Table of Contents

Introduction

Accounting firms are facing increasing pressure to deliver more services at a faster pace and at a lower cost. At the same time, wage inflation and shifting client expectations make it harder to scale up an in-house accounting team without sacrificing quality. Eventually, these firms found a solution: accounting outsourcing.

For U.S.-based firms, outsourced accounting services have become a viable option and a strategic move to maintain margins, boost capacity, and access global talent.

But here’s the catch: not all outsourcing destinations are created equal. Choosing the wrong country or outsourcing partner results in high turnover, communication gaps, or worse, client dissatisfaction.

That’s why it’s absolutely critical to understand the landscape of outsourcing destinations before making a decision. By evaluating factors like talent quality, cultural fit, time zone overlaps, and long-term scalability, accounting firms can find the right offshore team that supports growth without compromising service standards.

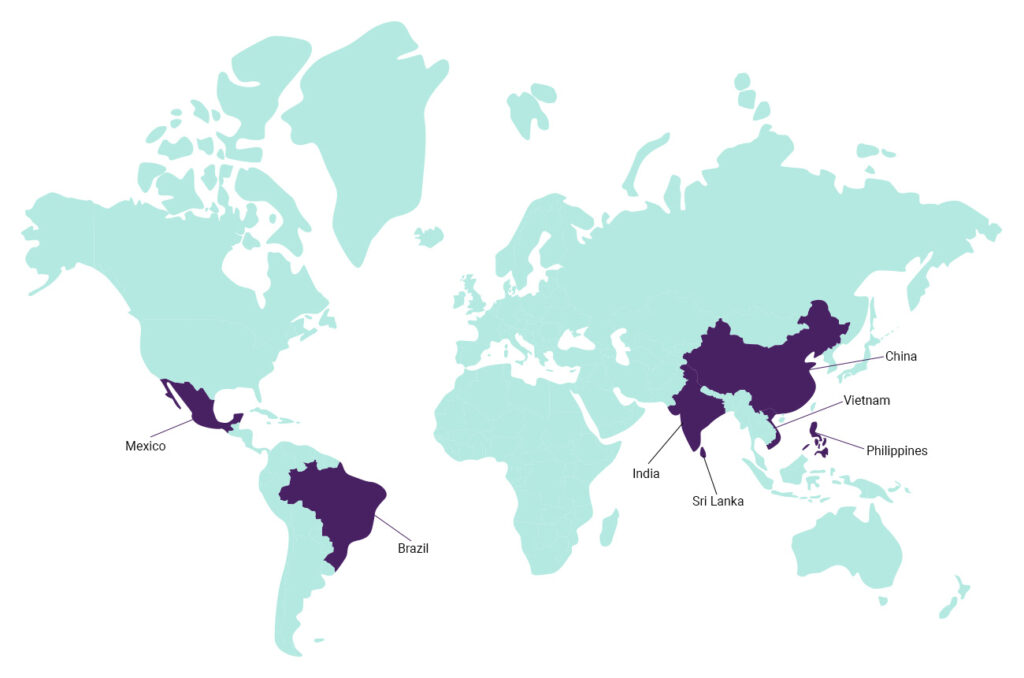

In the next section, we’ll explore the top global destinations for accounting outsourcing and how each stacks up in terms of talent and capability.

Offshoring Accounting Talent: A Strategic Advantage

Let’s start with the benefits. Accounting outsourcing isn’t just about reducing the costs of finance and accounting functions. When done right, it becomes key in back-office operations for business growth.

Here’s how:

- Lower labour costs, higher margins: Outsourced accounting services typically costs less than in-house equivalents, even when factoring in management, accounting software, and tech expenses, making it especially attractive for Australian businesses.

- Access to global talent: Firms tap into offshore accountants that can work with Australian businesses, with certified experience, CPA training, and industry expertise.

- Time zone advantages: Outsourcing enables 24/7 productivity, especially when collaborating with teams in different time zones.

- Operational focus: With transactional work offloaded, U.S. firms can focus their limited resources on advisory, tax strategy, client-facing roles, and other critical decisions.

Outsourcing helps firms solve capacity issues, especially during tax season or growth surges. It also helps scale advisory services by freeing up senior accountants and instead delegate tasks like bookkeeping, A/P, payroll, and reconciliations to reliable teams offshore as the business expands.

