Whenever you hear about accounting technology trends, the words “blockchain” and “Artificial Intelligence” are usually not far behind.

And while these emerging technologies will become increasingly important, there are plenty of ways in which technology is transforming the accounting industry today. On the flip side, there are also ways in which tech won’t change the industry for many years to come.

Knowing the difference between the two is key to creating a winning strategy, and that’s what we’ll cover in this article.

6 Ways Tech WILL Transform Accounting

Technology is now an integral part of the typical accountant’s toolbox. Here are some of the ways tech is having the most impact in today’s firms, as well as a couple of emerging technologies to watch closely.

1. Data Entry

There are no prizes simply for moving data from A to B. Bank feeds, integrations, data matching and document collection technologies all assist in getting data into the right place so it can be processed, manipulated and interpreted.

Whereas a decade ago, accountants and bookkeepers may have spent many hours every week doing data entry, this is now the exception.

2. Data Integrations

Connecting systems together to create more value has never been easier or more relevant. Apps such as Zapier, IFTTT, Microsoft Flow and Workato make it relatively easy to get different data streams talking to each other. The list of applications is endless, but common themes are:

- Making data more valuable through transformations and visualizations

- Cutting out manual handling

- Shipping more value to the end users with less time and effort

Savvy accounting firms are getting value not just from integrating their own systems, but by offering data integration services to clients who are more than happy to pay for the value you create for them.

3. Cloud Accounting

Cloud accounting is now very well established. However, not every accounting firm has grasped the full implications of the cloud.

On the plus side, cloud technology has enabled real time accounting, giving clients access to the data they need to make decisions.

At the same time, the cloud has enabled savvy firms with unique market positioning to reach well beyond their geographical constraints to tap into a national or even global market.

The flip side of this is that global competitors may also start coming after your clients. It’s important to remain on the front foot to avoid becoming a victim.

4. Visibility and Transparency

When accountants used to deal with manual processes, there wasn’t a lot of transparency and visibility over activities and progress.

Now it is easy to know who is logging in and when, and where each file is up to. This means firms have to be better resourced and more process-driven to ensure you meet client expectations.

An increasing number of firms are building outsourced accounting teams to ensure they have the resources to stay on top of this process-driven work.

5. Blockchain

Blockchain or distributed ledger technology is one of those things that you seem to hear about a lot but aren’t always clear about how exactly it will be used.

We put blockchain into the “emerging technology” category because most accounting practices aren’t dealing with blockchain on a regular basis at the moment. However, that is set to change.

For example, it’s easy to imagine a blockchain ledger being used to verify company and entity details, rather than relying on a “trusted” entity such as a government department.

Relatively soon, blockchains will start to interlock and interact.

Imagine an invoice that pays itself after checking that the purchased goods have been received in the warehouse and that sufficient funds exist in the company’s bank account.

If that sounds fanciful, remember that social media as we know it didn’t exist 15 years ago. Over the coming decade, it won’t be surprising to see blockchain technology advance with similar speed.

6. Artificial Intelligence (AI)

The other blue sky technology that is frequently mentioned is Artificial Intelligence or AI.

