- Practice management software is essential for modern accounting firms—it centralises tasks, client communication, documents, and deadlines into one streamlined system.

- When choosing a tool, focus on fit over features—consider your firm’s unique workflows, team size, budget, integration requirements, and growth plans.

- Small firms and solo practitioners benefit most from simple, affordable platforms with strong task automation.

- Mid-sized and large firms should prioritise scalability, advanced reporting, and collaboration features to handle complexity.

- The right software not only saves time and reduces errors, but also improves client experience and supports sustainable growth.

Running an accounting firm often feels like a constant juggling act—meeting client deadlines, ensuring compliance, and managing a team. Keeping everything under control can be overwhelming; that’s why a practice management software for accountants isn’t just a helpful tool; it’s a godsend solution, essential for optimising workflows, enhancing collaboration, and driving growth.

Working with over 1,190 accounting firms (and counting), we’ve seen how the right tools can transform accounting firms’ operations. In this guide, we’ll explore the benefits of accounting practice management software, discuss how to choose the right platform, and highlight the leading solutions in the market.

In no specific order, here’s a quick overview of the top accounting firm practice management software accountants use to streamline workflows, improve collaboration, and deliver consistent client service.

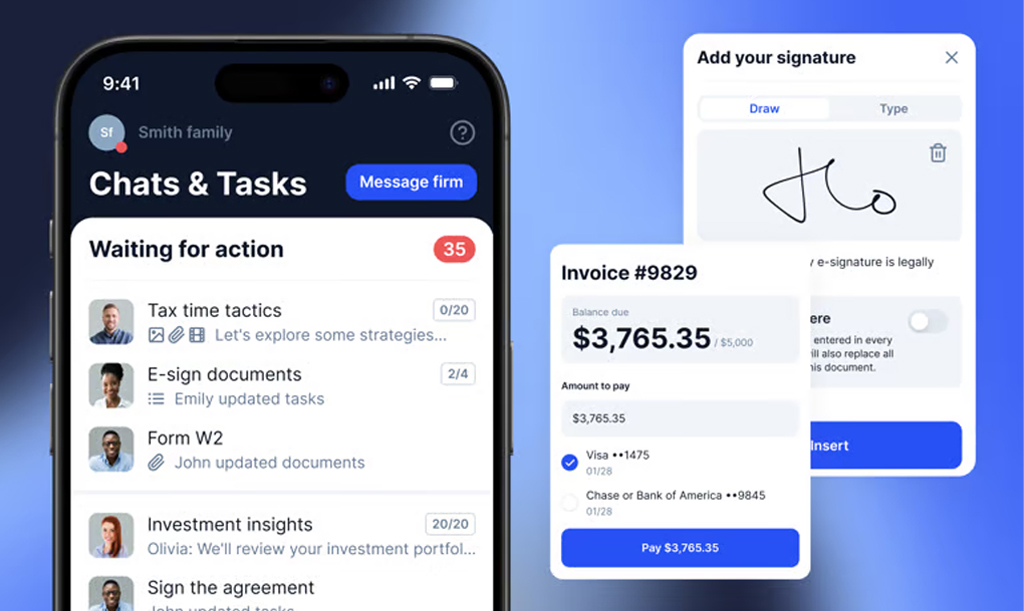

TaxDome

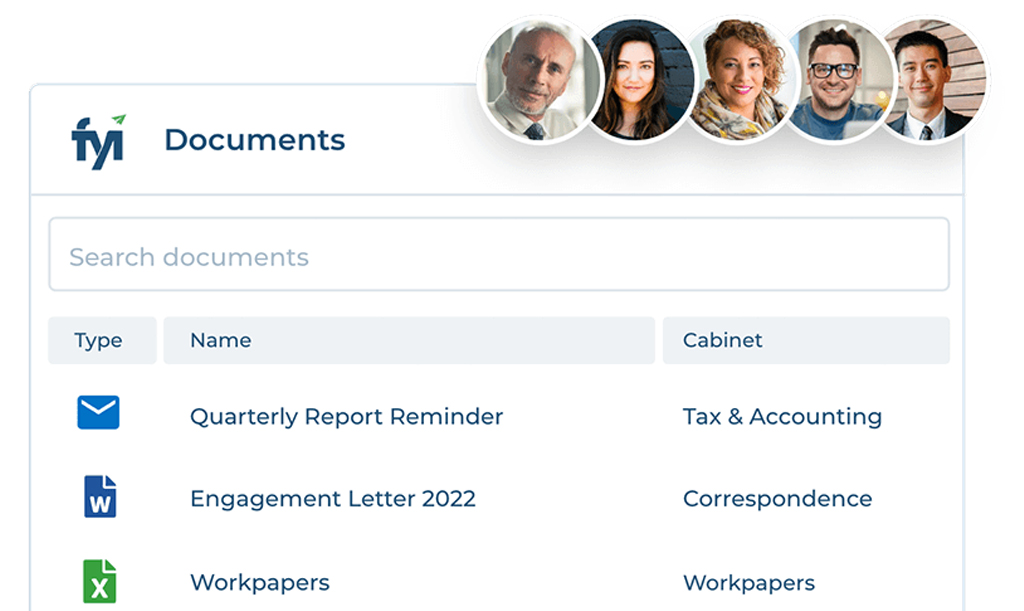

FYI

QuickBooks Online Accountant

Karbon

What Is Accounting Practice Management Software?

