You’re slogging through emails. Invoicing clients. Tracking expenses. Day in and day out, until the clock hits 5pm and you’re left wondering how you’re both exhausted and unaccomplished.

If you constantly find yourself stretched beyond your capacity, you’re not alone.

But your firm’s budget is tight, and you can’t manage another full-time hire right now. What’s left to do? Consider hiring an accounting virtual assistant.

You’ve probably heard of virtual assistants (VAs)—the remote heroes who work at odd hours to get things like inbox, calendar, and project management done for busy executives. But what about accounting virtual assistants? What do they do? How are they different? And how can they help you?

What is a Virtual Assistant for Accountants?

Virtual assistants for accountants are independent and remote contractors with specialized skillsets to support CAs and financial advisers. In addition to project management, organization, and communication assistance, they can help with accounting-related tasks like bookkeeping.

Unlike your in-house employees, VAs don’t require full-time compensation and benefits. You can pay them by their hourly, daily, or weekly rates. They also offer flexibility in their arrangements: they can come on board to help when you just need an extra hand or two during peak seasons at your firm.

In short: hiring them can help you cut costs without sacrificing work quality.

And because virtual assistants are remote workers, they don’t need to clock in physically at the office or be provided with proper infrastructure and equipment. They work hours within their own time zones and locations, going online to work with you and your team at specific hours.

Hiring VAs gives you the freedom and flexibility your firm needs while maintaining productivity.

What Can They Help Me Do?

Virtual assistants can help you with various tasks to keep your firm running smoothly, like:

- Build and maintain office systems and project management tools

- Produce documents, briefing papers, reports and presentations

- Streamline and optimize business processes

- Ensure timely employee payments, expense tracking, and payroll processing

- Handle bookkeeping tasks, invoices, financial transactions, bank reconciliation, accounts payable and receivable, and billing

- Assist with data entry

- Screen inquiries and requests, handling them as needed

- Manage incoming email and phone calls, often corresponding on behalf of the recipient

- Build and develop relationships with clients, business partners, and staff

- Handles calendar management, schedules appointments, and prepares manager for meetings

- Handle varied tasks, including research, marketing, and social media

Virtual assistants for accounting firms are familiar with the processes and software that are used in accounting firms. They can do general administrative tasks like payroll processing and management and social media marketing.

Why Hire a Virtual Assistant?

Save time

Any work that is repeatable can be delegated to your VA. In turn, you can focus on growth and revenue-generating work that actually moves the needle.

For example, TOA Global Founder Nick Sinclair saved 10-20 hours a week on admin work after hiring an assistant. You’ll not only increase the chances of working normal hours—you’ll be more productive in those hours, too. Increased productivity enables your business to grow and gives you more time to focus on acquiring new clients.

Increase savings

You can hire VAs from a global talent pool. This makes it easier to find highly skilled candidates that charge rates that work for you. For example, firms that work with TOA Global can save up to 66% on their staffing costs. Their flexibility also means that you don’t need to spend on overhead costs like office space, internet, and work equipment.

Scale your firm

The nature of virtual assistants’ flexible arrangements means that your firm has the agility to either scale up or down depending on your needs. This is particularly helpful when you’re short on capacity during peak seasons.

VAs help businesses expand their client base by providing valuable insights and support during periods of growth.

