Accounting leaders who successfully anticipate accounting industry trends are able to design better long-term strategies and ride on the crest of the wave.

Here are the people, software and technology trends that are shaping the accounting industry in 2020 and beyond.

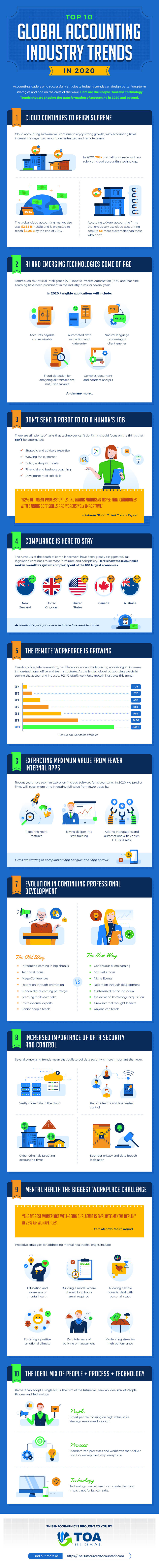

Table Of Contents

- 2. AI And Emerging Technologies Come Of Age

- 3. Don’t Send a Robot to Do a Human’s Job

- 4. Compliance Is Here To Stay

- 5. The Remote Workforce Is Growing

- 6. Extracting Maximum Value From Fewer Internal Apps

- 7. Evolution In Continuing Professional Development

- 8. Increased Importance Of Data Security And Control

- 9. Mental Health The Biggest Workplace Challenge

- 10. The Ideal Mix Of People + Process + Technology

1. Cloud Continues to Reign Supreme

The rise of cloud accounting software has been a continuing accounting industry trend for several years. Firms are increasingly organized around decentralized and remote teams, which is driving even faster cloud tech adoption.

- In 2020, 78% of small businesses will rely solely on cloud accounting technology.

- The global cloud accounting market size was $2.62 billion in 2018 and is projected to reach $4.25 billion by the end of 2023 (a 63% increase).

- According to Xero, accounting firms that exclusively use cloud accounting acquire 5X more customers than those who don’t.

2. AI And Emerging Technologies Come Of Age

Terms such as Artificial Intelligence (AI), Robotic Process Automation (RPA) and Machine Learning have been prominent in the industry press for several years.

In 2020, these technologies will continue to be baked into more products in tangible ways. Example applications include:

- Accounts payable and receivable

- Automated data extraction and data entry

- Natural language processing of queries such as, “How much did I spend on stock last quarter?”

- Fraud detection by analysing all transactions, not just a small sample

- Complex document and contract analysis

These applications aren’t coming soon. They’re already here.

3. Don’t Send a Robot to Do a Human’s Job

Even though technology gets better every day, there are still plenty of tasks that technology can’t do. Firms should focus on the things that can’t be automated:

- Strategic and advisory expertise

- Wowing the customer

- Telling a story with data

- Financial and business coaching

- Development of soft skills

According to LinkedIn’s Global Talent Trends Report, “92% of talent professionals and hiring managers agree that candidates with strong soft skills are increasingly important.”

4. Compliance Is Here To Stay

The rumours of the death of compliance work have been greatly exaggerated. While technology has streamlined data entry and mundane work, tax legislation continues to increase in volume and complexity.

Here’s how these countries rank in overall tax system complexity out of the 100 largest economies:

New Zealand – 12th

United Kingdom – 43rd

United States – 53rd

Canada – 57th

Australia – 62nd

Accountants: your jobs are safe for the foreseeable future!

5. The Remote Workforce Is Growing

Accounting industry trends such as telecommuting, flexible workforce and outsourcing are driving an increase in non-traditional office and team structures.

The old way was to insist that all team members physically attend a central office within officially mandated hours. The new way is to focus less on a specific physical arrangement of humans, and more on ensuring the right people are in the right roles at the right price.

As the largest global outsourcing specialist serving the accounting industry, TOA Global’s workforce growth illustrates this trend:

| Year | No. Of Staff |

| 2014 | 103 |

| 2015 | 238 |

| 2016 | 455 |

| 2017 | 665 |

| 2018 | 986 |

| 2019 | 1420 |

| 2020* | 2357 |

* Projected

6. Extracting Maximum Value From Fewer Internal Apps

Recent years have seen an explosion in cloud software for accountants. Many firms have adopted this trend with enthusiasm, but now the tide may be starting to turn.

Firms are starting to complain of “App Fatigue” and “App Sprawl”. (A well-known cloud software provider confided in us that the average firm uses only 30% of their features.)

In 2020, we predict firms will invest more time in getting full value from fewer apps, by:

- Exploring more features

- Diving deeper into staff training

- Adding integrations and automations with Zapier, ITTT and APIs.

7. Evolution In Continuing Professional Development

In a slower-paced world, the old model for professional development was to send team members to a mega-conference once every year or two. Specialized training was mostly in technical topics such as tax training. Today, one of the strongest accounting industry trends is the way learning has changed:

| Old Way | New Way |

| Infrequent learning in big chunks | Continuous Microlearning |

| Technical Focus | Soft Skills Focus |

| Mega-Conferences | Niche Events |

| Retention through promotion | Retention through development |

| Standardized learning pathways | Customized to the individual |

| Learning for its own sake | On-demand knowledge acquisition |

| Invite external experts | Grow internal thought leaders |

| Senior people teach | Anyone can teach |

8. Increased Importance Of Data Security And Control

Accounting firms have always dealt with sensitive financial information. The difference today is that a number of converging trends mean that bulletproof data security is more important than ever. These trends include:

- Vastly more data in the cloud

- Remote teams and less central control

- Cyber criminals targeting accounting firms

- Stronger privacy and data breach legislation

Firms are not only responding with security and password management software, but also ensuring that data access and control processes are robust.

As well as generic password management software, industry-specific solutions such as Practice Protect have evolved to address the needs of accounting firms in particular.

9. Mental Health The Biggest Workplace Challenge

Staff development has traditionally focused on helping team members to develop relevant skills. But according to Xero’s latest Mental Health Report, “The biggest workplace well-being challenge is employee mental health” in 72% of workplaces.

Some of the proactive strategies for addressing this challenge include:

- Education and awareness of mental health

- Building a model where chronic long hours aren’t required

- Allowing flexible hours to deal with personal issues

- Fostering a positive emotional climate

- Zero tolerance of bullying or harassment

- Moderating stress for high performance

10. The Ideal Mix Of People + Process + Technology

To date, much of the business improvement in the accounting industry has been driven by accountants responding to the question, “How can I make MY life easier?”.

Today we’re seeing growth in new business models where the focus is on making the client experience amazing.

Rather than adopt a single focus, the firm of the future will seek an ideal mix of people, process and technology:

- PEOPLE: smart people focusing on high-value sales, strategy, service and support.

- PROCESS: standardized processes and workflows that deliver results “one way, best way” every time.

- TECHNOLOGY: technology used where it can create the most impact, not for its own sake.

Conclusion

How is your firm placed to profit from the emerging accounting industry trends in 2020 and beyond?

And what decisions do you need to make now in order to ensure your firm is riding the crest of the wave?

We offer a range of services and support to help you navigate the future of accounting. Contact us to request a Free Outsourcing Strategy and Plan for your firm.