Accounting practice management software is the backbone of a modern accounting firm. It brings together the essential tools accounting professionals need into one organised system:

- Task tracking

- Client communication

- Document management

- Deadline monitoring

Instead of switching between spreadsheets, email, and multiple apps, everything is centralised. That means you can see what needs to be done, who’s responsible, and whether deadlines are on track. Routine tasks, such as monthly reconciliations, payroll, and tax preparation, can be automated, while client reminders and compliance checks occur seamlessly in the background.

The real value is clarity and control. Teams can collaborate in real time, share files securely, and keep clients updated without chasing information. For firm owners, it means peace of mind knowing nothing is slipping through the cracks, and for clients, it means consistent, timely, professional service.

How to Choose the Right Accounting Practice Management Solution for Your Firm

Choosing the right practice management software for your accounting firm is not as easy as it seems. Your accounting practice management software will house all your firm’s tasks and clients’ sensitive data, and can also affect your service delivery. With so many options available, it’s natural to feel overwhelmed.

However, by breaking the process into clear, actionable steps, you can confidently decide to align with your firm’s unique needs. Below, I’ll guide you through a strategic approach to help you select the best tool for your business.

Identify Your Firm’s Unique Needs

Before exploring specific tools, analyse your team’s day-to-day challenges and needs. The correct accounting practice management tool should address these pain points directly.

- Recurring Workflows – A massive part of accounting is handling repetitive tasks, such as monthly reconciliations, payroll, tax prep, and client follow-ups. Ensure the software can automate these tasks or provide templates to standardise them.

- Team Collaboration – If your team struggles with miscommunication or missed deadlines, look for project management tools that integrate email with task management to keep everyone aligned.

- Deadline Management– Do missed deadlines or bottlenecks cause issues, especially during tax time? An accounting task management tool with visual project timelines can improve transparency.

- Regulatory Compliance – Many firms need tools to help track regulatory deadlines or secure sensitive financial data. Ensure the software complies with data privacy standards like SOC 2 or GDPR.

Create a list of must-have features versus those that are “nice to have.” This will help you evaluate tools more objectively in the future.

Consider Your Team Size and Budget

Accounting practice management tools can vary significantly in pricing and scalability, so your firm’s size and resources will heavily influence your choice.

- Small Firms or Solo Practitioners – Prioritise simplicity and affordability. Look for intuitive practice management tools that require minimal setup and offer essential features without daunting functionality.

- Mid-Sized Firms (10-50 Employees) – To manage growing complexity, consider practice management tools that handle multiple users, projects, and integrations.

- Large Firms (50+ Employees) – For enterprise-level firms, focus on scalability and advanced reporting features to accommodate multiple teams and high work volumes

Don’t forget to account for long-term costs, such as subscription fees and any add-ons required for additional features or integrations. Balance your budget with the potential efficiency gains the accounting practice management solution can offer.

Evaluate User Experience (UX) and Ease of Use

No matter how powerful a practice management tool is, it won’t be effective if your accounting team finds it confusing or time-consuming.

- Does the software have a user-friendly interface?

- How steep is the learning curve? Will your team need extensive training to use it effectively?

- Does the platform offer mobile accessibility, enabling team members to manage tasks or projects remotely?

Request demos or trial accounts to test how quickly your accountants can adopt the software. Gather feedback to ensure it meets their needs.

Look for Integration Capabilities

These days, accounting practices require a robust accounting tech stack, and your practice management tools should complement these systems, not disrupt them. Poor integration can result in a manual workaround, negating the software’s efficiency gains. Always confirm the compatibility of your current systems with the practice management tool.

Scalability and Flexibility

As your firm grows, your needs will evolve. Choosing a practice management software that can adapt to these changes ensures your investments remain valuable long-term.

- Additional Users – Look for platforms that simplify adding new accounting team members or clients without requiring a full system overhaul.

- Custom Workflows – As your firm grows and takes on new service lines or more complex client portfolios, you'll need adaptable practice management tools. Choose software with customisable workflows that can evolve alongside your processes.

- Advanced Reporting – As your firm scales, you must track team performance, billable hours, and client profitability. Ensure your accounting task management software provides advanced analytics to support data-driven decisions.

Assess Customer Support and Training Resource

Reliable customer support can save your firm significant time and frustration.

- What customer support options (e.g., live chat or phone) are available?

- Does the project management software provider offer comprehensive training materials like video tutorials, webinars, or user guides?

- Is there an active user community or knowledge base where you can find answers to common issues?

Strong support and resources can save your firm time and ensure smooth adoption across your accounting team.

You Might Also be Interested in our Free eBook:

Best Practice Management Software for Accountants

Now that you understand how to pick the right practice management tool for your firm, below is a detailed breakdown of some of the best practice management software for accountants, including their standout key features and ideal use cases.

1. TaxDome

TaxDome sets itself apart by offering a end-to-end platform with unlimited clients and unlimited document storage included in every plan. For growing firms, that means no surprise costs or scaling headaches, just predictable pricing as you add more clients.

Combined with a polished, fully branded client portal and integrations with leading accounting apps like Xero and QuickBooks Online, TaxDome delivers a level of scalability and professionalism many competitors find hard to match.

Key Features:

- All-in-One Operations – Manage CRM, workflows, billing, e-signatures, documents, and payments under one login.

- Unlimited Clients & Storage – Scale your practice without worrying about caps or hidden fees.

- Customisable Client Portal – White-labelled, mobile-friendly portals create a seamless client experience under your firm’s brand.

- Workflow Automation – Automate recurring pipelines and tasks to reduce manual follow-up and save hours each month.

- Local Integrations – Connect with tools widely used in ANZ, including Xero, QuickBooks Online, Stripe, and more.

- Team Collaboration Tools – Internal chat, @mentions, access controls, and wikis keep teams aligned and accountable.