Factors in Evaluating Accounting Outsourcing Destinations

When considering accounting outsourcing, the country you choose matters, especially since you have to factor in their different strengths and potential challenges to increase productivity and boost efficiency:

1. Cost Efficiency (Even as Business Grows)

Different countries offer different wage levels, which impact your labour and operational cost budgets, especially if you are looking for cost-effective solutions.

When deciding where to offshore, compare salaries for accounting roles, expected benefits like mandatory vacation days and health insurance, and overall operational expenses to make the best out of your investment.

Most top outsourcing countries are affordable, but financial insights alone can’t be your main basis for your offshoring decision.

2. Language Proficiency

Clear communication is non-negotiable, especially when sensitive data, compliance, or advisory work is involved. Written English matters for documentation, while spoken English matters for meetings and collaboration.

Choose a country where language proficiency is high, with accounting professionals who are proficient in English or in any other language your business operates in (for firms that want to go global).

3. Back Office Operations and Dedicated Support

You need to know if the talent pool is deep enough, not just in numbers, but in their ability to make informed business decisions. Are their outsourced accountants actually CPA-level professionals? Can you scale quickly if needed?

More than that, does the country have advanced security measures and data protection laws that comply with international standards to safeguard the sensitive information, as well as your finance and accounting needs that are necessary to your business? Start with assessing internet connectivity and cyber security measures; ensure that it has the technology required to run your business seamlessly.

4. Time Zone Compatibility

Collaboration across time zones can be a benefit or a burden. Outsourced accounting firms ideally work while you sleep or overlap enough to support your entire team for real-time meetings and quick feedback loops.

For example, a California-based accounting firm may favour Mexico for same-day collaboration, but a New York-based firm may prefer the Philippines for asynchronous work, which effectively speeds up turnaround times.

Significant time differences may require adjustments to work schedules, though. For instance, instead of asynchronous work schedules, many firms might want same-day collaboration with their internal staff, so Philippines-based accountants may have to work night shifts.

5. Cultural differences

Some companies make the mistake of overlooking the importance of culture, which plays a big part in successful collaboration and integration. For instance, in communicating style, some cultures favour direct communication, while others prefer subtle approaches.

Workplace structure and values also demand alignment. Differences like hierarchical vs. flat structures, or individualism vs. collectivism, impact employee interaction in companies. Recognising these creates a more cohesive environment if you want a unified team approach.

Adopting a proactive approach to culture and values fosters a true collaborative partnership with your outsourced team, moving beyond a transactional one.

Accounting Outsourcing Talents in Different Countries

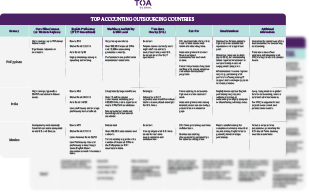

Let’s look at how some of the leading accounting outsourcing countries compare on these criteria:

| Country | Cost-Effectiveness (vs. Western Regions) | English Proficiency (EF EPI Score / Band) | Workforce Availability & Skill Level | Time Zone Overlap (U.S.) |

|---|---|---|---|---|

Philippines |

High savings, up to 70% lower labor costs. Significant reduction in overheads. |

Score: 570 Global Rank: 22nd out of 116 Asia Rank: 2nd out of 23 High Proficiency. Strong in Speaking and Writing |

|

Excellent, with Filipino teams routinely working night shifts to achieve full overlap with U.S. business hours, enabling 24/7 operations. |

India |

High savings, typically 50-70% reduction in labor costs. |

Score: 490 Global Rank: 69th out of 116 Asia Rank: 10th out of 23 Low Proficiency. Average proficiency has declined. |

|

Strategic, enabling a 24/7 asynchronous workflow where tasks are completed overnight for U.S. firms. |

Mexico |

Competitive, with relatively lower labor costs compared to the U.S. and Europe. |

Score: 459 Global Rank: 87th out of 116 LatAm Rank: 20th out of 21 Low Proficiency. General proficiency is low, though pockets of fluent accountants exist |

|

Excellent, closely aligns with U.S. time zones, facilitating real-time communication and collaboration. |

Vietnam |

Very high savings, up to 90% cheaper than the U.S. and up to 50% lower than India/Philippines. |

