The Australian government actively advocates for businesses to embrace invoicing software to improve productivity, streamline cash flow, and combat payment redirection scams. You understand, as an accounting firm, that beyond communicating costs, fees, and payment terms, proper invoicing is a critical legal and tax obligation for your clients.

With numerous invoicing software options available, each boasting features designed to simplify financial management, the key lies in selecting the right tool for your clients. This article guides you through the essential considerations for choosing online invoicing software that aligns with their needs for adherence to Australian tax regulations.

Our Top Picks: Invoicing Software Popular in Australia

A good invoicing software has a few core functions that small and medium-sized enterprises (SMEs) need: it must be able to create invoices, track payments, send reminders, and generate financial reports.

Having these core functions improves the entire accounting process, allowing you to save time, be prepared for audits, and view real-time updates.

Here is a curated list of small business invoicing software that we believe offers excellent value to your clients:

1. QuickBooks

QuickBooks turns invoicing from a chore into a strategic advantage by directly enhancing your cash flow and improving your professional image.

At its core, QuickBooks allows you to effortlessly create customised, professional invoices that reflect your business brand. Easily personalise your invoices by adding your logo, brand colours, and custom details so you can send professional, branded invoices in minutes.

Its efficiency, however, is thanks to its automation. You can set up recurring invoices for regular clients and batch-send multiple invoices simultaneously, so you save time. Integrated payment processing also enables you to add a “Pay Now” button directly to invoices, allowing customers to pay instantly online via credit card, debit, or bank transfer.

QuickBooks also provides intelligent tracking with real-time updates on invoice status (sent, viewed, paid) and can automatically send personalised payment reminders, so there is no need for manual follow-ups. For project-based work, progress invoicing enables you to bill in stages, ensuring a steady cash flow.

While part of a broader accounting suite, QuickBooks’ invoicing features alone offer immense value by simplifying the billing process and accelerating your payments.

QuickBooks offers tiered pricing ranging from $29 for a Simple Start subscription to an Advanced account that costs $110 and over. QuickBooks offers flexible options for small and growing businesses.

2. MYOB

MYOB enables businesses to easily create and send professional, branded invoices from any device for flexibility and efficiency. The platform allows for invoice template customisation, so users can incorporate their brand identity while detailing all necessary information, from itemised services to payment terms.

One of the key strengths of MYOB’s invoicing capabilities is its integrated payment options and automation. Businesses can add fast payment links to their invoices for faster online settlements. MYOB also simplifies the sales process from quote to invoice, allowing your clients to manage transactions smoothly. Recurring invoices and automated payment notifications enable consistent billing and proactive follow-ups.

As for subscription costs, MYOB offers multiple pricing plans: the basic Lite Plan, best for sole traders and small businesses, costs $17 per month. Pro Plan for SMEs with more employees at $31.50, and AccountRight Plus, for established companies, at $75.00. For those who want to use MYOB solely for payroll purposes, a Payroll Only plan costs $9 per month.

3. Xero

Xero is designed to simplify and accelerate the payment process for businesses. It also streamlines the inclusion of all necessary details, such as payment terms, taxes, and itemised services, so invoices are transparent and compliant.

One of the most significant advantages of Xero’s invoicing is its emphasis on automation and integrated payments. You can help your clients set up recurring invoices for regular clients to minimise manual effort for consistent billing.

Xero also allows customers to pay directly online via various methods, including credit cards, debit cards, and direct debits. This online payment integration enhances cash flow by reducing the time it takes to receive payment.

With its real-time visibility into invoice statuses, Xero enables you and your clients to track which invoices have been sent, viewed, and paid, providing a clear overview of your accounts receivable.

Pricing starts at $ 35 per month for its basic “Ignite” plan, all the way up to $115 per month for its most comprehensive “Ultimate 10” plan.

