As technology continues to deliver new efficiencies to the accounting profession, the nature of the work is changing.

Although the volume of compliance work is not going anywhere and is in fact increasing, clients are less inclined to pay premium fees for standard compliance work, yet more open to paying for value-added advice.

This means that the most successful firm model involves delivering tax and compliance work efficiently, while also keeping plenty of time and mental bandwidth in reserve to provide high-profit advisory services.

In this article, we’ll explore how to increase advisory revenue; why firms sometimes get stuck when attempting to shift to a greater mix of advisory work; and how to overcome the common blockers to making this shift.

Why Offer Advisory Services?

If you’re reading this article, chances are you’re already interested in doing more advisory work and you don’t need further convincing.

Nevertheless, it’s worthwhile reviewing the positive outcomes that advisory and consulting services can deliver to your clients, your staff and your firm:

1. It’s about helping your clients

The reality is that many business owners are struggling. They no longer just want to know their numbers. They want to know what their numbers mean.

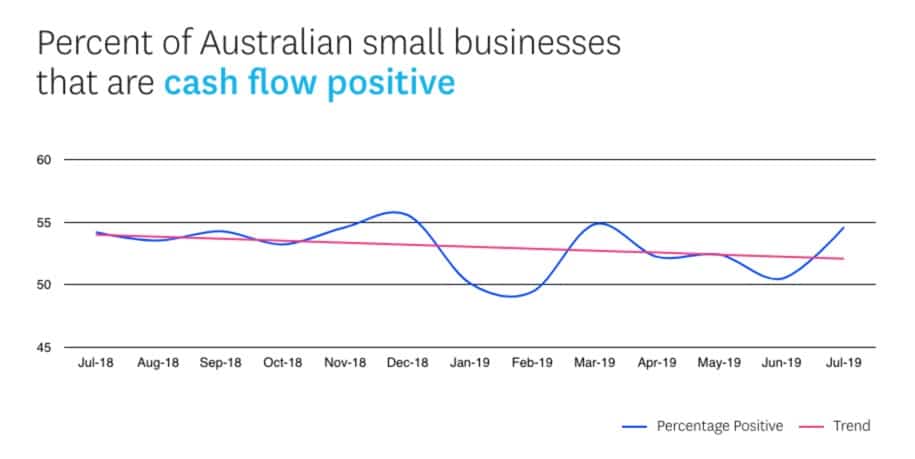

Here’s a shocking statistic to illustrate: according to Xero Small Business Insights, just over 50% of Australian small businesses are cash flow positive. Nearly half are cash flow negative! (We expect these figures are typical of the North American market too).

This statistic alone highlights the need for services such as budgeting, cash flow forecasting and business development.

2. Clients will happily pay for value

While compliance work isn’t going anywhere, clients typically won’t pay a premium in order to merely complete their tax returns and lodge their taxes on time.

However, what clients will pay for is tangible value. For example:

- Structuring advice that saves tens of thousands of dollars in tax every year.

- Business acquisition advice that reduces risks and minimises future tax liabilities.

- Software setup that streamlines workflow and saves wage costs.

Offering services such as these to your clients is like “selling money at a discount”. What client wouldn’t pay 20c to get $1 worth of value?

3. Advisory work commands high fees and high hourly rates

Whereas the pricing of standardised compliance work is easily comparable between accounting firms, advisory services are about value, not price.

A brilliant structure that saves a client $50,000 per year in tax may well command fees of $20,000, even if it only takes you 5 hours to implement. (Even the best tax return preparation will never come close to this hourly rate!)

4. Advisory work is interesting and challenging

Accounting principals and staff members alike want to pursue interesting, challenging and meaningful work.

By doing more of this type of work, you’re more likely to enjoy a pleasant work-life balance and keep your staff engaged. You’ll also be able to afford to pay your staff more because of the extra value they’re able to deliver.

What Are The Trending Advisory Services In Today’s Accounting Practices?

Advisory offerings can either be one-off projects (e.g. business acquisition advice), or ongoing services delivered on a retainer basis.

This image (courtesy of @HeatherSmithAU, taken at a recent Xerocon) reveals which services are currently driving the most revenue growth for accounting firms:

These include:

- Budgeting, cashflow forecasting and business planning services

- Startup mentoring

- Business development advice

- Software/app setup and software support

- Virtual CFO services

- Business performance benchmarking

- Capital raising and financing

- Succession planning

In addition, accounting firms within TOA Global’s [toa_count target=”firms”]-strong client base are driving advisory revenue via services such as:

- Business acquisition advice

- Major asset purchasing advice

- Specialized tax advice / restructuring

- Debtor management

- Business coaching

- Specialized projects

If you’re like most accountants, then you understand the argument for providing more advisory services, and you want to do it.

Why then do so many firms struggle to make this transition? Let’s explore the four major reasons why, before proposing some practical solutions…

Common Barriers To Doing More Advisory Work (And How To Solve Them)

There are a few common barriers to shifting to a greater mix of advisory work. You may find that some (or all) of them apply to you:

Reason #1: You’re too busy delivering essential compliance work to offer more advisory services.