Score: 498 Global Rank: 63th out of 116 Asia Rank: 8th out of 23 Low Proficiency. |

|

Asynchronous, tasks assigned at the end of the U.S. workday can be completed overnight. |

Sri Lanka |

High savings, 10% lower than India in IT and 20% lower in BPO. |

Score: 486 Global Rank: 73th out of 116 Asia Rank: 8th out of 23 Low Proficiency. |

|

Asynchronous, due to significant time differences. |

China |

Competitive, recognized as a popular outsourcing destination. |

Score: 455 Global Rank: 91th out of 116 Asia Rank: 15th out of 23 Low Proficiency. |

|

Asynchronous, due to significant time differences (12-15 hours ahead of U.S.). |

Brazil |

Competitive, with significantly lower accountant salaries compared to American salaries. |

Score: 466 Global Rank: 81th out of 116 LatAm Rank: 18th out of 23 Low Proficiency. |

|

Closer real-time overlap (1-3 hours difference from EST), making real-time collaboration more feasible than Asian locations. |

Philippines |

|---|

|

Cost-Effectiveness (vs. Western Regions) High savings, up to 70% lower labor costs. Significant reduction in overheads. |

|

English Proficiency (EF EPI Score / Band)

Score: 570 Global Rank: 22nd out of 116 Asia Rank: 2nd out of 23 High Proficiency. Strong in Speaking and Writing |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Excellent, with Filipino teams routinely working night shifts to achieve full overlap with U.S. business hours, enabling 24/7 operations. |

India |

|---|

|

Cost-Effectiveness (vs. Western Regions) High savings, typically 50-70% reduction in labor costs. |

|

English Proficiency (EF EPI Score / Band)

Score: 490 Global Rank: 69th out of 116 Asia Rank: 10th out of 23 Low Proficiency. Average proficiency has declined. |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Strategic, enabling a 24/7 asynchronous workflow where tasks are completed overnight for U.S. firms. |

Mexico |

|---|

|

Cost-Effectiveness (vs. Western Regions) Competitive, with relatively lower labor costs compared to the U.S. and Europe. |

|

English Proficiency (EF EPI Score / Band)

Score: 459 Global Rank: 87th out of 116 LatAm Rank: 20th out of 21 Low Proficiency. General proficiency is low, though pockets of fluent accountants exist. |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Excellent, closely aligns with U.S. time zones, facilitating real-time communication and collaboration. |

Vietnam |

|---|

|

Cost-Effectiveness (vs. Western Regions) Very high savings, up to 90% cheaper than the U.S. and up to 50% lower than India/Philippines. |

|

English Proficiency (EF EPI Score / Band)

Score: 498 Global Rank: 63th out of 116 LatAm Rank: 8th out of 23 Low Proficiency |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Asynchronous, tasks assigned at the end of the U.S. workday can be completed overnight. |

Sri Lanka |

|---|

|

Cost-Effectiveness (vs. Western Regions) High savings, 10% lower than India in IT and 20% lower in BPO. |

|

English Proficiency (EF EPI Score / Band)

Score: 486 Global Rank: 73th out of 116 La Rank: 11th out of 23 Low Proficiency |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Asynchronous, due to significant time differences. |

China |

|---|

|

Cost-Effectiveness (vs. Western Regions) Competitive, recognized as a popular outsourcing destination. |

|

English Proficiency (EF EPI Score / Band)

Score: 455 Global Rank: 91th out of 116 Asia Rank: 15th out of 23 Low Proficiency |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Asynchronous, due to significant time differences (12-15 hours ahead of U.S.). |

Brazil |

|---|

|

Cost-Effectiveness (vs. Western Regions) Competitive, with significantly lower accountant salaries compared to American salaries. |

|

English Proficiency (EF EPI Score / Band)

Score: 466 Global Rank: 81th out of 116 LatAm Rank: 18th out of 21 Low Proficiency |

Workforce Availability & Skill Level

|

|

Time Zone Overlap (U.S.)

Closer real-time overlap (1-3 hours difference from EST), making real-time collaboration more feasible than Asian locations. |

Matching Your Firm’s Needs to the Right Country

Your best-fit outsourced accounting destination depends on a variety of operational goals, support, and long-term business strategy. Each country brings unique strengths that align with specific outcomes.

