Invoices have been around for as long as accounting itself has existed as a practice.

In ancient Mesopotamia, merchants used styluses on clay tablets to document trade. The Egyptians later had papyrus for scrolls. Jumping ahead to Renaissance Italy, merchants tracked debits and credits in massive leather-bound ledgers. By late 19th century, office clerks were click-clacking on typewriters to produce carbon-copy invoices.

The developments that would follow—computers and accounting software—have certainly made invoice processing more intuitive. Yet, throughout more than 5,000 years of progress, the format for recording what was bought and sold and how much was paid and owed has remained largely, curiously, unchanged.

The Costly Persistence of Manual Invoice Processing

Walk into the accounts payable departments of most modern companies, and you’ll likely find staff caught in the time-consuming invoice-to-payment workflow:

Verification of invoice amounts against purchase orders and contracts

Routing to assigned personnel and chasing invoice approvals

Processing of payments

Filing and storing of physical documents

This manual approach is prone to human errors and fraud. In fact, a report by Ardent Partners found that invoice exceptions—discrepancies between invoices and associated purchase orders, contracts, or receipts—were the top challenge for 53% of accounts payable professionals in 2024.

These errors largely stem from often short-staffed AP departments manually processing a deluge of documents. Each error further prolongs approval and payment timelines, straining cash flow and partnerships.

The same report revealed that the average AP team spends 17.4 days and US $12.88 on invoice processing compared to best-in-class teams. These figures easily double when you factor in error corrections while managing hundred other invoices simultaneously.

It might not be hyperbole to suggest that today’s AP function would still be recognisable to accountants from a century ago. But with mounting demands for efficiency, invoicing practices must urgently catch up with the rest of our operations.

Transforming Accounts Payable Through Automated Invoice Processing

Automated invoice processing, also called invoice automation, addresses the inefficiencies of manual systems by leveraging machine learning capabilities to capture, interpret, and process invoice data. This technology reduces, if not eliminates, manual data entry mistakes and lengthy approval times, leading to faster, more secure payments.

For firm owners and client companies alike, this benefit translates to less time spent chasing funds, thereby improving cash management.

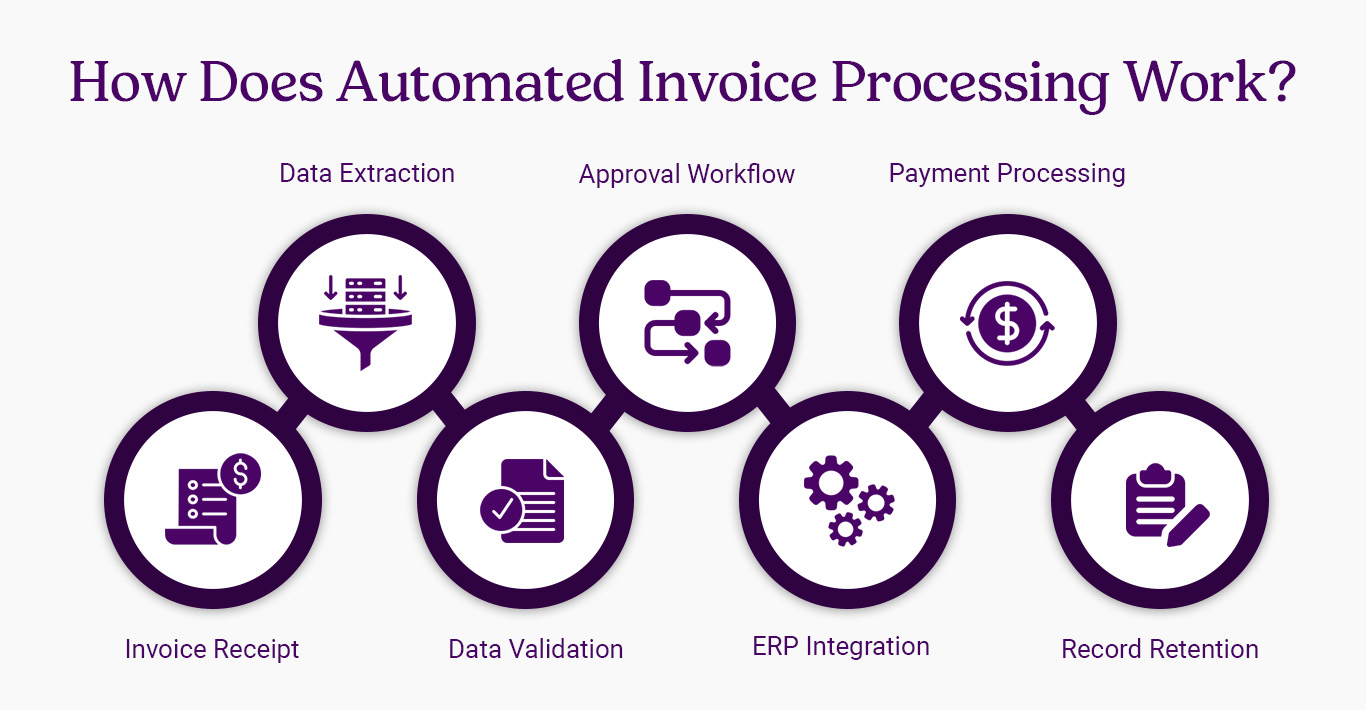

How Does Automated Invoice Processing Work?

Invoice Receipt

Software captures vendor invoices from multiple channels (email, upload portal, or scanned documents) and centralises them in a digital queue.

