The new year is well underway, and so is another tax filing season. It’s generally a stressful time for individuals and businesses alike, but being proactive about deadlines can make for a smooth filing experience. To save you some headaches down the road, we’ve compiled key tax season dates, deadlines, and best practices for 2025.

While we’ve tried to ensure accuracy, note that this calendar is not exhaustive. We recommend checking directly with the Internal Revenue Service (IRS) and your state and local governments for guidance relative to your filing status.

Tax Calendar 2025

| JANUARY (The US tax season starts this month.) |

|

|---|---|

| DATE | DETAILS |

| 10th of every month, starting January | Deadline for employees to report tips of at least $20 from the previous month to employers |

| 15 | Deadline for Q4 2024 estimated tax payments using Form 1040-ES Last day to set up payment plans for outstanding tax bills from previous years |

| 29 | IRS begins accepting returns for 2024 New tax law provisions for 2024 take effect |

| 31 | Deadline for employers to send W-2 forms to employees Deadline for businesses to deliver certain 1099 forms Optional filing date for individuals who missed Q4 2024 estimated tax payment on the 15th |

| FEBRUARY | |

|---|---|

| DATE | DETAILS |

| 18 | Deadline to file updated Form W-4 to reclaim withholding exemption for 2024 Last day for businesses to submit information returns for 2024 payments using the appropriate Form 1099 IRS typically issues refunds for early filers |

| MARCH | |

|---|---|

| DATE | DETAILS |

| 17 | Deadline for Partnerships (Form 1065) and S-Corporations (Form 1120-S) to file 2024 returns |

| 31 | Deadline for electronic filing of Forms 1097, 1098, 1099, 3921, 3922, and W-2G issued for 2024 |

| APRIL | |

|---|---|

| DATE | DETAILS |

| 1 | Deadline for required minimum distributions (RMD) for individuals who turned 73 in 2024 |

| 15 (Tax Day) |

Deadline to file federal tax return and individual income tax return using Form 1040 or 1040-SR

Last day to request tax extension using Form 4868 (extends filing to October 15) Deadline for first quarterly installment of 2025 estimated tax Deadline for Corporate tax returns (Form 1120) Deadline to make 2024 IRA and HSA contributions Last day to set up direct deposit for tax refunds |

| 17 | Deadline to file 2021 returns |

| JUNE | |

|---|---|

| DATE | DETAILS |

| 16 |

Deadline for US citizens/residents abroad to file 2024 returns

Due date for second quarterly installment of 2025 estimated tax |

| SEPTEMBER | |

|---|---|

| DATE | DETAILS |

| 15 |

Deadline for third quarterly installment of 2025 estimated tax

Deadline for Partnership returns (Form 1065) with extensions Deadline for S-Corporation returns (Form 1120-S) with extensions Deadline for corporate third installment of 2025 estimated income tax |

| OCTOBER | |

|---|---|

| DATE | DETAILS |

| 15 |

Deadline for 2024 individual returns with approved tax extension

Deadline for corporate returns with extensions Last opportunity to claim tax deductions for 2024 |

| DECEMBER | |

|---|---|

| DATE | DETAILS |

| 15 | Deadline for corporate fourth installment of 2025 estimated income tax |

| 31 | Last day to make employee-sponsored retirement plan contributions (2025 limit is $23,500) |

| JANUARY 2026 | |

|---|---|

| DATE | DETAILS |

| 15 |

Deadline for fourth quarterly installment of 2025 estimated tax

Begin preparing tax forms for 2025 tax return |

The IRS offers tax relief to individuals and businesses impacted by federally declared disasters, as identified by the Federal Emergency Management Agency (FEMA). For 2024, the full list of such disasters and postponed deadlines is published on the IRS website