For scalable CPA-level talent:

The Philippines and India both offer extensive talent pipelines. The Philippines excels in English proficiency and cultural alignment, while India provides sheer volume and technical depth. Remember that the right outsourced accounting functions service providers should have extensive real-world industry experience. This is why preferred outsourcing accounting providers are the ones that employ certified professionals.

For Australia/New Zealand time zone compatibility:

The Philippines offers solid partial overlap for key early-day touchpoints and can facilitate overnight accounting work completion, while India provides significant overlap for the latter half of the ANZ workday. Mexico presents limited direct real-time collaboration but can manage tasks that don’t require immediate synchronised interaction.

Client-facing support

Workflow continuity or 24/7 turnaround:

The Philippines and India allow for overnight processing, so their accounting outsourcing talents deliver faster results to their partner companies.

Priority on labour and operational costs:

All top countries rank high on affordability. But beyond cost, consider culture, quality, scalability, and communication standards of your expert team of accountants, for better ROI.

Identifying your outsourcing priorities allows you to match with a destination that helps improve overall accounting services and delivery, team dynamics, and long-term growth among finance professionals.

Implementation Checklist for Accounting Firms

Ready to take the next step? Here’s a simple checklist to help your firm get started with outsourcing:

- Audit internal workflows. Identify which tasks, like bookkeeping, payroll, or other finance functions, can be delegated to the outsourced finance team.

- Shortlist top countries. Compare your countries of choice based on your specific accounting needs: time zone, workforce, English skills, technology, data entry, and data security.

- Vet outsourcing providers. Look for SOC 2 or GDPR compliance frameworks, strong recruitment pipelines, or ongoing support for daunting tasks that may be more challenging to outsourced solutions talent.

- Pilot before scaling. Start with 1-3 full-time team members (FTEs) and assign them to an accounting manager to see how the offshore team integrates with your company culture and current staff and observe the benefits these initial team members bring before making a larger investment.

- Document your Standard Operating Procedures and Key Performance Indicators. Set clear expectations and track performance from Day 1. This way, your finance department, whether in-house or offshore, know your accounting processes and functions, so you are productive at every stage.

88 Time-Consuming Accounting Firm Tasks That Are Most Easily Offshored

Better Accounting Services with Offshore Partnerships

While various global destinations provide unique advantages in outsourcing services, some regions have cultivated exceptional environments for professional accounting functions and finance services.

Consider the following benefits of a well-chosen outsourced accounting services partner:

- Expert Guidance. The global talent pool includes highly skilled professionals with significant real-world experience in accounting and finance. Partners dedicated to these sectors connect firms with individuals deeply familiar with diverse financial systems and practices.

- Focus on Career Pathways and Training: Leading offshore finance companies invest in their teams' professional development, so staff remain at the forefront of industry knowledge and technology.

- Strong Security and Compliance: Handling sensitive financial data demands the highest levels of security and compliance. Reputable offshore companies prioritize these aspects, with up-to-date technology and internationally recognized compliance for frameworks like AICPA SOC 2 to safeguard sensitive information, at the same time offering real-time visibility into financial data.

- Dedicated Full-Time Employee Model: A dedicated team model means your offshore accounting staff works only for your firm, so they integrate better with your business. This approach builds your accounting team's capacity, delivering a direct return on your investment and supporting your long-term goals.

- Predictable, Value-Driven Pricing: Transparent and flat-rate pricing, encompassing all-inclusive services, offers clear financial forecasting and helps firms manage costs effectively without unexpected expenses.

Strategically collaborating with offshore partners who excel in remote accounting services help firms optimise their operations and unlock new avenues for growth and service delivery.

TOA Global is Your Accounting Outsourcing Partner

Outsourced accounting is now a strategy that allows companies to boost capacity, serve clients better, and future-proof their operations.

Among the top outsourcing countries, the Philippines stands out for its English fluency, cultural alignment, skilled workforce, and reliable infrastructure, making it the preferred choice for many U.S., Canada, Australia, and New Zealand firms.

However, the best destination depends on your firm’s unique needs. Don’t let operational limits stifle your growth. Partner with TOA Global to scale smarter, improve efficiency, and build a team that drives long-term success.

Ready to explore what’s possible? Schedule a no-obligation chat with us today and take the first step toward building your global team.