Ideal Firms for TaxDome

TaxDome is used by firms of all sizes, from solo practices to firms with 50+ staff, but it’s particularly useful for mid-sized firms that want to scale and need a platform that grows with them. It’s beneficial for firms handling high volumes of client work, where unlimited storage, automated workflows, and branded portals deliver both efficiency and client confidence.

Pricing (as of 2025)

| Subscription | Price |

|---|---|

| 1-year subscription | AU$1,500 per user/year |

| 2-year subscription | AU$1,400 per user/year |

| 3-year subscription | AU$1,300 per user/year |

| Free Trial? | 14-day free trial |

Reviews

Pros and Cons

- Ease of use

- Automation features

- Prompt and helpful customer support

- Client portal’s ease of use

- Document management system

- Steep learning curve

- It can be difficult and time-consuming to set up

- Some missing features (proposal sending and video file support)

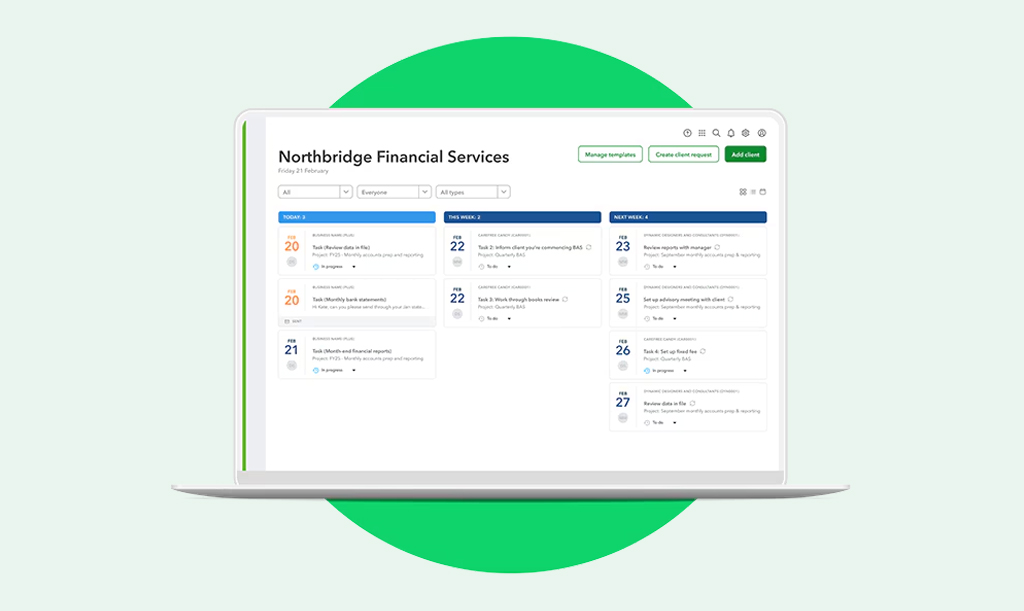

2. FYI

FYI is an Australia-based practice and document management platform built by accountants, for accounting firms. It’s designed to reduce the friction of managing documents, client tasks, and internal workflows—especially for firms wanting cloud-first operations without losing control or visibility.

FYI shines when firms want to clean up their internal back office: fewer manual tasks, less searching for documents, and tighter control over workflows. While it may not (yet) provide every specialised feature that firms in other regions might demand, its deep focus on document and practice management (and strong presence in Australia & New Zealand) makes it a compelling choice for firms aiming to modernise operations with reduced friction.

Key Features:

- Automated Document & Email Filing – FYI helps you eliminate manual filing: client emails and documents are automatically captured and organised. No more hunting through inboxes or shared drives.

- Search & Retrieval – Powerful search tools make finding what you need fast—whether that’s a client interaction, document, or correspondence. Time savings add up.

- Tasks, Jobs & Workflows – Delegate work, track tasks, manage jobs, and set up workflows with review/approval stages. This helps ensure everything proceeds in order and nothing gets dropped.

- Client Management & Collaboration – Keep a complete record of client interactions in one place; collaborate internally and with clients via comments and shared workspace. Improves transparency and reduces miscommunication.

- Time, Billing & Reporting – Track WIP (work-in-progress), bill for it, and generate reports to monitor performance, profitability, and compliance across clients.

- Automation & Integrations – FYI offers prebuilt automations (a library of routines) to streamline repetitive admin tasks. Also integrates with other practice tools you already use.

- Security, Onboarding, Migration Services – Enterprise-grade reliability and uptime, guided onboarding, support, and migration services to help firms transition without downtime or data loss.

Ideal Firms for FYI

FYI makes the most sense for accounting/bookkeeping firms in Australia and NZ, who want a cloud-native platform that handles both document and practice management elegantly. If your challenges include disorganised files, lost emails, slow job tracking, or difficulty in scaling internal processes, FYI provides a strong, locally relevant option. Its features are convenient for firms that provide compliance, tax, bookkeeping, or advisory services, which require a rich document history and workflow control.

Pricing (as of 2025)

| Per user/Month (minimum 5 users per plan) | |

|---|---|

| Intermediate | AU$30 |

| Pro | AU$50 |

| Elite | AU$70 |

| Free Trial? | 30-day free trial |

All prices exclude GST

Reviews

4.7 stars on Xero App Store

Pros and Cons

- Powerful automations (templates, merge fields, signing bundles) save time

- Smooth client onboarding & statutory docs

- Missing basics: no drag & drop, no duplicate alerts, can’t save doc to multiple folders

- Slow load times; frequent log-ins required

3. QuickBooks Online Accountant

QuickBooks Online Accountant (QBOA) aims to bring together everything accounting firms need into one platform. From managing clients’ books to handling your firm’s workflows, billing, and permissions, it’s designed for firms wanting a practice management layer embedded in a major accounting ecosystem.