Tax Due Dates by State

States with Different Due Dates

| Hawaii | April 20, 2025 |

| Delaware | April 30, 2025 |

| Iowa | April 30, 2025 |

| Virginia | May 1, 2025 |

| Louisiana | May 15, 2025 |

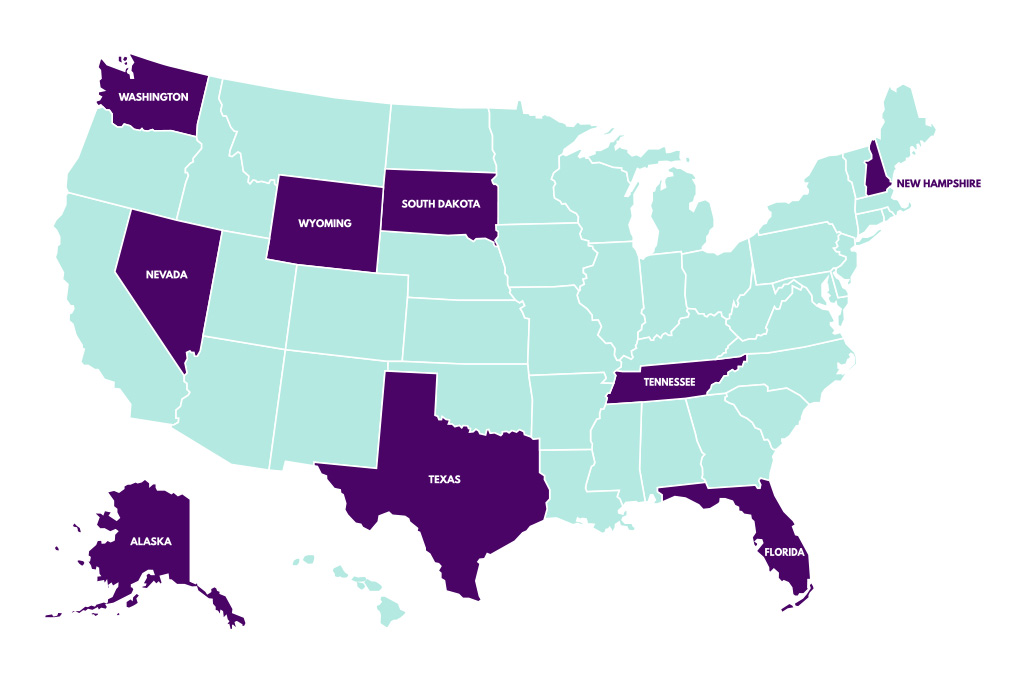

States Without Individual Income Tax

People and businesses in any of these states won’t need to file a state income tax return, although federal taxes still apply:

Alaska

Florida

Nevada

New Hampshire

South Dakota

Tennessee

Texas

Washington

Wyoming

Best Practices for a Successful Tax Season

Whether you’re an accounting firm owner, small business stakeholder, or individual taxpayer, navigating the 2025 filing season doesn’t have to be overwhelming. There are measures you can take to manage your tax obligations. Below, we recommend six.

File Early

Don’t wait until the last minute to prepare and file taxes. Filing early ensures quicker access to potential tax refunds and gives you ample time to gather any missing tax documents.

If you or your clients are indeed expecting a refund, setting up a direct deposit can help you receive funds more securely than waiting for a paper check. In this setup, most eligible taxpayers can expect their tax refund within 21 days of filing.

But if you need the money sooner, a tax refund advance loan may be an option to explore. Keep in mind, however, that this type of financing involves fees and interest charges.

Keep Accurate Records

Create a comprehensive filing system, whether digital or physical, for each tax year. Organize separate folders for different types of income and expenses. Be sure to store all pay stubs and receipts for which you plan to claim tax deductions.

For digital records, use consistent naming conventions and maintain regular backups. Accounting firms should encourage their clients to adopt similar documentation practices.

Stay Updated

Stay informed about tax law changes that could affect federal tax returns. This year, updates to tax credits and deductions include expanded Child Tax Credit provisions and inflation-adjusted income tax brackets.

Consider setting up alerts or subscribing to IRS newsletters for real-time updates. Professional tax preparers should schedule regular training sessions to stay current with regulations and filing requirements.

Invest in a Tax Preparation Software

Use modern tax preparation software to simplify and optimize your filing process. Consider cloud-based software for enhanced data security and accessibility without the added cost of IT infrastructure.

Tap Expert Support

Scale up your team’s capacity by engaging offshore staffing services. These services connect you with global tax professionals who can help you handle filing requirements throughout the year and especially during the busy tax season.

Related Reading: The Ultimate Guide to Offshore Accounting

Use IRS e-File

The IRS encourages electronic filing to avoid delays and identity theft risks. To make the process easier, they have streamlined many tax forms.

When choosing the e-File option, ensure your return is transmitted and accepted by the IRS by 11:59 PM on the due date in your local time zone.

A Note on Extensions

If you need more time to file, you can request an extension using Form 4868. However, keep in mind that any taxes owed are still due by the original deadline. Extensions are for filing, not paying.

Payment plans are available for those who cannot pay their full tax bill by the deadline.

Access Tax Experts with TOA Global

Tax season demands can stretch even the most capable businesses and accounting firms to their limits. If you’re looking to build your long-term tax preparation capabilities, TOA Global is a trusted partner in offshore staffing solutions.

By offshoring with us, you’ll have access to qualified tax professionals who become an extension of your in-house team. Experience our expertise firsthand. Talk to us today.