Accounting firms thrive only when they hold a lasting competitive edge; just look at the biggest names in the industry like Deloitte, EY, PwC, and KPMG, standing the test of time by constantly adapting, innovating, and expanding their global reach.

Unfortunately, most practice owners can’t build that edge because their local teams are too busy preparing invoices, chasing client payments, and scrambling to close books come deadline season.

One of the most time-intensive parts of running an accounting practice is bookkeeping, which inevitably pulls all your focus away from strategic, high-value, and competitive work, like advisory, analytics, or client relationships.

Add rising costs and the shrinking global talent pool to the equation, and you’ve got yourself a compelling reason to rethink how your firm operates, and maybe why outsourced bookkeeping is the key to long-term resilience.

Let’s explore what outsourced bookkeeping can do for your firm.

How Outsourcing Helps with Books

The well-known American investor and Berkshire Hathaway founder once drove home a powerful message to his shareholders: One that highlights how outsourcing not only bolsters and protects firms but also gives them a leg up over other practices.

When you entrust financial recordkeeping to global professionals, you don’t only free yourself from the dreaded, repetitive day-to-day grind of handling and managing books, but also achieve speed, accuracy, and compliance like no other practice can.

These are some of the ways that outsourced bookkeeping can transform your firm:

- It eliminates the need for in-house bookkeepers, allowing you to save thousands of dollars on overhead, production, and overall costs.

- It adapts to your business needs, whether you need more support during peak seasons or less during slow periods.

- It ensures accuracy by implementing advanced software and multi-step reviews to minimize errors and maintain clean, audit-ready books.

- It provides instant access to trained bookkeepers who stay updated on the latest regulations, tax laws, and best practices.

- It frees firm owners and staff from tedious financial tasks, allowing them to focus on core operations.

The Basics of Outsourced Bookkeeping

Let’s first define outsourced bookkeeping: It basically means handing over financial recordkeeping to a third-party provider instead of managing it in-house. Outsourced bookkeepers can either be local or virtual bookkeepers

- Local Bookkeepers – they live onshore, but they're not directly employed by your firm. These bookkeepers can work either in-house, online, or in a hybrid setup.

- Virtual Bookkeepers – they exclusively work online, meaning they don’t have to be physically in your state or city.

Whether you’ve already chosen between hiring a local or virtual bookkeeper, or you’re still defining the scope of their services, take a look at this list of the most common outsourced bookkeeping services:

- Accounts payable (AP) management – recording vendor bills, scheduling payments, and reconciling supplier accounts

- Accounts receivable (AR) management – issuing invoices, tracking collections, and following up on overdue payments

- Bank reconciliation – matching transactions in books with bank statements to ensure accuracy

- Payroll processing – calculating wages, deductions, and preparing pay slips or payroll reports

- Financial reporting – preparing monthly/quarterly financial statements such as profit and loss (P&L), balance sheets, and cash flow reports