If your firm is working in QBO (or planning to), QuickBooks Online Accountant brings a lot to the table:

- Tools that automate review work

- Capabilities for managing teams and permissions

- Closer client collaboration

All without having to bolt on an entirely separate practice-management system.

It’s not always going to replace every specialised tool, but for many firms it will handle ~80-90% of what you’ll need well, leaving just the “extra bits” to pick up elsewhere.

Key Features:

- Practice & Client Management in One Place – You can see where all client jobs are at a glance—projects, recurring tasks (like BAS or year-end), due dates—and assign responsibility across your team. Makes keeping track of multiple clients much cleaner.

- Accountant-Specific Tools – QBOA gives you access to features that regular users don’t have: adjust journal entries, reclassify batches of transactions, write off invoices, undo reconciliations, set default date ranges/filters for reports, etc. These tools help speed up reviews and corrections.

- Workflow Automation and Role Permissions – Automating things like invoices, bills, expenses, and setting approval workflows. Plus, you get role-based permissions so you control who can do sensitive stuff in the system. Helps with internal controls and data security.

- Collaboration & Client Interaction – You can share documents, request info from clients, invite them into workflows, and store relevant files, which improves communication and keeps everything traceable.

- Integrations, Reporting & Insights – Since it's part of the QuickBooks ecosystem, there’s strong integration with accounting, bank feeds, and other apps. Reporting and performance dashboards help you monitor firm-wide photo workflow health, client status, and other key metrics.

Ideal Firms for QuickBooks Online Accountant

QuickBooks Online Accountant is particularly useful for small to medium-sized accounting or bookkeeping firms in Australia that either already use QuickBooks Online for their clients or are considering migrating their clients to it. If your firm needs tools beyond basic bookkeeping, QBOA can be a solid home base.

Pricing (as of 2025)

| For your practice | For your clients |

|---|---|

| The firm side of QuickBooks Online Accountant is free; you aren’t billed just for using QBOA. | You do pay (or your clients do) for their QuickBooks Online subscriptions/plans. QBOA includes tools to manage those client subscriptions, sometimes with discounts via the ProAdvisor or “wholesale client billing” features. |

