“Work-life balance” has become a hot topic in the accounting profession, as firms explore how to attract and retain staff, while also ensuring optimal client satisfaction and financial performance.

This article explores what current research reveals about the importance of work life balance to the average accounting professional, and suggests 7 practical ways to improve work life balance in your firm.

How Much Do Accountants Value Work Life Balance?

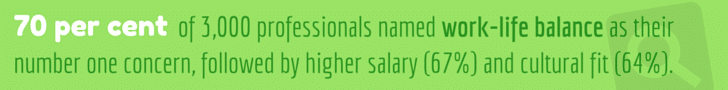

A number of information sources suggest that work-life balance is growing in importance for accounting professionals.

A recent report by recruitment firm Hudson found that work life balance is the single most important factor professionals are looking for in a new role.

Furthermore, the Accounting and Financial Services Benchmarking Report from Macquarie included placing an importance on work life balance as one of the Top 4 People Strategies adopted by the most financially successful accounting firms.

On the flip side, the internet abounds with horror stories of people in the accounting profession who have suffered illness and in extreme cases, death, from too much work and too much stress.

While these articles are typically anecdotal, there is no doubt that extreme overwork can have a severely negative effect on accountants’ morale.

So if work life balance is worth improving, let’s look at how to do that:

7 Strategies For Improving Accounting Work-Life Balance

Firms face the challenge of offering team members a fulfilling career, while still keeping their clients happy and their bottom line healthy.

While these might sound like mutually exclusive goals, many firms are doing just that by following these work life balance tips:

- Reward and recognise VALUE, not effort. Employee KPIs should be based around outputs, not inputs. Measure and reward numbers like billings under management (not just direct billings), effective hourly rate and new revenue closed. Place less importance on metrics such as the raw number of hours billed.

- Lead from the front. Partners and owners should set an example for their team by placing a mutual focus on work and outside pursuits.

- Don’t drown your people. Some partners and managers are in the habit of selling whatever they can, then simply throwing the work at their team to get done. This practice can very quickly erode team productivity and motivation. See this article on managing and planning firm capacity for solutions.

- Provide challenging and engaging work. Team members become stale if they’re fed a constant diet of mundane or non-challenging work. Staff who are assigned more challenging advisory work are more likely to be able to bill for value, and therefore command a much higher hourly rate. These staff can then bill well, without putting in huge hours.

- Provide enough resourcing to get the work done. It’s an impossible task for accountants to get 100 hours of work done in a 40 hour week – even if they work efficiently. Our clients engage offshore team members based in the Philippines to handle the bulk of their compliance and procedural work. This allows their internal people to perform more client-facing work. It also turns more of their internal people into managers who are leveraging a team, not just individual contributors.

- Ensure staff rest and rejuvenate. A culture where staff view taking holidays, or going home at a reasonable hour as a “career limiting move”, is a culture where work life balance can’t thrive. Insisting that staff get adequate rest and rejuvenation should pay dividends in the form of a more productive workforce.

- Institute family-friendly policies – for real. Family-friendly policies such as extended parental leave and flex time are talked about a lot, but are often not executed as thoroughly as they might be. Stories like this one that discusses the experiences of a CPA firm’s first female part-time partner prove that many firms are being innovative with family-friendly policies and reaping the rewards.

We encourage you to give some of the accounting work life balance strategies above a try and let us know how you get on.

And if you need help leveraging your existing team members with more qualified yet low-cost resources, click here to get a Free Accounting Outsourcing Strategy And Plan for your firm. This is a detailed blueprint for rapidly scaling your capacity, margins and profits for free – a $500 value.