Learn about outsourcing, what it can do for your firm, and why it has become so popular in the accounting and bookkeeping industry today.

As one of today’s leading solves for the growing pains of practices from small to large, ‘outsourcing’ is a word that has become closely linked to the modern accounting firm.

It stands alongside IT as one of the most commonly outsourced business processes, meaning discussions around outsourced accountants are bound to come with many trends, opinions, and misconceptions in tow. So, as a global talent solutions provider in the accounting industry, we thought we’d help paint a fuller picture and, in turn, do our part in separating the facts from some popular fiction.

In this definitive introduction to outsourced accounting, we’ll examine why so many are turning to outsourced accounting as a considered solution, what it could mean for your accounting and bookkeeping business exactly, and (of course) how you yourself can get started.

What is outsourced accounting?

By definition, outsourced accounting is the assigning of accounting, bookkeeping, and/or compliance work to accounting professionals in another country.

This is usually accomplished by a business owner partnering with an outsourced accounting services provider who, in turn, is then tasked with presenting them vetted portfolios of several qualified candidates for screening, interviewing, and (hopefully) onboarding as a new global team member.

At its core, the service operates as an accounting department that’s both on-demand and to-scale. Now the owner can delegate previously self-driven day-to-day work to their new global team members. This saves time which can then be used to focus on the core business and growth.

Why has outsourcing become so popular?

Firms turn to outsourced accounting solutions in general as a means of countering several common pressures; pressures found both internally and externally.

- Price pressure: Thanks to advances in cloud accounting technology, clients expect to pay less for compliance and administrative services.

- Talent shortage: Attracting and retaining qualified accountants is a challenge, especially as they tend to fall on the higher end of the pay scale. This squeezes margins on more routine work, drying up the recruitment pool.

- Capacity crunch: There just isn’t enough time in a day to complete the procedural work and still leave time for high-margin strategic work. Owners are obliged to action new solutions in order to remain competitive.

- Greater competition: Back in the day, your competitors were often across town. Now they can be anywhere: across the country, or even the globe. Growing your capacity also means matching their reach.

Solve for all

The benefits of outsourcing can be a holistic solve for the above. They include:

- Increased capacity, efficiency, and profitability. These are probably the biggest benefits because, from these advantages, others arise:

- More time to focus on business development and providing a better client experience.

- A better work-life balance.

- The ability to fill roles more quickly with qualified staff.

But we’d prefer it if you heard it from our clients.

Alessio Roscio, managing director of RCR Partners, takes comfort in knowing his firm now has the resources available to fill gaps in his team. Hear what he has to say about his outsourcing experience and the benefits he found regarding staffing:

A look at the lesser-known benefits

While all firm owners expect to see ROI through some if not all of the above benefits, many are surprised when they also start to notice:

- The increased ability to promote your local staff to help with higher-level work.

- Happier staff and staff retention. Along with growth, team members are often relieved that they no longer have to just “get the job done” under tight time pressures.

- Cost-effectiveness; the by-product of saving on technology and infrastructure. Outsourced teams often come with their own desk spaces and computer equipment.

- Business continuity. A power outage at your firm (for example) will obviously not affect your team members abroad.

- Increased productivity and competitiveness.

But doesn’t outsourcing hurt the local job market?

A common reaction to the idea of outsourcing is fear for the local job ecology. Some people see it as a “job replacement”, or worse, the loss of local jobs. Consequently, as the owner of a firm that aspires to service its local community, you yourself may be asking yourself, “What will my clients think if I outsource work?”

While our article on what clients will think of your outsourcing strategy goes further into detail, firms that have been outsourcing for a while have seen the value first-hand. Such is the case with Chad Heit of Modern CPAs, Inc.

The takeaway is that global outsourcing actually creates richer roles for local staff; roles that involve greater responsibility and higher pay. It’s not about replacing the regional team with a remote one; it’s the delegation of work so that the local staff can help you grow your business and add more value to clients with additional higher-value services.

The result? As they grow, these firms end up hiring more people locally, in roles that require a higher level of skill.

But let’s consider a few things first

If up until this point you’ve started thinking that outsourced accounting might be a viable solution for your firm’s current needs, there are a few factors to consider first, to establish a good fit. Start by:

- Defining your objective for assigning your work to an outsourced team. This will provide your team with direction.