Reviews

Pros and Cons

- User-friendly, easy to use, suitable for small business accountants

- Helps with organising multiple clients; centralised dashboard/visibility

- Value for money & good pricing structure for clients

- Training & ProAdvisor certification seen as useful

- Customer support is hit-or-miss; sometimes slow or not helpful

- Some features (e.g. bank feeds, invoice edits) have glitches or limitations

- Lack of advanced/custom reporting for more complex needs

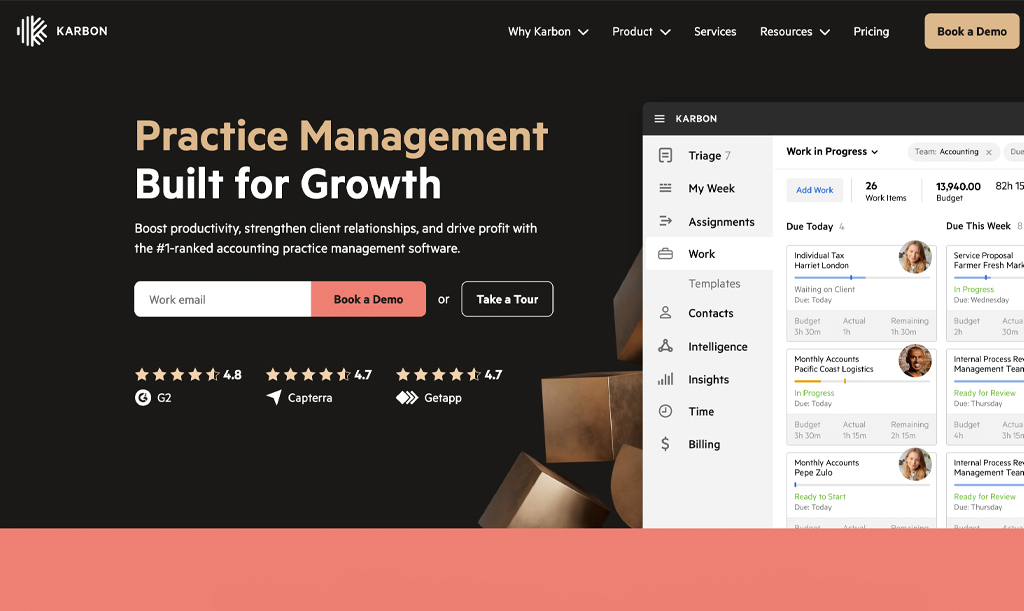

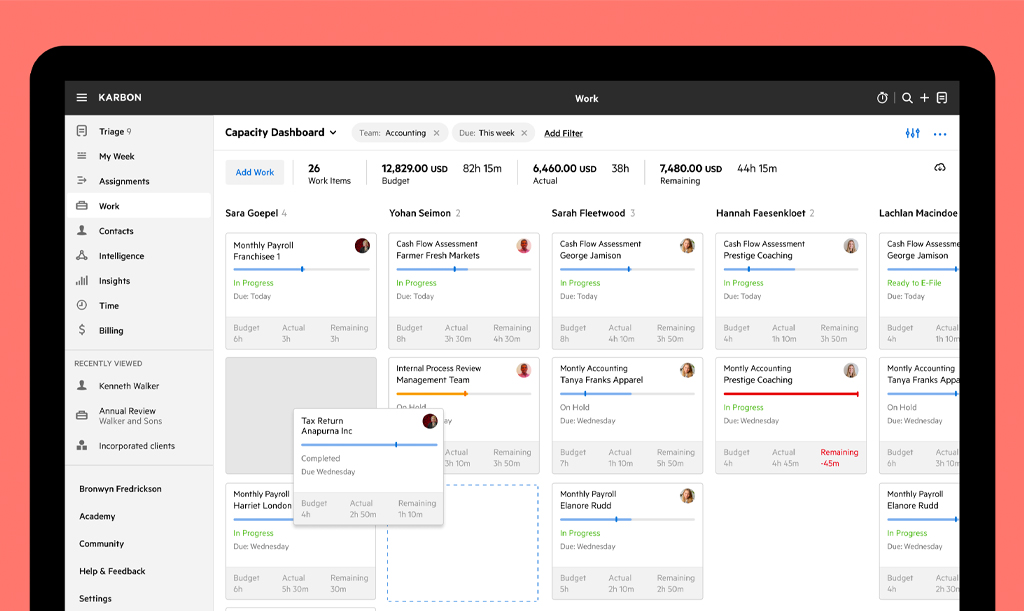

4. Karbon

Karbon is built around one core mission: to become your firm’s single source of truth. Everything—emails, tasks, documents, workflows, and client interactions—lives in one workspace. That deep integration not only boosts visibility but transforms how teams collaborate and get work done.

Key Features:

- Unified Email & Task Management – Karbon’s shared inbox allows emails to become tasks, which can be assigned, commented on, and tracked—keeping communication tied directly to client work.

- Workflow Automation & Templates – Standardise processes with customisable workflow templates and automation. This helps ensure every task (from client onboarding to recurring service delivery) is consistent and reliable.

- Client Portal & Document Handling – Store, share, and organise documents securely from within the platform. Karbon also provides client portal access and e-signature support to keep files and approvals centralised.

- Time Tracking, Billing & Budget Reporting – Track time against tasks, generate budgets vs. actuals, and manage billing workflows, all from one place. It helps you monitor team performance and financial workflows with ease.

- Business Analytics & AI Support – Dashboards and reporting tools give you insights, like bottlenecks or productivity trends, so that you can make operational decisions based on real data. Karbon also integrates AI-powered aids to help draft communications and suggest next steps.

- Secure Platform & Robust Integrations – Built with enterprise-grade security and mobile support. Integrates with tools like QuickBooks, Xero, Dropbox, and more via APIs or direct app links.

Ideal Firms for Karbon

Karbon is an ideal choice for mid to large practices that value collaboration, visibility, and process consistency. If your firm handles complex workflows, relies on distributed teams, or needs to track both client communications and internal processes in one place, Karbon provides the unified, organised environment you need.

Pricing (as of 2025)

| Per User/Month, Billed Annually | Per User/Month, Billed Monthly | |

|---|---|---|

| Karbon Team | AU$59 | AU$79 |

| Karbon Business | AU$89 | AU$109 |

| Karbon Enterprise | Custom | |

| Free Trial | 14-day free trial | |

All prices exclude GST

Reviews

Pros and Cons

- Ease of use

- Effective task management

- Efficiency improvement

- Effective team collaboration

- Centralised email triage (turning emails into tasks)

- Steep learning curve

- Missing features in task assignment or client request handling

- Email management shortcomings (formatting, Outlook/meeting invites)

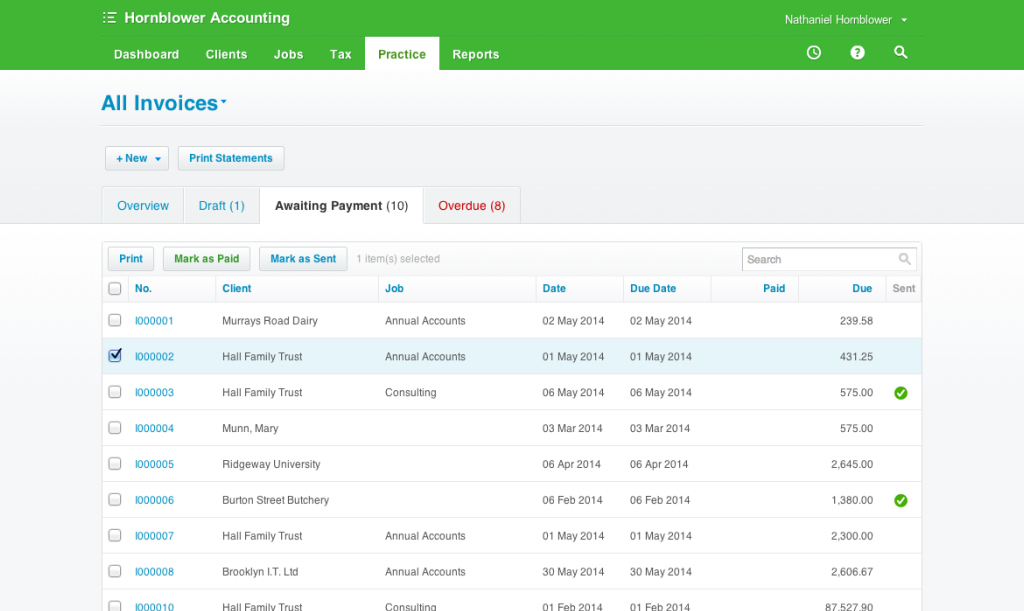

5. Xero Practice Manager

Xero Practice Manager (XPM) is Xero’s native practice-management tool, built for accounting and bookkeeping firms that already live inside the Xero ecosystem. It brings together job tracking, time & billing, reporting, and staff management into one cloud-based platform designed for efficiency and consistency.

