customer support

- Lack of API/Zapier connectivity

- Lack of a mobile app

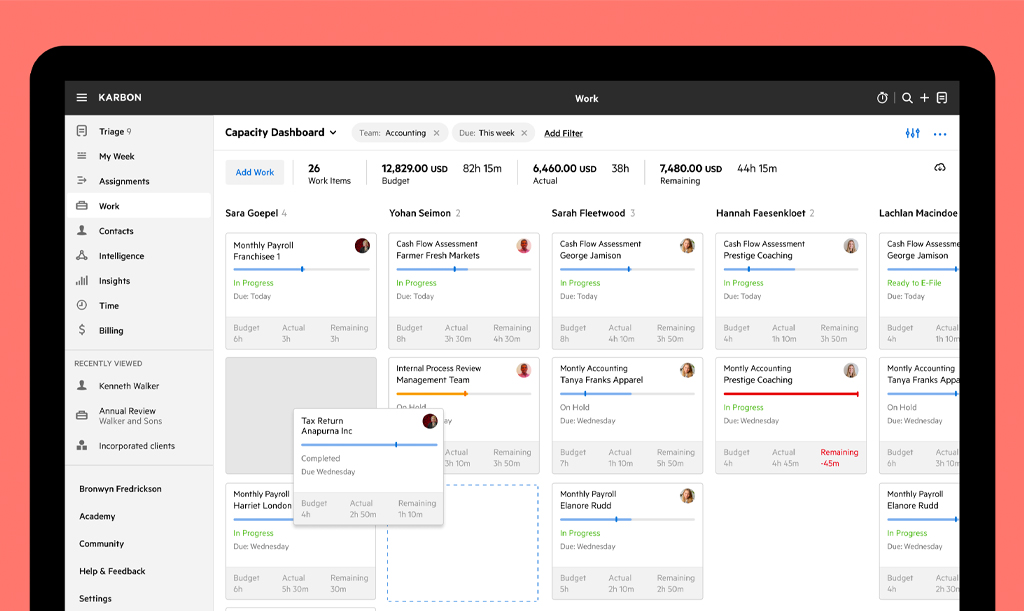

4. Karbon

Karbon is built around one core mission: to become your firm’s single source of truth. Everything—emails, tasks, documents, workflows, and client interactions—lives in one workspace. That deep integration not only boosts visibility but transforms how teams collaborate and get work done.

Key Features:

- Unified Email & Task Management – Karbon’s shared inbox allows emails to become tasks, which can be assigned, commented on, and tracked—keeping communication tied directly to client work.

- Workflow Automation & Templates – Standardize processes with customizable workflow templates and automation. This helps ensure every task (from client onboarding to recurring service delivery) is consistent and reliable.

- Client Portal & Document Handling – Store, share, and organize documents securely from within the platform. Karbon also provides client portal access and e-signature support to keep files and approvals centralized.

- Time Tracking, Billing & Budget Reporting – Track time against tasks, generate budgets vs. actuals, and manage billing workflows, all from one place. It helps you monitor team performance and financial workflows with ease.

- Business Analytics & AI Support – Dashboards and reporting tools give you insights, like bottlenecks or productivity trends, so that you can make operational decisions based on real data. Karbon also integrates AI-powered aids to help draft communications and suggest next steps.

- Collaboration & Centralized Knowledge – Every email, task, and note ties back to clients and jobs—creating a searchable, visible history of what’s happened and what needs attention next. Great for onboarding, remote teams, or simply making sure nothing gets lost.

- Secure Platform & Robust Integrations – Built with enterprise-grade security and mobile support. Integrates with tools like QuickBooks, Xero, Dropbox, and more via APIs or direct app links.

Ideal Firms for Karbon

Karbon is an ideal choice for mid to large practices that value collaboration, visibility, and process consistency. If your firm handles complex workflows, relies on distributed teams, or needs to track both client communications and internal processes in one place, Karbon provides the unified, organized environment you need.