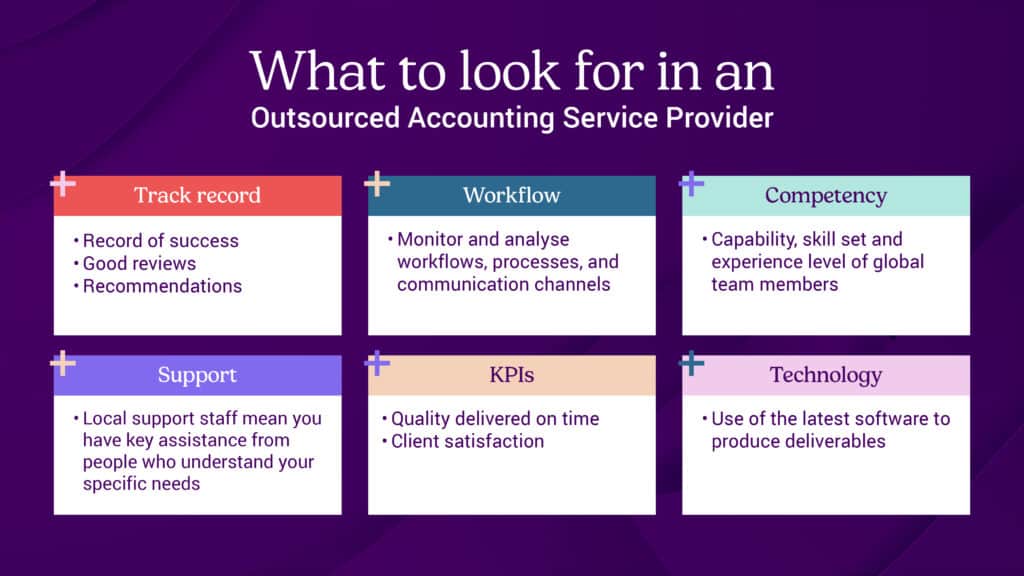

- Assessing whether a service provider would make a good partner for your firm (see our table below for some tips). You want a good fit, just like you do when hiring a local staff member.

- Identifying whether you have the capability, in terms of time and tools, to communicate with a global team. Think time zones and technology.

Are the above boxes ticked? Then the last pro tip from TOA Global would be to appoint a local “champion” at your firm to manage your global team – it doesn’t have to be you. (TOA Global’s client experience managers can help you operationally from overseas.)

Your champion should embrace change, understand outsourcing, have excellent communication skills, and be available to conduct team meetings via video calls.

Who to outsource?

Let’s now look at some of the more typical jobs that are best outsourced.

A global team can fill several roles at a firm. These include the more obvious ones: financial services and any accounting function, such as bookkeeping, accounts receivable, accounts payable, personal tax returns, and business tax returns; but also roles like executive assistants.

An offshore executive assistant can take administrative tasks off your hands. By having someone else schedule your meetings, manage your inbox and complete your reporting, you can get a lot of time back – oftentimes up to two to three hours a day. That’s 10 to 15 hours per work week! What would you do with that time?

Here’s a list of some other roles you can outsource in certain areas:

- Administration: Corporate secretary

- Business intelligence: Data analytics assistant

- Client experience: Client service assistant

- Finance: Paraplanner, financial planning assistant, mortgage broker assistant

- Human resources: Human resources assistant, recruitment support assistant

- IT: IT assistant, integrations specialist

- Marketing: Marketing coordinator, social media manager

- Sales: Business development associate

For a closer look at why your firm benefits from outsourcing these roles, read our analysis on which roles to hire first.

Avoidable outsourcing mistakes

There are some best practices when delegating work to global team members and working with them – just like there are when implementing any new strategy.

We’ve worked with many clients and this experience has helped us to identify several common outsourcing missteps. Knowing what these are beforehand will help you embark on the process as seamlessly as possible. After all, the best way to learn from mistakes is if they’re someone else’s.

These are the most common pitfalls we see:

- Beginning by delegating the most challenging work

- Failing to create standardised workflows

- Not getting clients and your local staff onboard

- Hiring only one remote team member

- Not taking time to understand the global team’s culture and not fully integrating them into your company

- Waiting too long before meeting your global team members in person. *

* As the COVID-19 pandemic subsides, we recommend meeting with your global team in person twice a year. At the very least, this will help build a sense of belonging and articulates their value within the company, especially since you’ve travelled potentially thousands of miles to see them!

We’re here for your global team ambitions

Outsourced accounting can be an attractive low-risk high-reward prospect for accounting firms and businesses to onboard global accounting departments, provided the correct steps are taken.

Should your firm be one of them, feel free to book a chat with one of our outsourcing experts.