For many firms in Australia, XPM will cover most of what you need in practice management, especially if combined with a few supplementary tools for document or client portal needs.Key Features:

- Job & Task Assignment with Deadlines – You can assign jobs or tasks to staff, set due dates/milestones, track progress, and get visibility over who’s doing what.

- Time Tracking & Invoicing – Capture hours worked (manually or via start/stop), convert work-in-progress into invoices, apply rates/markups, or set fixed fees. This ensures clean billing and better work visibility.

- Integration with Xero Accounting & HQ – Because it’s from Xero, client data, invoices, payment status, clients & contacts sync across Xero HQ, your accounting ledger, etc. Invoices marked paid in Xero become reflected as paid in XPM, and vice versa.

- Custom Reporting & Dashboard Insights – Standard and custom reports: productivity, work in progress, billable time, costs, staff performance. The dashboard gives you a snapshot of what’s due, what’s overdue, and how the practice is tracking.

- Configurable Templates & Workflow Settings – You can tailor job templates, task categories/statuses, job workflows, and customise job-related documents (quotes, invoices, job briefs, engagement letters) to match your firm’s processes.

- Staff Permissions & Access Control – XPM allows fairly granular control over who sees and does what—permissions for jobs, financial info, editing, and reporting are adjustable for each staff member.

Ideal Firms for Xero Practice Manager

Xero Practice Manager is perfect for Australian accounting/bookkeeping practices that:

- Already use or are committed to using Xero accounting tools (ledgers, invoicing, Xero HQ, etc.).

- Have multiple clients and recurring workflows (like BAS, tax, bookkeeping cycles) to track.

- Want to improve practice visibility: WIP, staff capacity, profitability, and billing accuracy.

- Prefer a solution tightly integrated with their accounting ledger rather than cobbling together multiple tools.

If your firm has complex document management, deeply custom workflows, or needs features like client-facing branded portals, XPM might require supplements. However, for many firms, it covers most of their core practice management needs.

Pricing (as of 2025)

- New/Bronze Partners pay AU$163.90/month for up to 10 users if they’re not yet at Silver partner status.

- Silver, Gold, or Platinum level Xero Partners can use XPM for free.

- There is a 14-day free trial available for those who are new or Bronze-level partners.

Reviews

4.4 stars on Xero App Store

Pros and Cons

- Ease of use

- Automation of tasks/workflow automation

- Organisation features

- Time-consuming mainly due to its complex setup.

- Locked timesheets & inability to access offline invoices

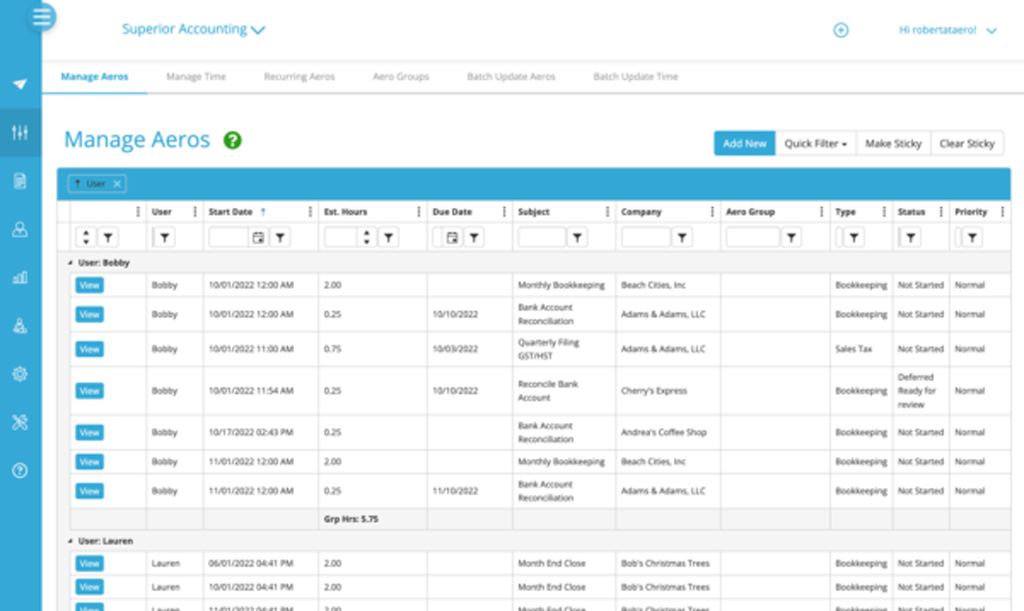

6. Aero Workflow

Aero Workflow is a cloud-based workflow automation system designed specifically for accounting, bookkeeping, and Client Advisory firms. It’s a strong choice if your firm wants clean, reliable workflow automation, excellent visibility, and predictable pricing without surprise fees.

It may not replace every specialty tool in your tech stack, but for recurring work, tracking deadlines, and keeping the internal machine running smoothly, Aero delivers much value. For many firms, especially those scaling up, it hits the sweet spot between capability, simplicity, and support.

Key Features:

- Pre-Built Workflow Templates & Checklists – Aero provides a library of accounting-specific templates (checklists) that you can instantly turn into client tasks. This helps ensure consistency, especially across recurring work (e.g. compliance, bookkeeping cycles).