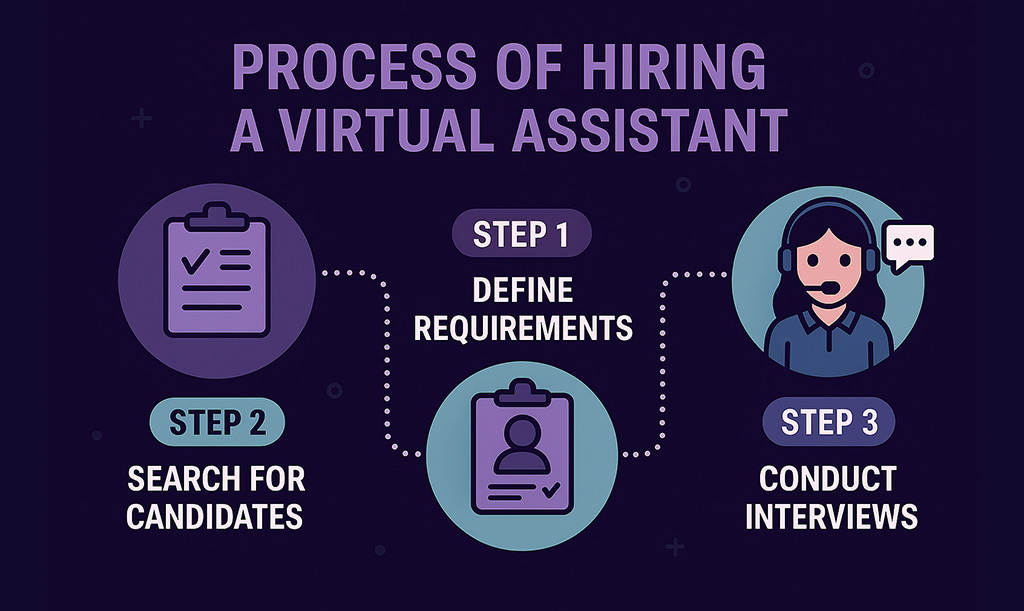

How Do You Hire an Accounting Virtual Assistant?

Identify the Skills and Expertise You Need

Hiring the right virtual assistant depends on what you need help with. Admin? Payroll management?

Auditing your needs helps you clearly identify what kind of virtual assistant to hire. This also ensures a clear scope of role and smooth communication with whoever you end up hiring.

A strong VA should have the following:

- Solid understanding of accounting principles

- Previous experience working with a firm like yours

- Strong communication skills and proficiency in your language

- Time management and organization skills

Rigorous training ensures your virtual assistant is a reliable team member who can integrate seamlessly into your business operations. If you are a CA firm, look for ones with experience in the accounting industry and familiarity with CA-specific requirements.

Ask the Right Questions During the Interview

When you hire a VA, it’s crucial that you ask the right questions to learn more about their experience and expertise. Remember, you are sourcing from a massive global talent pool. It’s essential to focus on finding the right VA who matches your firm’s specific needs.

Some good questions to ask include:

- What experience do you have working with accounting firms similar to mine?

- How do you ensure accuracy when managing financial records?

- How do you ensure client confidentiality and data security?

- Can you provide me with references from past clients?

Optimize Your Onboarding

Ready the essential documents and processes when onboarding your virtual assistant. Walk them through your workflows, SOPs, and even your tech stack. This will make their transition into your team smoother and faster.

Lastly, make sure that you protect your clients’ data by having your VA sign a non-disclosure agreement (NDA). Strict confidentiality agreements are essential for protecting sensitive financial data.

How to Outsource Tasks to a Virtual Assistant

Audit, Organize, and Integrate Financial Data

The first step to outsourcing tasks is to audit all the work you’re currently doing.

Consider the following questions:

- What do you spend the most time on?

- What tasks are repetitive? Time-consuming?

- What keeps you away from your strategic, revenue-generating work?

List them all into categories, like administrative tasks, marketing tasks, or tax and compliance tasks. Then, start your delegation process. Set clear communication standards, expectations, and timelines with your assistant. This will ensure seamless integration and collaboration as they work closely with you and your team.

How TOA Global Can Help You

If you’re interested in hiring a virtual assistant, TOA Global can help you get started.

We can connect you to our highly skilled and professional virtual assistants. Their qualifications include:

- Work experience as a corporate secretary

- Experience with systems including Xero/XPM, Now Infinity, and Microsoft Office

- Knowledge of process management

- Excellent time-management skills

Our virtual assistants also gain further training through our RTO-registered training division, the Ab² Institute of Accounting. This ensures that you get the exact help you need to keep your firm running smoothly.

To learn more, schedule a call with us.