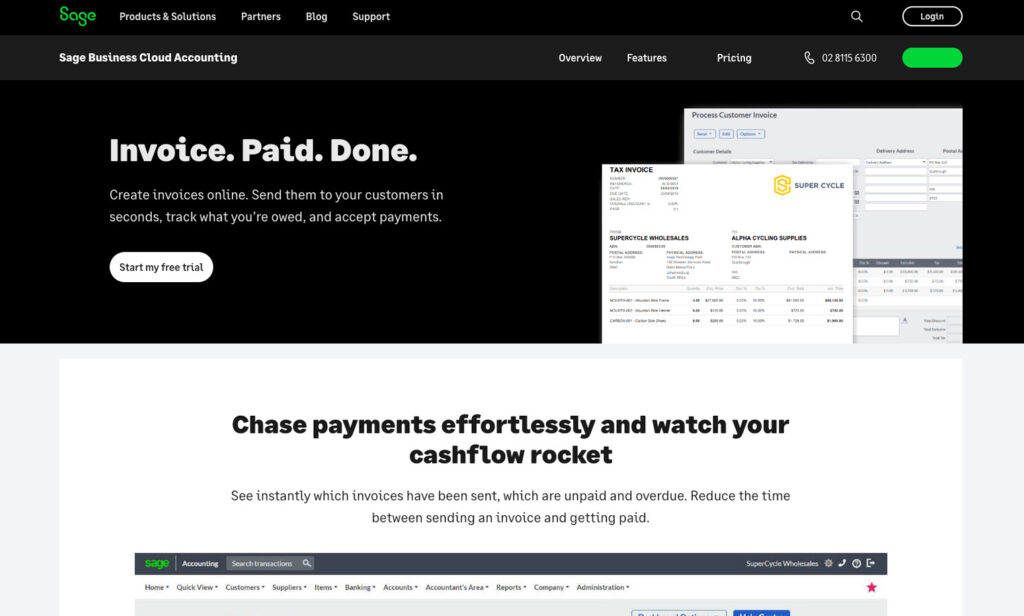

4. Sage

Sage is ideal for small to mid-sized businesses that need to navigate accounting and compliance. Thanks to its integrated online invoicing and accounting on a single platform, Sage is AU tax-ready with GST BAS and payroll modules. Its real-time dashboard shows invoice status and cash flow, making accounting much easier.

Pricing is tailored to your business size and specific needs, which means you can expect to pay only for what you need with its flexible and customisable pricing.

5. Zoho Books

Zoho Books is designed to simplify billing and improve financial control. The system supports various payment methods, providing convenient payment terms and accelerating cash flow.

A key advantage of Zoho Books is its focus on automation and security in the invoicing workflow. Businesses can automate reminders for unpaid invoices, saving effort and speeding up collections. For regular services, businesses can also easily set up recurring invoices to streamline billing. Security features, such as digital signatures and an invoice approval process, help ensure compliance and prevent errors while credit card processing is handled securely.

Zoho Books caters to specific payment scenarios. It supports multi-currency pricing, so it’s suitable for businesses with global clients. The software handles advance payments through retainer invoices and efficiently manages returns and refunds via credit notes. It also offers unique features, such as tracking customer withheld percentages, for a detailed and accurate view of accounts receivable.

For small businesses making less than $50,000 per annum, Zoho offers free plans, but for bigger businesses, there is a tiered payment scheme where you can expect to pay $16.50 for the standard version, up to $319 for the ultimate package.

Read More: Free Checklist For Accountants

FAQs

What is the best invoice software?

- QuickBooks: Best for small to medium-sized businesses needing comprehensive accounting alongside powerful invoicing.

- MYOB: Ideal for Australian and New Zealand businesses seeking integrated accounting and robust payment tracking.

- Xero: A great small business invoicing software for growing teams prioritising ease of use, automation, and real-time financial insights.

- Sage: Suitable for businesses requiring scalable accounting solutions with strong financial reporting and multi-currency invoicing capabilities.

- Zoho Books: Excellent for freelancers and small businesses looking for a free, comprehensive, and highly customisable invoicing and accounting solution.

Can I send invoices from a mobile device or app?

Yes, most modern invoicing software, including cloud-based solutions such as QuickBooks, Xero, MYOB, Sage, and Zoho Books, offer dedicated mobile apps or mobile-responsive interfaces that enable you to create, send, and track invoices on the go.

Do all invoicing tools support GST and BAS in Australia?

No, not all invoicing tools automatically support GST (Goods and Services Tax) and BAS (Business Activity Statement) in Australia.

In choosing invoicing and accounting software for your Australian clients, prioritise solutions like QuickBooks that offer features and compliance for Australian GST and BAS. This helps your clients meet their tax obligations efficiently and accurately while streamlining your ability to support them.

Best Invoicing Software You Can Recommend For Clients

The right online invoicing software enables Australian small businesses to gain a clearer view of their cash flow, enhance productivity, and ensure strict tax compliance.

There is no single “best” solution for selecting your invoicing software, but platforms like QuickBooks, MYOB, Xero, Sage, and Zoho Books each offer distinct advantages.

By carefully evaluating your clients’ unique operational needs, compliance requirements, and budget, you guide them toward the right online invoicing software that meets their business needs, nothing less.