- Client Vault / Secure Data Storage – Sensitive client credentials, tax IDs, and related resources can be stored securely in the “Client Vault,” so everything necessary is centralised and accessible within workflows.

- Integrated Time Tracking + Task Scheduling – Time tracking is built into each accounting task. Tasks can be scheduled, tracked, and monitored via live firm dashboards.

- Real-Time Dashboards & Deep Reporting – The platform features a dashboard that provides live visibility into the progress of workflows, along with detailed reporting on productivity, efficiency, and profitability. These insights help you identify bottlenecks or areas to improve.

- Integrations & Open API – Aero integrates with QuickBooks Online, QuickBooks Time, Zapier, and more. It also offers an open API, allowing firms to extend functionality or connect to other tools they use.

- Support & Training Built In – Free onboarding, free one-on-one support, and on-demand training/certification are part of all plans. This reduces friction when implementing it with your team.

- Flat-Rate Pricing – Pricing isn’t per user: Aero offers plans by number of users (e.g. 1-5, 6-25, etc.) but doesn’t charge per additional user beyond that band. It also includes all main integrations, templates, etc., within those flat rates.

Ideal Firms for Aero Workflow

Aero Workflow is best suited for small to mid-sized firms managing high volumes of recurring work. It provides clear visibility across teams, helps prevent missed deadlines, and gives leaders insights into productivity and profitability. With flat-rate pricing and strong implementation support, it’s a dependable choice for firms seeking a streamlined internal workflow engine, even if client-facing features are limited.

Pricing (as of 2025)

| Per Month, Billed Monthly | Per Month, Billed Annually | |

|---|---|---|

| Startup (1-5 users) | AU$205 | AU$165 |

| Growth (6-25 users) | AU$380 | AU$305 |

| Scaling (26-50 users) | AU$555 | AU$445 |

| Enterprise (50+ users) | Custom | |

| Free Trial? | 30-day free trial | |

Reviews

Pros and Cons

- Built-in SOPs & workflows

- Good time-tracking

- Pre-built workflow library & recurring/re-useable tasks/templates

- Transparent pricing & value

- Steep learning curve/setup effort up front

- Dated or unintuitive UI

- Reporting limitations

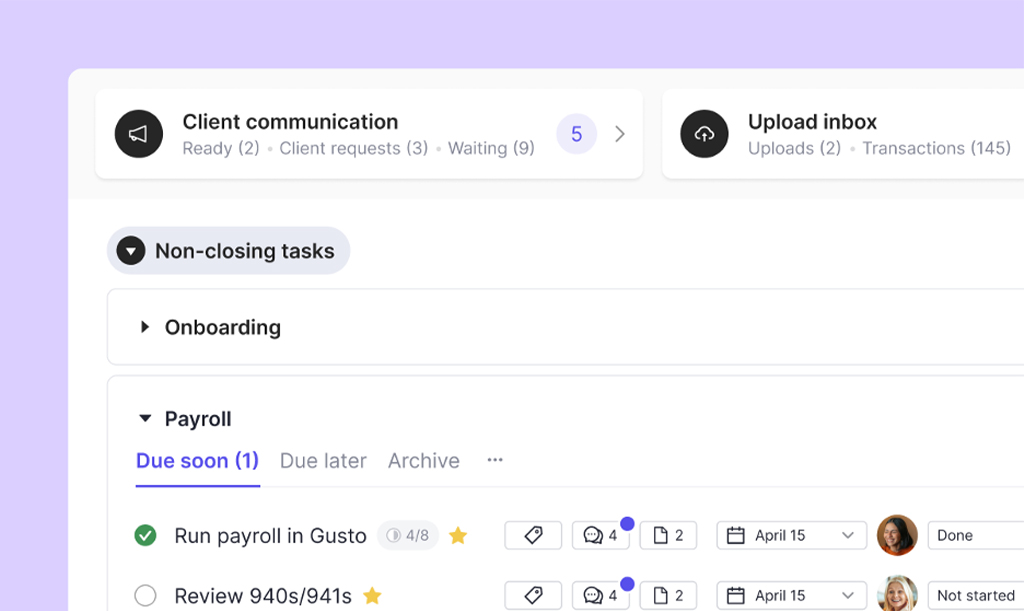

7. Keeper

Keeper is a bookkeeping practice management software that positions itself as the single, powerful workspace for firms working with clients on QuickBooks Online or Xero. What makes it stand out is its tight integration with accounting software, which cuts review time, improves client communication, and automates everyday workflows. It’s built specifically around what bookkeepers need to “close the books faster”—and often does just that.

Key Features:

- Two-Way Integration with QBO & Xero – Keeper is unique among peers in offering two-way sync: changes in Keeper update the client’s ledgers in real time, and vice versa, so workflows stay accurate and in sync effortlessly.

- Automated File Review & Coding Quality Control – Keeper’s intelligent review tools flag inconsistencies (like miscoded transactions, missing payees, or uncategorised entries), helping firms close the books up to three times faster.

- Client-Collaborative Portal with Real-Time Interaction – Asking clients questions directly from their bookkeeping feeds, automating reminders via email or text, and having it all happen inside a secure, branded portal means communication stays tidy, fast, and within one system.

- Client-Based Pricing, Unlimited Team Access – Rather than charging per user, Keeper charges a flat monthly fee per connected client, making expenses more predictable as you scale, with no limit on team seats.

- Built-In Workflow, Reporting & CRM Tools – Templates for recurring tasks, internal chat, tagging and filtering, custom client dashboards, management KPIs, and executive summaries—all help teams stay aligned and firms stay performance-aware.

