Running your own firm can be a big, bold risk.

But what’s a big, bold risk to some isn’t always the case for others. So, if you’re planning to break into the world of numbers, spreadsheets, and tax returns, our guide will help you lay the groundwork for your future accounting empire!

But before we get into our list of best tips, practices, and strategies, here’s a rundown of things to consider:

- Your budget

- Your business experience as a firm owner

- The market demand for CPA firms

- Your competitors

- How small or big you’d want your firm to grow

These are only a few but nonetheless important guide points to kick off your firm ownership journey. Let’s get into each below.

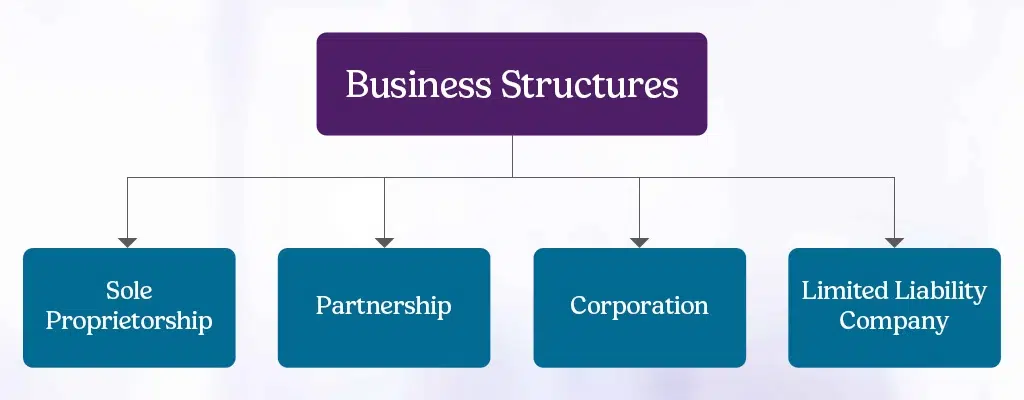

Learn About Accounting Business Structures

Just like how good architecture is the key to a sturdy building, the right structure allows your firm to stand strong amidst vast changes in and out of the industry.

This is why it’s ideal to choose a structure that supports your current budget and future growth.

Here are the four most used legal structures:

Sole Proprietorship

A sole proprietorship means that a single person owns and operates the business.

In other words, there’s no legal distinction between the owner and the business entity—if you’re the sole firm owner, you have complete control over all decisions, and you’re personally responsible for all liabilities and debts.

Partnership

Compared to a sole proprietorship, a partnership is where two or more business owners (or entities) share ownership and operate a business together. All entities share profits and losses.

Formal agreements should outline the terms of your relationship, the distribution of your profits, your responsibilities, and your management duties.

Corporation

A corporation is a legal entity separate from its owners, known as shareholders, established under the laws of a particular jurisdiction. A corporation is recognised as a separate “person” in the eyes of the law.

This separation provides certain benefits, such as limited liability for its shareholders, who are not personally responsible for corporate debts beyond their investment in the company.

Limited Liability Company (LLC)

A limited liability company or LLC is a flexible business structure with elements taken from sole proprietorships, partnerships, and corporations.

Its owners are known as members, who are provided with limited liability protection while also allowing for the operational flexibility and tax benefits of a partnership.

Many successful accounting firms began as sole proprietors, like Deloitte in 1845, or partnerships. Others were born from mergers or acquisitions, like EY, PwC, and KPMG.

As for your CPA firm, it really boils down to how much you’d like to protect yourself from possible business-related risks(debts, business credit score, possible malpractice claims, and tax laws).

Not to mention your firm’s current projected size, how big you’d want it to grow, and how you’d be managing your people and operations.

It’s a good first step to pair up with a more experienced business partner for financial safety, but you can go the sole proprietorship route if you’ve had prior business experience outside of accounting and/or finance.

Register Your Name and Get Qualified

After brainstorming and selecting a company name, look at domain name records to see if your chosen name is still available. To check if the name you have in mind is already trademarked, you can look at the Australian Trademark Online Search System (ATMOSS).

For the meantime, here are some ideas for your company name:

- Portmanteaux, like “VisioMax” (vision maximum)

- Bicapitalisation to join two or more last names, like “DavisWaters”

- Words related to accounting, like “Accounting Pros” or “BooksWise”

-

- Apply online via Australian Business Register (ABR) website

- Fill out the application form

- Provide any required documentation that verifies your identity and business operations

- Allow additional time for potential verification inquiries

As for your business insurance, consider the following factors:

- Kind of coverage (general liability, property insurance, workers’ compensation, etc.)

- Quotes from different insurance providers

- Consultation with an insurance agent or broker

Don’t forget your goods and services tax (GST), which you should also register with ATO.

