On September 19, 2025, President Donald Trump signed a proclamation that changes the math of hiring foreign talent. Every new H-1B visa application now carries a $100,000 fee, a rule that came into effect just two days later on September 21.

Many eyes have since been on Silicon Valley, where H-1B visas have long staffed tech companies big and small. But other industries already struggling with a chronic dearth of talent, like accounting, are also bracing for impact.

Here’s what you need to know and what options remain available.

What is the H-1B Visa Program?

The H-1B visa program, created by the Immigration Act of 1990, allows US companies to temporarily hire foreign nationals for “specialty occupations” where qualified domestic talent is scarce. These roles typically demand highly specialized knowledge and at least a bachelor’s degree or its equivalent.

An H-1B visa is initially valid for three years and can be extended for another three, allowing a maximum stay of six years. For many foreign workers, it also serves as a pathway to a green card.

Only 85,000 new H-1B workers can join the US workforce every year: 65,000 regular cap plus 20,000 for those with advanced degrees from a US institution. When petitions exceed the cap, a lottery system determines who gets considered for processing.

Demand is so intense that the quota is often filled in just days. Indeed, the US Citizenship and Immigration Services (USCIS) announced that they received enough petitions to reach the cap for fiscal year 2026 by July 2025.

What Changed on September 21

The new rule is straightforward but consequential: Companies must now pay a one-time $100,000 fee for every new H-1B applicant for petitions filed after 12:01 AM ET on September 21, 2025. That’s a sharp jump from the $2,000 to $10,000 companies typically spent before, even after factoring in legal and administrative fees.

Exemptions are given to:

- Beneficiaries of petitions filed before the effectivity date

- Beneficiaries of previously approved petitions

- Current H-1B visa holders

Following pressures from various medical bodies, the Department of Homeland Security (DHS) can also grant exemptions for “national interest” on a case-by-case basis. This clause could cover physicians and medical residents in rural and underserved areas.

To prevent potential workarounds, Customs and Border Protection (CBP) said it may deny entry to recent H-1B visa holders seeking to enter the country as B-1/B-2 visitors (business travelers or tourists). The concern is that these individuals might circumvent the fee by changing status after arrival.

The Administration’s Rationale

The Trump administration frames the fee as necessary to combat what it called “systemic abuse” of the visa program. Instead of addressing genuine shortages in the workforce, the proclamation asserts that companies hire thousands of foreign workers at a steep discount while simultaneously laying off American employees. Critics and policymakers argue that this setup drives wages down and limits opportunities for domestic talent.

There’s substance to this concern. H-1B contracts specify employers to pay either the “prevailing wage” or the same wage offered to workers with similar experience, whichever is higher. The fine print, however, has enough flexibility that companies can sometimes pay H-1B workers less than their US counterparts in similar roles, particularly if the former holds below-average qualifications for the position.

The logic seems to be that by setting such a high fee, only those with a genuine need will pursue foreign hires. This should, in theory, push companies to be more selective about the talent they petition for and, by extension, prioritize domestic hiring.

Why the H-1B Visa Fee Hits Accounting Hard

The talent crisis in the accounting profession is well documented and worsening. According to the CFO Pulse Survey 2024, 83% of financial leaders couldn’t find talent for open roles. This challenge is compounded by two trends: fewer students are pursuing accounting careers just as experienced practitioners retire. Contributing factors range from rigid certification requirements to outdated stereotypes of the field as pure number-crunching.

Accounting firms have come to rely on the H-1B visa program to fill roles that domestic hiring couldn’t satisfy. In 2024, for instance, Deloitte and EY both ranked among the top 20 H-1B sponsors:

These firms tend to push back against claims that they hire foreign workers to cut wage costs, and data on pay differentials for H-1B holders is mixed. What it does show is that these professionals represent some of the best talent from their home countries.

Research even suggests that foreign workers at audit firms are associated with higher audit quality, highlighting the specialized expertise they bring to their companies.

The STEM Push

The profession has even lobbied for inclusion in STEM classifications, where 80% of H-1B visas go. Firm leaders and trade groups cited the increasingly technical nature of modern accounting work involving data analytics and sophisticated technology as justification.

While critics claim this push is profit motivated, it reflects a real desperation to rejuvenate the pipeline with qualified talent.

But now, with the H-1B pathway essentially eliminated for all but the large firms, competition for an already shrinking domestic talent pool only intensifies further.

The $100,000 Question: What Happens Now?

