In the last 5 years, offshoring has shifted from being a niche strategy to a central one, used by more and more accounting firms.

But are these firms ultimately “outsourcing themselves out of a job”? This article will explore the impact of offshoring on local job creation. Specifically, we’ll answer the question:

Does outsourcing accounting work replace local workers with offshore workers, or does it drive local employment by creating more opportunities?

What Are The Drivers Of Offshore Outsourcing?

Before looking at the impact of outsourcing on local employment, we first need to consider why accounting firms choose to hire offshore resources in the first place.

According to our client base of over firms, the 4 key market forces driving their outsourcing strategy are:

-

Market Force #1:

Price Pressure

Due to advances in cloud accounting technology, clients expect to pay less for compliance and administrative services.

-

Market Force #2:

Talent Crisis

Attracting and retaining qualified accountants is hard, and wage costs are high, causing margins to be squeezed on lower-value jobs.

-

Market Force #3:

Capacity Crunch

There aren’t enough hours in the week to get through the procedural work and still leave enough time for high margin strategic work.

-

Market Force #4:

Intense Competition

Your competitors used to be based across town. Now they may be based across the country, or even across the globe.

- Many accounting firms acknowledge there’s a talent crisis for accounting staff. In the USA, the unemployment rate for accountants is around 1.5%.

- In Australia, according to the Australian Government Job Outlook website, demand for accountants is increasing and the supply is insufficient to keep up.

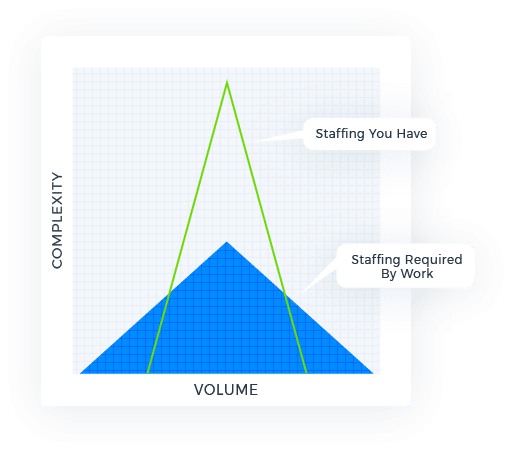

- Furthermore, accounting principals typically complain of a capacity mismatch between the staff they have, and the staff required by work, as depicted here:

- As a result, highly-qualified local accountants are often required to perform lower-value work. They not only find this less interesting, but they aren’t able to add as much value as they otherwise could.

- This makes staff retention a challenge. Most ambitious professionals don’t want to do low-level data-punching for multiple years. They demand career progression and increasing responsibility.

- To some extent, low-value work such as routine data entry can be streamlined with technology. (For example, automated bank feeds.) Yet at the same time, tax and retirement legislation is getting more and more complex. The mountains of compliance work never seem to get smaller, only bigger!

- At the same time, many clients have a greater number of entities and an increasing appetite for sophisticated advice and advisory services.

- Yet, with many local accounting teams snowed under with so much compliance work, there isn’t enough time in the day to provide the strategic advice that clients really need and value.

The result is a perfect storm where firms are motivated to scale their capacity so they can take on more of the right type of work.

Once you understand the drivers of accounting outsourcing, it’s worth considering what types of work are actually outsourced:

What Jobs and Tasks Are Typically Outsourced?

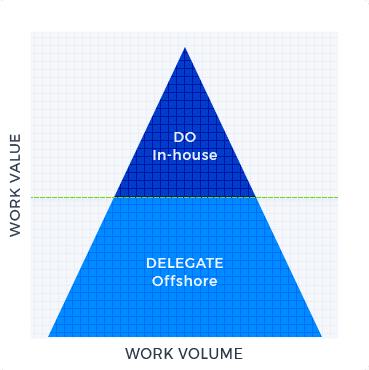

Most accounting firms who employ an outsourcing strategy keep the most complex, strategic and lucrative work in-house, and delegate the most routine tasks to their offshore teams.

The most common tasks we see delegated by client base include:

- Tax return preparation

- Preparation of working papers

- Corporate secretarial work

- Accounts payable / receivable

- Sales tax calculations

- Etc.

And What Jobs and Tasks Aren’t Typically Outsourced?

Certain tasks don’t lend themselves to offshore outsourcing.

Luckily for accounting firms, these are also the tasks that command the highest fees and are the most interesting to perform!

For example:

- Client Needs Analysis and Solution Prescription

- Analysis and Communication of What The Numbers Mean, as opposed to Preparing The Numbers

- Strategic Advice

By freeing up capacity for this type of strategic work, accountants are able to respond to client needs while also contributing to local staff development and growing profit margins – all at the same time.

What’s The Real Impact On Local Jobs When Overseas Outsourcing Is “Successful”?

When overseas outsourcing is successful, the following things are true:

- Your local team members become more client-facing

- They can be more strategic and deliver more value at higher hourly rates

- At the same time, essential compliance work can be delivered at high margins by your offshore team

- Your firm can now afford to hire more local people to manage the work and advise more clients at higher and higher levels of value.

When done right, overseas outsourcing creates MORE well-paid local jobs.

Local team members get to do more stimulating work where they’re interacting with business owners and clients more regularly.

And compliance work can get done quickly and profitably (for a price clients are willing to pay.)

While an outsourcing strategy may or may not be right for your firm, the perception that outsourcing “takes local jobs” is not supported by the data. In fact, quite the opposite.

To explore the right outsourcing strategy for your firm, click here to get a Free Accounting Outsourcing Strategy And Plan. This is a detailed blueprint for rapidly scaling your capacity, margins and profits for free – a $500 value.