Pricing (as of 2025)

| Per User/Month, Billed Annually | Per User/Month, Billed Monthly | ||

|---|---|---|---|

| Karbon Team | $59 | $79 | |

| Karbon Business | $89 | $99 | |

| Karbon Enterprise | Custom | ||

| Free Trial? | 14-day free trial | ||

Reviews

Pros and Cons

- Ease of use

- Effective task management

- Efficiency improvement

- Effective team collaboration

- Centralized email triage (turning emails into tasks)

- Steep learning curve

- Missing features in task assignment or client request handling

- Email management shortcomings (formatting, Outlook/meeting invites)

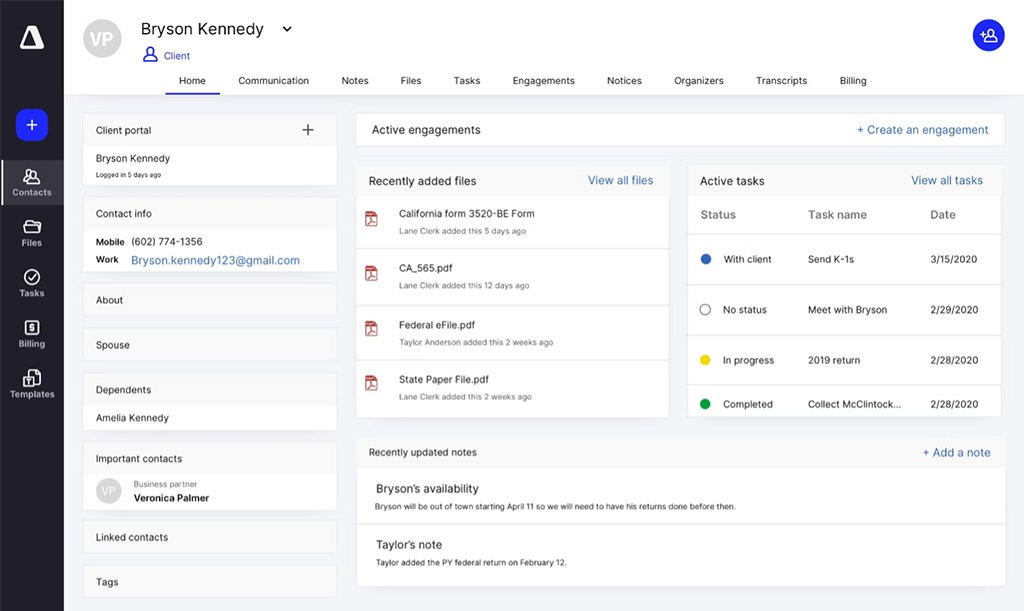

5. Canopy

Managing clients, documents, billing, and tax work often means jumping between multiple disconnected tools. Canopy consolidates these functions into a single, cohesive platform. It’s designed for tax and accounting firms that want an all-in-one system, especially those handling tax resolution or IRS interactions, where traditional accounting firm practice management software falls short.

Key Features:

- Client Management & CRM – Centralize client information, emails, notes, and tasks in one place. No more piecing together communication history across multiple systems.

- Document Management & Client Portal – Secure file storage, e-signatures, and branded client portals make it simple to share and collect documents without third-party apps.

- Workflow Automation – Create, assign, and automate recurring tasks so your team stays on track even during peak tax season.

- Time, Billing & Payments – Track billable hours, generate invoices, and accept payments directly inside the platform.

- Tax Resolution Tools – One of Canopy’s standout features is its IRS transcript retrieval and notice management tools—giving firms a unique edge in handling compliance-heavy cases.

- Insights & Reporting – Dashboards and reports highlight bottlenecks and team performance, helping you run the firm with data-driven clarity.

Ideal Firms for Canopy

Canopy is particularly beneficial for mid-sized tax and CPA firms seeking an all-in-one solution to manage client relationships, documents, workflows, and billing processes. Its tax resolution tools and IRS transcript retrieval features make it especially valuable for firms handling complex tax matters.

However, firms should be aware of the pricing model, which charges by feature, client, and user, potentially leading to higher costs as additional functionalities are added.

Pricing (as of 2025)

| Per User/Month, Billed Annually | Per User/Month, Billed Monthly | ||

|---|---|---|---|

| Canopy Starter | $45 | $60 | |

| Canopy Essentials | $66 | $88 | |

| Free Trial? | 14-day free trial | ||

The pricing table above outlines options for small firms. For growing firms, Canopy provides flexibility with its modular structure. It starts with the Client Engagement Platform, priced at $150 per month, which offers essential tools such as a client portal, email integration, and CRM features. From there, you can tailor your plan by adding modules such as Document Management, Workflow, and Time & Billing, each priced separately to suit your specific needs.