Data Extraction

Optical Character Recognition (OCR) converts invoices into a text-searchable document before extracting key data, including:

1. Vendor details

2. Invoice numbers and dates

3. Line-item details

4. Payment terms

5. Total amounts

Data Validation

The system automatically validates extracted data against vendor master files and verifies calculations. It also checks for duplicates and flags discrepancies, all in real time.

Approval Workflow

Invoices route through configured approval chains based on amount thresholds, business rules, and exception handling paths.

ERP Integration

Approved invoices and their data are transferred to your Enterprise Resource Planning (ERP) system for posting to the general ledger, payment scheduling, and financial reporting.

Payment Processing

The system triggers electronic payments based on agreed terms, due dates, and cash flow considerations.

Record Retention

Finally, digital copies are stored in compliance with retention policies, with searchable archives for easy data retrieval as needed.

The ROI of Automated Invoice Processing

Accounts payable teams that have streamlined their operations with automation software enjoy lower average invoice processing costs and shorter cycle times.

These are their numbers (global benchmarks from North America, EMEA, and APAC regions shown in US dollars):

| Metrics | Best-in-Class AP Teams | Other AP Teams |

|---|---|---|

| All-inclusive cost of invoice processing | $2.78 | $12.88 |

| Time to process one invoice | 3.1 Days | 17.4 Days |

| Invoice exception rate | 9% | 22% |

| Invoices processed straight-through (processing that doesn’t require human intervention) |

49.2% | 23.4% |

Ardent Partners, 2024

As the table shows, automating paper-laden invoicing processes leads to drops in exception rates and processing times. These improvements correspond to savings on costs that would otherwise be allocated for staff salaries and paper and filing expenses.

Consequently, your clients can pay on time and may even enjoy early-payment discounts. And because your team is no longer scrambling to chase deadlines long overdue, your accountants can redirect their efforts toward higher-value activities like financial analysis. A wholesale win in efficiency and productivity for all parties involved!

Steps for Implementing Automated Invoice Processing

As of 2024, financial leaders are changing priorities due to the high costs of manual processes. A Gartner survey found that 79% of CFOs plan to digitise their companies’ accounts payable function.

If you’re thinking about making this transition too, whether for your firm or your clients, here are some steps to take:

Assess Your Current Process

Document existing invoice workflow from receipt to payment, naming pain points and quantifying processing costs and timeframes. That way, you can establish a baseline for improvement.

You’ll also want to determine integration requirements with your existing accounting software to facilitate seamless data flow.

These assessments will help you set measurable objectives and identify the automated invoice processing software to help you achieve them.

Select the Right Invoice Automation Software

Once you’ve established your objectives, research options that align with your invoice volume and complexity requirements. Choose a solution that balances functionality, integration capabilities, and value for business needs.

Some features to look for include:

- Customisation – Your solution should enable you to configure approval paths based on multiple criteria with delegation options and automatic escalations. It should also support brand continuity through customisable emails featuring company logos.

- Reporting capabilities – A dashboard offering insights into your KPIs will help track and report on the entire payable process, exceptions data, and vendor performance.

- Security and compliance – Your automated invoice software will handle large amounts of sensitive financial and vendor information. So, it’s imperative that it comes with role-based access controls, data encryption, and thorough audit trails to protect both your firm and your clients.

- Support and service – Can you contact your solution provider for technical support well after onboarding? Make sure you can, and confirm that they regularly update their product to align with advancements in the market.

To get a better sense of your shortlisted vendors, request demonstrations that simulate specific invoice processing scenarios.

Configure and Integrate

Suppose you’ve chosen a solution. It’s time to set up your invoice automation system with comprehensive vendor master data and approval workflows. You should also establish clear procedures for handling invoices requiring special attention, such as those with amounts exceeding predefined thresholds.

More importantly, connect your invoice automation system with your existing ERP or accounting software and email systems to ensure seamless data flow across your financial ecosystem. This step is critical to eliminating info silos.

Train and Prepare Employees

As we’ve always said, a tech stack is only as effective as its users. So, develop role-specific training materials and conduct hands-on sessions that allow your AP team members to practice with realistic scenarios.

Consider also creating accessible reference guides for ongoing support. If you can identify super-users, empower them to provide peer assistance.

Finally, be prepared to address concerns about job changes, clarifying how automation will enhance, not replace, roles. Well-prepared users make way for successful adoption.

Launch in Phases

Begin with a controlled pilot group to identify and resolve issues before full deployment. To minimise business disruption while building confidence in your new system, gradually transition from simple to complex invoices. Once your team becomes more adept, you can then implement additional features.

Remember to collect feedback and analyse performance metrics against your baseline to measure success and identify areas for further improvement.

Transform Your Invoice Processing Today

Firms and businesses of any size can improve their financial decision-making and bottom line if manual paper processes don’t bog down their accounts payable teams. While invoice automation requires investment, the return manifests through faster processing, fewer errors, and happier employees and partners.

After all, our current marketplace operates faster than merchants from Mesopotamia, ancient Egypt, or 15th-century Venice could barely imagine. Why should our invoice processing remain stuck in analogue mode?

Invoice automation is a step toward excellence in financial operations for both accounting firms and businesses. Our team of Australian-trained outsourced accountants provides the expertise that complements any automation system. They can handle your daily numbers while you control what matters most.

Ready to optimise your invoice processing? Book a chat with us today.