For mid-sized and smaller accounting firms, the option is simply off the table. Even if they can prove a candidate brings specialized value, spending $100,000 per hire when operating on already thin margins could threaten the viability of their practice.

These are some of the downstream effects:

- You may need to turn away lucrative work because you lack the manpower to handle it

- Expansion plans get stalled or canceled entirely

- Existing staff stretch themselves thin to cover gaps, increasing the risk of errors, compliance issues, and burnout

In a profession where precision is everything, even one such consequence is one too many.

We thus must point out the irony that the program ostensibly designed to protect American jobs and wages may push firms toward offshore solutions anyway, just structured differently.

Offshoring as a Viable Staffing Solution

With domestic hiring constrained and H-1B visas now economically unfeasible for most firms, offshoring is shaping up to be the most sustainable path forward. Firms access a diverse pool of qualified accounting professionals versed in US standards at a fraction of the cost of traditional full-time hiring or H-1B visas. The talent gap that would otherwise stay empty gets filled.

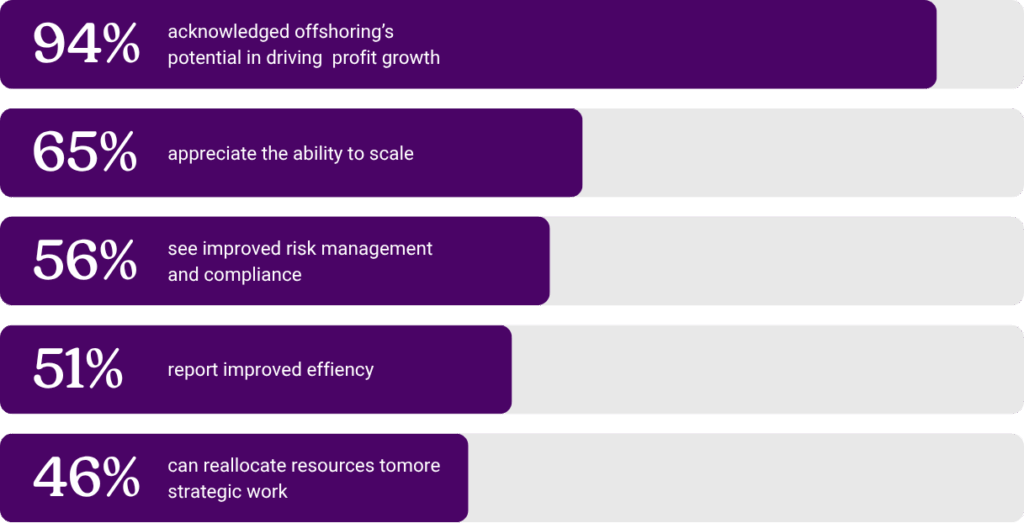

The 2024 Intuit Quickbooks survey reveals compelling benefits:

The Philippines as a Smart Choice

Of the many options available to firm owners, the Philippines consistently ranks in the top three outsourcing destinations. Based on our experience placing thousands of accounting professionals, here’s why:

Accounting Expertise

The Philippines produces thousands of accounting and finance graduates yearly. Many gain international exposure early in their careers, even holding US-equivalent qualifications.

English Proficiency

The Philippines ranks 2nd in Asia and 22nd globally for English proficiency.

Time Zone Advantages

Philippine teams work while US firms sleep. This setup enables your local staff to focus on strategic, client-facing tasks during their normal hours while routine tasks progress overnight.

Strong Government Support

Tax incentives, infrastructure investments, and data privacy legislation give firms confidence they’re building compliant offshore teams. Agencies like the Board of Investments (BOI) and the IT and Business Process Association of the Philippines (IBPAP) also actively support the industry.

Building Your Talent Strategy for the New Reality

The H-1B visa changes aren’t going away. The Trump administration has made its position clear. Whether you agree with the rationale or not, the practical impact on your practice is the same. You’ll need alternative pathways to qualified talent.

At TOA Global, we’ve spent over a decade connecting US accounting firms with highly qualified professionals from the Philippines. Every candidate is screened to be job-ready from day one. To ensure they meet standards and evolve with them, they undergo role-aligned training and career development programs through our registered training division, the Ab2 Institute of Accounting.

Our vast pool of bookkeepers, auditors, junior CPAs, and US-trained offshore accountants allows you to tailor solutions based on your immediate needs. At the same time, you can create a talent strategy that supports your long-term goals.

The H-1B landscape has changed, but your access to qualified talent doesn’t have to. Ready to explore your options? Schedule a call with our growth experts to discuss how we can help you build sustainable teams.