Reviews

Pros and Cons

- Ease of use

- Document management

- Task management capabilities

- Seamless client interaction

- Responsive and knowledgeable customer support

- Limited customization

- Missing features such as client messaging

- High pricing / perceived cost vs. value

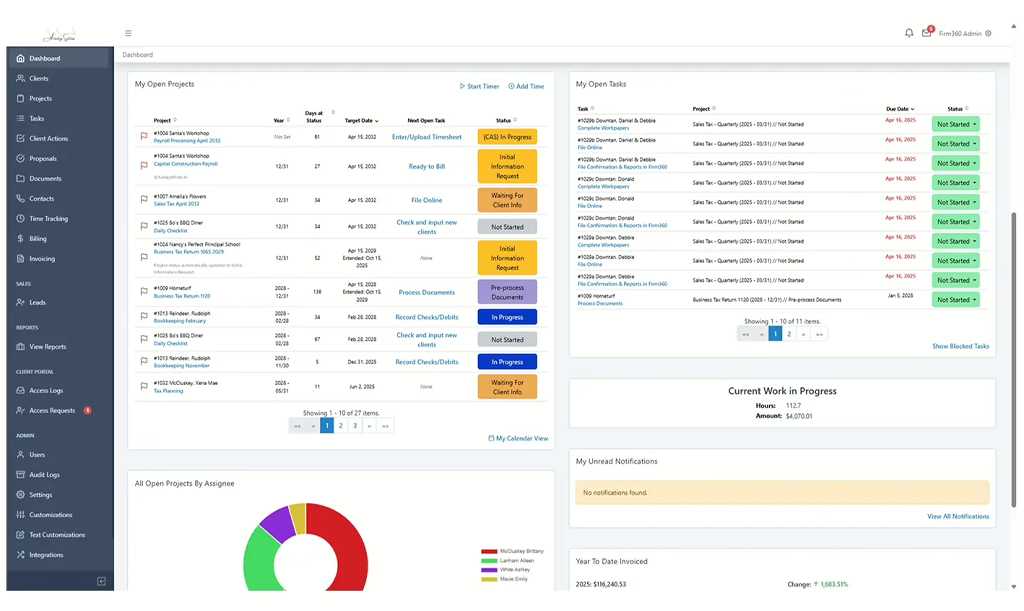

6. Firm360

Firm360 is a cloud-based practice management solution purpose-built by accountants for accountants. Designed to unify your workflow, it consolidates project management, client communication, billing, document handling, and reporting into one intuitive platform. Think of it as a one-stop operational dashboard built around real-world accounting workflows.

Key Features:

- Workflow & Project Management – Automate client onboarding, recurring tasks, and reminders with reusable workflows and templates. Built-in task management helps keep operations running smoothly and efficiently.

- Secure Document Management & Branded Portal – Firm360 provides secure, cloud-hosted storage, e-signature functionality, and a polished client portal—keeping sensitive files organized and client interactions professional.

- Time Tracking, Billing & Payments – From time capture to online invoicing and payment collection, Firm360 streamlines financial workflows to reduce administrative overhead and speed up cash flow.

- Client Management – Store contact details, project history, and billing information, all searchable and scalable as your client base grows.

- Advanced Reporting & Dashboards – Analyze staff utilization, client profitability, receivables, and project progress with real-time dashboards and reports designed for firm leadership.

- Support & Onboarding – Firm360 includes hands-on onboarding, video training, email support, and higher-tier clients receive dedicated customer success. It stands out for its white-glove service approach.

Ideal Firms for Firm360

Firm360 is especially well-suited for small-to-mid firms that seek to bring structure and clarity into daily operations without juggling multiple tools. Its design, crafted by accountants, makes it intuitive and highly practical, especially for teams seeking process consistency, improved client communication, and operational insight.

Pricing (as of 2025)