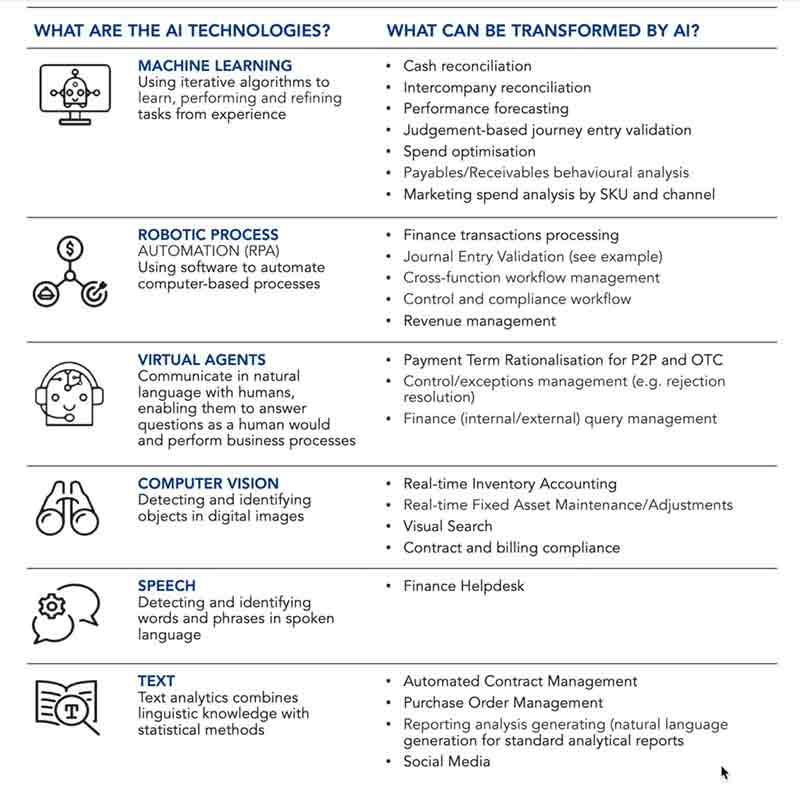

AI is already in use in the accounting industry. This table from the CPA Australia report Charting The Future Of Accountancy With AI shows a number of real examples and applications:

The common element in these applications is that they are all examples of Narrow AI. In other words, focused use cases designed to tackle a specific problem or task.

While the trend is for AI to become more and more capable over time, for the next decade or so, AI tools are likely to be used to leverage human efforts rather than replace entire roles.

4 Ways Tech WON’T Transform Accounting

Just as important as recognising where new technology can help and enable accounting firms is to recognize where it can’t.

This distinction enables firm owners to work out the dividing line between technology and people and design their ideal People Strategy accordingly.

We call these non-technology factors the 4 S’s: Sales, Strategy, Support and Service

1. Sales, Influence and Persuasion

Accountants typically sell through expertise and advice. Giving the right advice involves gaining an understanding of the client’s situation and goals, as well as many other internal and external factors.

Then, accountants translate that advice into a compelling vision that communicates value to the client in a way they can understand. When you do this successfully, a sale is made.

Understanding, empathy and charisma are the soft skills that humans have and computers do not. Therefore, consultative sales will remain at the forefront of valuable accountant skills for many years to come.

2. Strategy

Next is Strategy. Computers are great at crunching large volumes of low-level data, but humans excel at making sense of the bigger picture.

Computers can visualise and even analyze data to some extent. But it is humans who are able to interpret what the data mean and formulate a cohesive plan.

Advisory services where these interpretation skills are most important include:

- Structuring and entity setups

- Tax planning

- Financial planning

- Change management

- Advice and decision making

- Verification

- Customization

- Explanation / translation

Once again, this is the area where humans have the edge and where some of the highest-value work can be done.

3. Support

Humans also tend to be good at Support functions, including unsticking problems, explaining gaps and making it easier for the client to take action toward their goals.

While “smart” knowledge bases can interpret text and offer a range of potential solutions from content that already exists, humans are able to come up with bespoke solutions.

People are also great at providing the process-driven support that underlies an overall strategy – ensuring the background work is done to deliver.

4. Service

Service and Customer Experience (CX) is becoming an increasingly important differentiator for accounting firms.

As technology automates many of the tasks accountants used to do (such as data entry), tech becomes less of a “Wow Factor” and more of an expectation.

Great Customer Service makes the client feel good about their interactions with your firm. This in turn leads to a higher degree of trust, loyalty and reduced fee sensitivity.

This in turn leads to a higher lifetime value, better profit margins and a more pleasant working relationship with clients.

Conclusion

Understanding what technology can do so you can harness full value is critical. However, it’s equally important to understand what technology can’t achieve so you can maximise the impact your people can have.

A big part of people strategy is ensuring your staff are freed up to prioritise their time around the 4 S’s (Sales, Strategy, Support, Service).

Many firms are expanding their back-office support resources to help ensure their best people are available to deliver the highest-value work.

If you’d like to explore how we can help you expand your capacity and maximise the value delivered by every team member, get in touch to arrange a free Outsourcing Strategy and Plan for your firm.