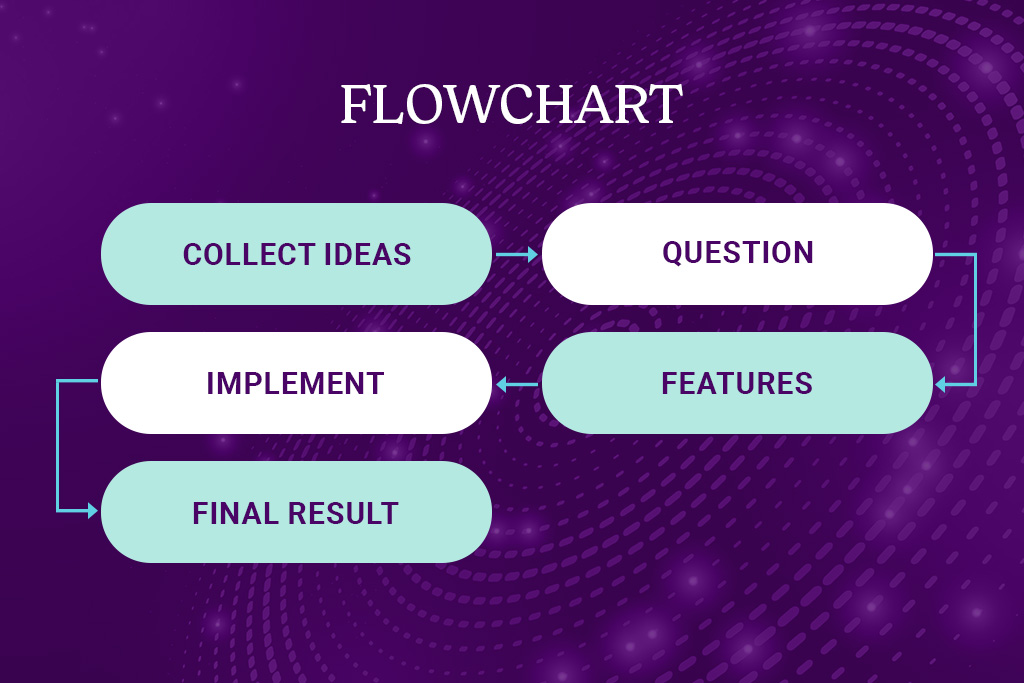

How Does Outsourced Bookkeeping Work?

Let’s go through it step by step. Outsourced bookkeeping works like this:

- Accounting firms choose their preferred bookkeeping expert, such as freelancers or service providers.

- Both parties involved agree on a business arrangement, formalized through a bookkeeping contract that outlines key terms, including work scope, duration, pay, and other relevant details.

- They acquire cloud-based accounting software, typically QuickBooks Online or Xero, to automate accounting systems.

- Accounting firms follow standard cybersecurity protocols to honor their confidentiality agreements with their clients.

- BONUS: You can leverage technology to make sure your outsourced talent handles day-to-day bookkeeping the way you want them to. Communicate with them regularly to receive updates, give your team feedback, and exchange insights with them to improve your processes.

How Outsourcing Bookkeeping Can Boost Your Firm

Is outsourcing really the unbreachable moat that Warren Buffett envisions?

Well, the short answer is a resounding (and conditional) yes. Your accounting firm is your castle. When applied wisely to bookkeeping, outsourcing can become the moat that shields it from risks and inefficiencies. In fact, outsourced bookkeeping can serve as a:

- Stronger moat through cost efficiency – Instead of draining resources on in-house bookkeeping overhead, outsourcing lets your firm scale financial operations affordably. That freed-up capital strengthens the “castle walls” by redirecting resources to core growth strategies.

- Fortified moat through accuracy and compliance – A reliable outsourced bookkeeping partner reduces risks of errors, fraud, or compliance missteps, which can erode a company’s defenses.

- Castle foundation through insight – With expert-managed books, leaders gain accurate, timely insights into cash flow and profitability. These insights are the bedrock for strategic decisions that protect and expand the moat.

While outsourced bookkeeping is a clear advantage, it’s only the beginning. When done strategically, outsourcing can reshape your firm’s internal processes, enhance agility, and unlock long-term growth from the inside out.

Outsourced Bookkeeping Best Practices

Outsourced bookkeeping delivers its full value only when guided by best practices. Here are 4 useful practices when outsourcing bookkeeping functions.

1. Leverage Cloud Accounting Tools

Cloud-based platforms like QuickBooks Online, Xero, or NetSuite allow you and your outsourced team to collaborate in real time. These tools make your books accessible anywhere, reduce delays in reporting, and improve transparency between your firm and your provider.

2. Prioritize Data Security and Compliance

When you hand over sensitive financial data, security is non-negotiable. Make sure your outsourcing partner uses encryption, secure file transfers, and complies with relevant financial regulations. Strong cybersecurity practices don’t only protect your data but also build trust with your clients.

3. Set Clear Processes and Communication Channels

Outsourced bookkeeping works best when expectations are clearly defined. Establish workflows for tasks such as invoice processing, reconciliations, and reporting. Agree on communication protocols, whether that’s weekly check-ins, shared dashboards, or ticketing systems so nothing falls through the cracks.

4. Choose the Right Partner

Not all outsourcing providers are created equal. Look for outsourced bookkeeping solutions providers with proven industry experience, strong client references, and a reputation for accuracy. The right partner shouldn’t just understand numbers, but also the unique challenges of accounting firms. With talent solutions providers such as TOA Global, you gain access to elite global experts prepared to handle your bookkeeping needs.

The Right Way to Do Outsourced Bookkeeping

By learning its basics, exploring its benefits, and following industry best practices, outsourcing your bookkeeping functions moves beyond cost-saving and becomes a sustainable strategy for accuracy, compliance, and sustainable growth.

If you’re curious how outsourced bookkeeping could fit into your firm’s workflow, talk to us today for a no-charge, obligation-free strategy call.