In the fast-paced world of accounting, firms face numerous challenges that can hinder their growth and success.

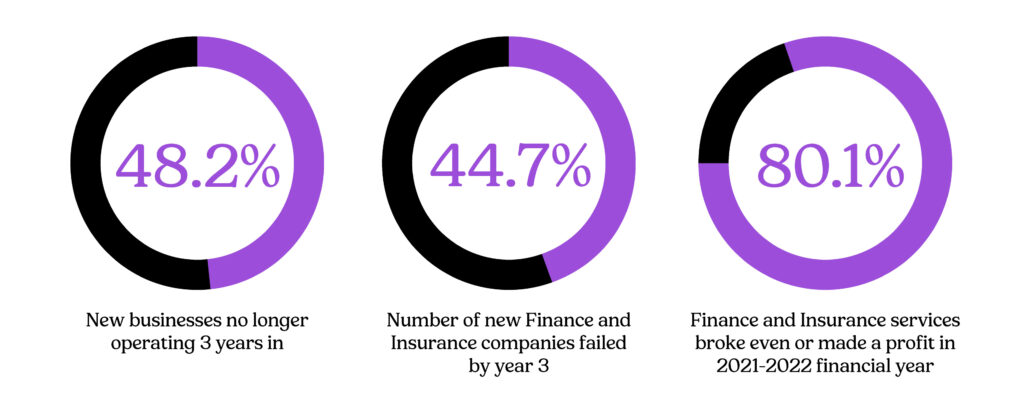

Australian Finance Business Outlook

With the global accounting services market expected to grow to approximately $735.94 billion by 2025 at a CAGR of 6%, it’s clear to see that there is a distinction between firms set up to benefit from this market growth, and firms set to struggle to adapt.

We explore the top challenges and solutions for your firm’s growth.

Challenge 1: Shift in Service Demands

Traditionally, accounting firms focused on providing compliance services for a fixed fee. However, the industry has evolved, and firms need to adapt to changing client expectations.

According to CPA Australia: “An accounting business of the future will be expected to go beyond the base-level number crunching work, with one of the most in-demand services from SME clients being business advisory.”

Agile accounting firms determined to stay relevant have shifted their focus to more comprehensive, professional client-services offerings, including advisory and consulting solutions.

Solution 1: Build Stronger Client Relationships

To stay relevant and profitable, accounting firms should shift their focus to value-add, comprehensive advisory and consulting solutions.

By building stronger client relationships and monetizing these services, firms can secure long-term success.

“There’s a widespread belief in the industry that an accountant has to choose between compliance and advisory… This simply isn’t true. The two live very happily together, and I believe this blended approach is the future of accountancy” – CPA and founder of The Small Business Project, Lynda Steffens.

Challenge 2: Skills Shortage

The accounting industry is facing a significant skills shortage with the Australian Financial Review Top 100 Accounting Firms survey showing, “three-quarters of Australia’s largest accounting firms reporting challenges in recruiting and retaining staff and that qualified auditors are especially thin on the ground.” This shortage poses a threat to the future of many firms, making it crucial to address the issue proactively.

“Three-quarters of Australia’s largest accounting firms reporting challenges in recruiting and retaining staff”

Solution 2: Talent Acquisition Strategies

For forward-thinking firms, there are solutions available in mitigating the effects of the global-industry shortage of accountants.

By implementing short and long-term talent and capacity-acquisition strategies your firm can secure the right talent at the right level and cost.

“The industry is under so much pressure with the volume of work, which means business leaders often find themselves focused solely on what they need to do now to get the work out as opposed to developing and growing their people. The benefit is that the more you grow your people, the more output they’re capable of and the more potential there is for them to add real value to your business” – Nick Sinclair, Founder of TOA Global.

With the right approach, firms can navigate the current talent crisis and emerge stronger than ever.

Challenge 3: Evolution of Technology

Technology is rapidly transforming the accounting industry, requiring firms to adapt to new practices and leverage emerging technologies. Cloud-based accounting software, data analytics, and automation are becoming crucial for efficient operations and staying competitive. Since 2020, 1 in 5 accounting firms were planning to implement additional emerging technologies to their tech stack.

Solution 3: Adapt and Upskill

As technology continues to transform the industry, it’s critical for accounting firms to focus on upskilling, ensuring they are well-placed to benefit from the changing landscape.

According to Oracle Netsuite, “the latest innovations around real-time analytics, robotic process automation (RPA) and AI will depend on having a sound, reliable, clean data infrastructure. But many companies are working with legacy, on-premises accounting systems that are outdated.”

Challenge 4: The ‘New Way of Work’

Like many industries, accounting is experiencing a shift towards flexible and remote work models.

While remote work offers benefits such as increased flexibility, work-life balance, cost savings, and access to a broader talent pool, it also presents challenges in terms of cybersecurity and adjusting to new work arrangements.

Solution 4: Prepare for Hybrid

To prepare for hybrid and remote working models, accounting firms can take several steps. First, they should establish a clear policy that outlines expectations and guidelines for remote work, while fostering effective communication and collaboration through systems. It is essential to assess the firm’s technology infrastructure to ensure it can support remote working needs, such as reliable internet connectivity and access to necessary software and tools.

Strengthening cybersecurity measures is crucial. Authentication protocols, VPNs, and encrypted communication need to be established, while protocols for handling sensitive data and remote access must be set up.

Challenge 5: Regulatory Changes

Accounting teams face ongoing challenges in order to ensure compliance, maintain professional competence, and provide accurate and reliable financial information to clients or employers. It is essential for accountants to stay updated on these regulatory changes:

- Tax Regulations

- Accounting Standards

- Audit and Assurance Standards

- Regulatory Compliance

- Data Privacy and Security

- Professional Ethics and Independence

- Financial Regulations

The need for public practice accountants to stay up to date is more crucial than ever, as emphasized by CPA Australia, due to the ongoing and frequent changes in the tax regime.

Solution 5: Research, Participate, Track and Implement

To address regulatory changes effectively, accounting firms can:

- Stay informed by monitoring official websites and industry publications.

- Encourage employees to participate in regulatory compliance-focused professional education.

- Designate a team to monitor and interpret regulatory changes and develop compliance strategies.

- Foster relationships with regulatory bodies through open communication and participation in consultations.

- Conduct regular internal audits and implement compliance management systems.

These measures, along with fostering a compliance culture, engaging external experts, participating in professional associations, and developing a regulatory change management plan, help accounting firms navigate regulatory changes and ensure compliance.

How can TOA Global assist your firm?

Increase capacity with global staff that can scale with your firm.

Free up onshore teams to provide more client-facing services.

24/7 enterprise-grade security and leading technologies.

Experienced global accounting professionals with mapped out career plans.

We’ve managed remote accounting teams for over a decade.

Find accounting talent trained in the latest Australian standards.