Note that these can change anytime, so always be on the lookout for any revisions in accounting rules and regulations.

Understand Client Base and Market Demand

Market demand is the total quantity of a product/service that potential clients are willing to purchase based on their personal preferences, income, service price, and overall economic conditions.

Meanwhile, your client base consists of existing customers who repeatedly purchase or use your services. Your business needs a solid client base because it leads to consistent revenue and organic growth through word-of-mouth and repeat purchases.

Identify Your Ideal Client

Now that you’ve understood what a client base is, it’s time to whittle down the best prospects from your client pool.

But how do you even know who your ideal client is?

For starters, it requires research: Study your clients’ ages, genders, locations, and income levels. Delve into psychographics by exploring your clients’ interests, values, motivations, and pain points using surveys or interviews.

This can help you understand not just who they are but also what drives their purchasing decisions.

Lay Out Your Service Offerings

Here’s a list of accounting services that you can either specialise or generalise in:

- Bookkeeping

- Tax Preparation

- Payroll Services

- Auditing

- Accounts Payable

- Accounts Receivable

- Management Accounting

- Consulting Services

- Assurance Services

- Budgeting and Forecasting

Choose a Pricing Structure

But to whittle them down into neater categories, we’ve come up with four:

- Hourly Billing

- Fixed Fees

- Value-Based Pricing

- Tiered Pricing

Use Accounting Software

To avoid unnecessary bottlenecks and time sinks, it’s crucial to choose the right accounting software.

- Need-specific software for specialised functions like tax preparation or time tracking

- Comprehensive practice management platforms that encompass multiple aspects of accounting

Develop a Digital Marketing Strategy

You’re not just invisible in the digital age if you don’t have an online presence — you’re practically nonexistent.

What you need is a sound and flexible digital marketing strategy that works for many causes, like increasing brand awareness, connecting with prospects, or maintaining client relationships.

Website Management

No firm owner wants their target market to lose its interest and trust in the business, and neither should that business get lost in a sea of competitors.

One of the best online touchpoints with your target market is your website, so keep it clean, searchable, relevant, and aligned with your firm’s goals.

To stand out from other accounting firms while keeping their audiences engaged, pay attention to:

UI/UX

User interface (UI) and user experience (UX) directly impact how users interact with your CPA firm’s online presence.

Good UI means your website is visually appealing, easy to navigate, and engaging for whoever visits, which impacts how long they stay on your page or interact with content. This matters because it boosts your conversion rates.

Meanwhile, good UX means that your website is both intuitive and seamless for users, like a responsive chatbot that accurately answers queries and provides what the users need, or a high loading speed whenever a user scrolls.

SEO

It can get pretty complicated when appeasing search engines like Google and make it favour your page. Typically, it takes time to crawl, index, and rank any webpages. Thankfully, you can turbocharge this process with:

- Content SEO techniques like keyword clustering, backlinking, and modified alt texts in images/graphics

- Technical SEO practices like rich snippets, schema markup, and modified URL slugs

Note that you cannot SEO-optimise your website as a whole—it only applies to pages, which gives you more chances to rank high for different categories.

Social Media

Drumming up interest, support, and credibility in the digital space requires strategies—plural.

Here are some time-tested social media best practices for accounting firms:

- Scheduled release of content – create a content calendar and follow the set schedule

- Timing of posts – mind time zone differences and optimal hours of the day to get the most engagement from audiences

- Seasonal posts – post according to current season (e.g. tax preparation tips before or during tax season, infographics on current changes in GAAP/IFRS)

- Community engagement – interact with accounts commenting on your posts

- Hashtags – help the algorithm categorise your content and make it discoverable among interested and relevant users

Invest in Talent

The heart of any business is talent. Your accounting firm will only thrive and flourish if you’re working with a well-oiled talent machine.

Not that acquainted with business roles? We got you! Here’s our rundown of the most common roles in accounting firms so you can assign the best possible positions to your talent team!

Senior/Executive Roles

Some of the high-ranking executive role in companies include:

- CEO or chief executive officer

- CFO or chief financial officer

- COO or chief operating officer

- Company directors

Intermediate/Mid-level Roles

-

- Department head or manager

- Accounting manager

- Finance manager

- Financial data analyst

- Internal auditor

- Controller

Entry Level Roles

Some common entry level accounting roles include:

- Bookkeepers

- Junior accountants

- Staff accountants

- FAP/AR Specialists

Talent: Your Accounting Firm's True Foundation

In starting your own firm, talent will always be your best asset. When you let your talent teams take center stage, you prop up your accounting firm internally. This strong scaffolding helps your firm to weather any storm externally—be it regulation changes, industry trends, or the global economic state.

Book a chat with us to future-proof your accounting firm with top-tier talent.