Ideal Firms for Keeper

Keeper shines for bookkeeping and accounting firms focused on delivering accurate, efficient month-end services, especially firms managing multiple QuickBooks or Xero clients. It’s ideal when transaction-level visibility, quality control, and seamless team-client communication are mission-critical.

Pricing (as of 2025)

| Per Client/Per Month | |

|---|---|

| Standard | AU$14 |

| Premium | AU$16 |

| Enterprise | Custom Pricing |

| Free Trial? | Available |

Keeper offers standard tiers (Standard, Premium, Enterprise) and additional features that can be purchased separately. These options provide firms with the flexibility to acquire specific capabilities without needing to upgrade to a higher comprehensive plan.

| Add-on | Per Client/Per Month |

|---|---|

| Keeper Receipts | AU$24 per client/per month |

| The Tax Suite | Starting at AU$320/month |

| Keeper Emails | AU$16 per connected team email/per month* |

Reviews

Pros and Cons

- Easy to use, smooth workflows

- Improves client & team collaboration

- Saves time on close & client follow-ups

- Email integration can be clunky

- Client management quirks

8. AccountKit

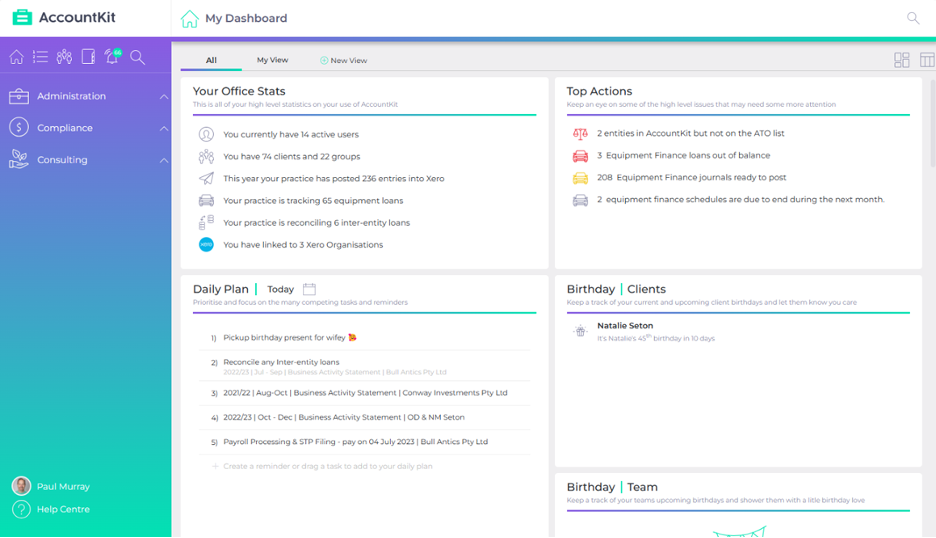

If your firm is looking to move beyond fragmented apps and spreadsheets and wants a single platform that blends workflow control, client visibility, and compliance automation, AccountKit delivers strongly in one package.

Its niche strength lies in compliance tools tailored for accountants, making it stand out for firms where recurring entity structures, inter-entity loans, and standardised workflows are pain points. If your needs focus more on client-facing portals or global multi-tax-jurisdiction support, but within the AU/NZ accounting market, it’s definitely one of the smarter picks.

Key Features:

- Workflow & Task Management – Create recurring templates, define custom statuses, assign teams, and view work-in-progress across your firm.

- Compliance Tool-Suite – Specialised features for accountants, such as inter-entity loan reconciliation across clients, equipment finance schedule automation, Division 7A calculations, and other compliance-heavy tasks.

- Central Client View & Correspondence Register – All client correspondence, documents, notes, and tasks collected in one place. Integration with emails, DMS, and Xero Practice Manager enhances visibility.

- Integrations & Customisation – Seamless links into the Xero ecosystem, DMS tools (FYI, SuiteFiles, OneDrive, etc.), Outlook/Gmail correspondence, and custom branding for your practice.

- Flexible Add-On Structure - Core platform plus optional add-ons so your firm pays for what you use (e.g., workflow module, correspondence register, etc.).

Ideal Firms for AccountKit

Pricing (as of 2025)

| Per Month | |

|---|---|

| Compliance | AU$275 |

| Professional | AU$435 |

| Practice | AU$595 |

| Free Trial? | 14-day free trial |

If your firm manages more clients than the number of Xero connections included in your chosen plan (100 for Compliance, 120 for Professional, and 140 for Practice), AccountKit automatically adds additional connections in packs of 20 for AU$60 per pack per month.

Reviews

5.0 stars on Xero App Store

Pros and Cons

- Saves significant time through automated tools (e.g., Inter-Entity Loan, Div 7A tools)

- Intuitive, all-in-one dashboard for client data, workflows, and structures

- Exceptional support & responsiveness from the team

- Some features are still developing.

- Fewer “advanced” customisations compared to larger suites

Which Accounting Practice Management Software is the Best Fit for Your Firm?

Choosing the right accounting practice management software is crucial for accounting practices. The right tool can transform your operations by organising workflows, boosting collaboration, and enhancing client service. Selecting an accounting management software that aligns with your firm’s needs, supports your growth, and integrates seamlessly with your current systems is essential to unlock these benefits.

At TOA Global, we understand that software is only part of the equation. Having the right people in place to use these tools effectively is just as critical. That’s why we specialise in providing highly skilled accounting talent who integrate seamlessly with your firm, helping you maximise the value of your technology investments.

If you’re ready to combine the right technology with the right talent, our Australian-trained outsourced accountants can help. Explore how we support accounting firms in scaling sustainably while delivering outstanding client service.