| Per Month, Billed Annually | |

|---|---|

| Basic | $49 |

| Standard | $79 |

| Premium | $99 |

| Custom Pricing | Custom |

| Free Trial? | N/A |

Reviews

Pros and Cons

- Centralized management

- Ease of use

- Efficiency improvement

- Easy document management

- Minor feature gaps

- Usability issues

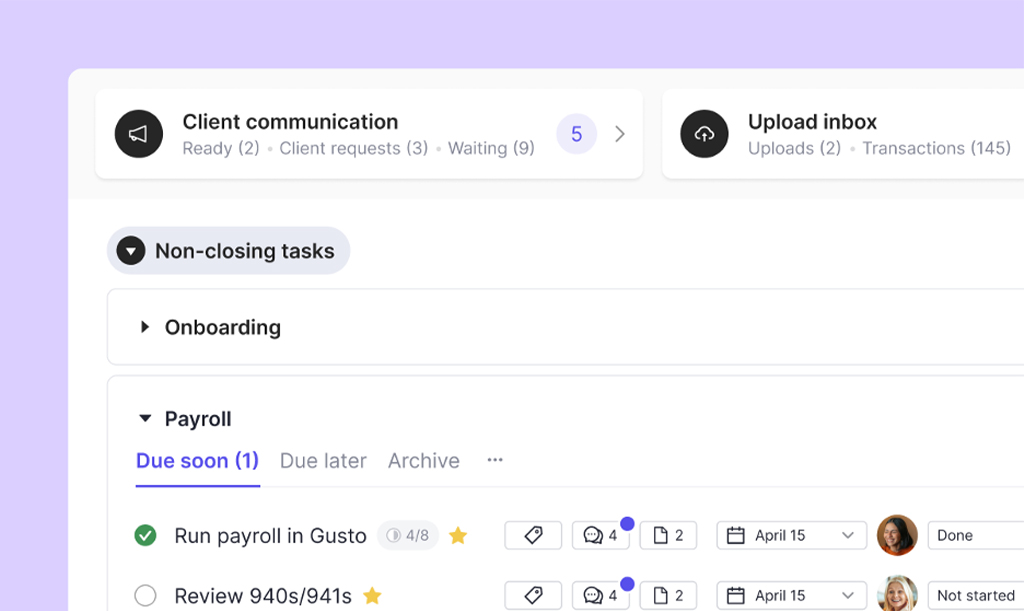

7. Keeper

Keeper is a bookkeeping practice management software that positions itself as the single, powerful workspace for firms working with clients on QuickBooks Online or Xero. What makes it stand out is its tight integration with accounting software, which cuts review time, improves client communication, and automates everyday workflows. It’s built specifically around what bookkeepers need to “close the books faster”—and often does just that.

Key Features:

- Two-Way Integration with QBO & Xero – Keeper is unique among peers in offering two-way sync: changes in Keeper update the client’s ledgers in real time, and vice versa, so workflows stay accurate and in sync effortlessly.

- Automated File Review & Coding Quality Control – Keeper’s intelligent review tools flag inconsistencies (like miscoded transactions, missing payees, or uncategorized entries), helping firms close the books up to three times faster.

- Client-Collaborative Portal with Real-Time Interaction – Asking clients questions directly from their bookkeeping feeds, automating reminders via email or text, and having it all happen inside a secure, branded portal means communication stays tidy, fast, and within one system.

- Client-Based Pricing, Unlimited Team Access – Rather than charging per user, Keeper charges a flat monthly fee per connected client, making expenses more predictable as you scale, with no limit on team seats.

- Built-In Workflow, Reporting & CRM Tools – Templates for recurring tasks, internal chat, tagging and filtering, custom client dashboards, management KPIs, and executive summaries—all help teams stay aligned and firms stay performance-aware.

Ideal Firms for Keeper

Keeper shines for bookkeeping and accounting firms focused on delivering accurate, efficient month-end services, especially firms managing multiple QuickBooks or Xero clients. It’s ideal when transaction-level visibility, quality control, and seamless team-client communication are mission-critical.

Pricing (as of 2025)

| Per Client/Per Month | |

|---|---|

| Standard | $8 |

| Premium | $10 |

| Enterprise | Custom Pricing |

| Free Trial? | Available |

Keeper offers standard tiers (Standard, Premium, Enterprise) and additional features that can be purchased separately. These options provide firms with the flexibility to acquire specific capabilities without needing to upgrade to a higher comprehensive plan.

| Add-on | Per Client/Per Month |

|---|---|

| Keeper Receipts | $15 per client/per month |

| The Tax Suite | Starting at $200/month |

| Keeper Emails | $10 per connected team email/per month* |

Reviews

Pros and Cons

- Easy to use, smooth workflows

- Improves client & team collaboration

- Saves time on close & client follow-ups

- Email integration can be clunky

- Client management quirks

Which CPA Practice Management Software is the Best Fit for Your Firm?

Choosing the right accounting practice management software is crucial for accounting practices. The right tool can transform your operations by organizing workflows, boosting collaboration, and enhancing client service. Selecting an accounting management software that aligns with your firm’s needs, supports your growth, and integrates seamlessly with your current systems is essential to unlock these benefits.

At TOA Global, we understand that software is only part of the equation. Having the right people in place to use these tools effectively is just as critical. That’s why we specialize in providing highly skilled accounting talent who integrate seamlessly with your firm, helping you maximize the value of your technology investments.

If you’re ready to combine the right technology with the right talent, our U.S.-trained outsourced accountants can help. Explore how we support accounting firms in scaling sustainably while delivering outstanding client service.