The ideal model for most firms is to offer a mix of essential compliance services, plus additional high-fee advisory and consulting work.

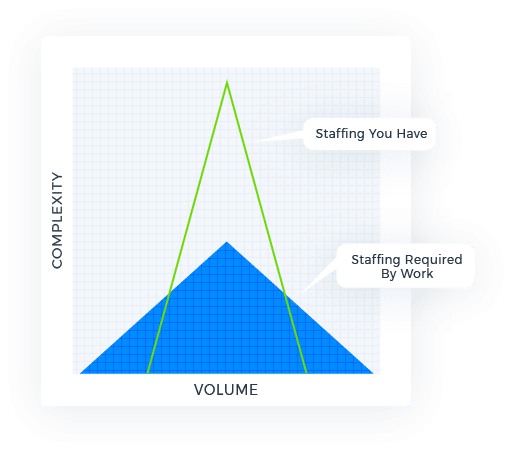

But the reality is that many firms are so snowed under with compliance work that they’re unable to deliver the added-value stuff. Their workload looks like this:

Before they can offer more brains work, they first have to re-balance their firm capacity.

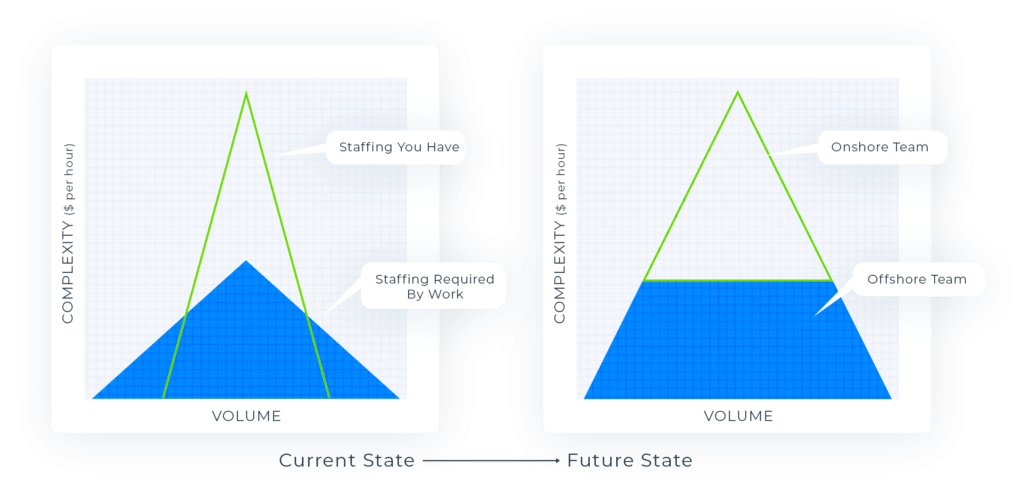

One immediate fix is to add an offshore team to handle the lower-complexity work, freeing up space for your onshore people to do the top-end stuff, as depicted here:

Book a free exploratory chat with our team to discuss how this could work in your situation.

Reason #2: You’re not spending enough face-time with clients

Another blocker to more advisory work (related to the previous issue) is that you’re not spending enough face-time with clients.

It’s all too easy to become stuck behind a computer, rather than talking on the phone or meeting with clients in person.

Deep, value-based conversations can only take place in real time. Email doesn’t cut it. So an important leading indicator of revenue is face time with clients.

Reason #3: Clients don’t perceive you as an “advisor”

Still related to the first two issues: when you don’t spend enough face time with clients, they’re likely to underestimate your value as a trusted business advisor. They may not even be aware of what you can offer them.

Clients who aren’t aware of your value can’t buy. And they’re also unlikely to pick up the phone to seek your advice when they have an important business decision to make.

The result is fewer revenue opportunities.

Reason #4: You already offer advisory work, but you haven’t been packaging or selling it optimally.

It may be that you have the capability to offer advisory services, but you’re not seeing the sales traction you desire. Many great thought leaders have also done a lot of work on how to “pitch” advisory services.

Two recommended resources are The Consulting Bible by Alan Weiss and Ron Baker’s Implementing Value Pricing: A Radical Business Model For Professional Firms.

Although these are brilliant resources, sometimes the problem isn’t actually a knowledge or skills gap at all. Returning to our first point: it’s the fact that you’re stuck behind your computer instead of out and about talking with clients about their challenges, issues and opportunities.

Final Advice & Next Steps

To summarize this article, the keys to growing your advisory revenue are to:

- Get out of the weeds of compliance work by adding more capacity and exploring an offshore team strategy, as hundreds of accounting firms are already doing.

- Schedule regular time to meet and talk with clients to understand their needs and where you can provide solutions.

- Propose more value-based projects and retainer engagements.

- Help your clients grow so you can grow with them and build a reputation among other growth-oriented businesses in your area.

The next step is up to you. How will you add more advisory revenue in the months and years ahead? We hope some of the advice in this article will help.

And if you’d like to explore adding an offshore team as part of your strategy, we’d love to help. To find out more, click here to get a Free Accounting Outsourcing Strategy And Plan for your firm. This is a detailed blueprint for rapidly scaling your capacity, margins and profits for free – a $500 value.