Hire Elite Talent for Your

Accounting Firm

Join thousands of leading firms empowering their teams with job-ready outsourced accountants & bookkeepers

Hire Elite Talent for Your

Accounting Team

Join thousands of leading firms empowering their teams with job-ready outsourced accountants & bookkeepers

International Clients

Elite Team Members

Local Support

24/7

Enterprise Grade Security

1,252+

International

Clients

4,249+

Elite Team

Members

503+

Support

24/7

Grade Security

Unlock Your Firm’s Potential with Strategic Outsourced Accounting Services

Boost Capacity. Maximize Productivity. Accelerate Growth.

Vast U.S. accounting expertise: taxes, IRS, QuickBooks, personal/corporate returns…

Drafting and completing U.S. income tax returns, IRS, financial statements/report…

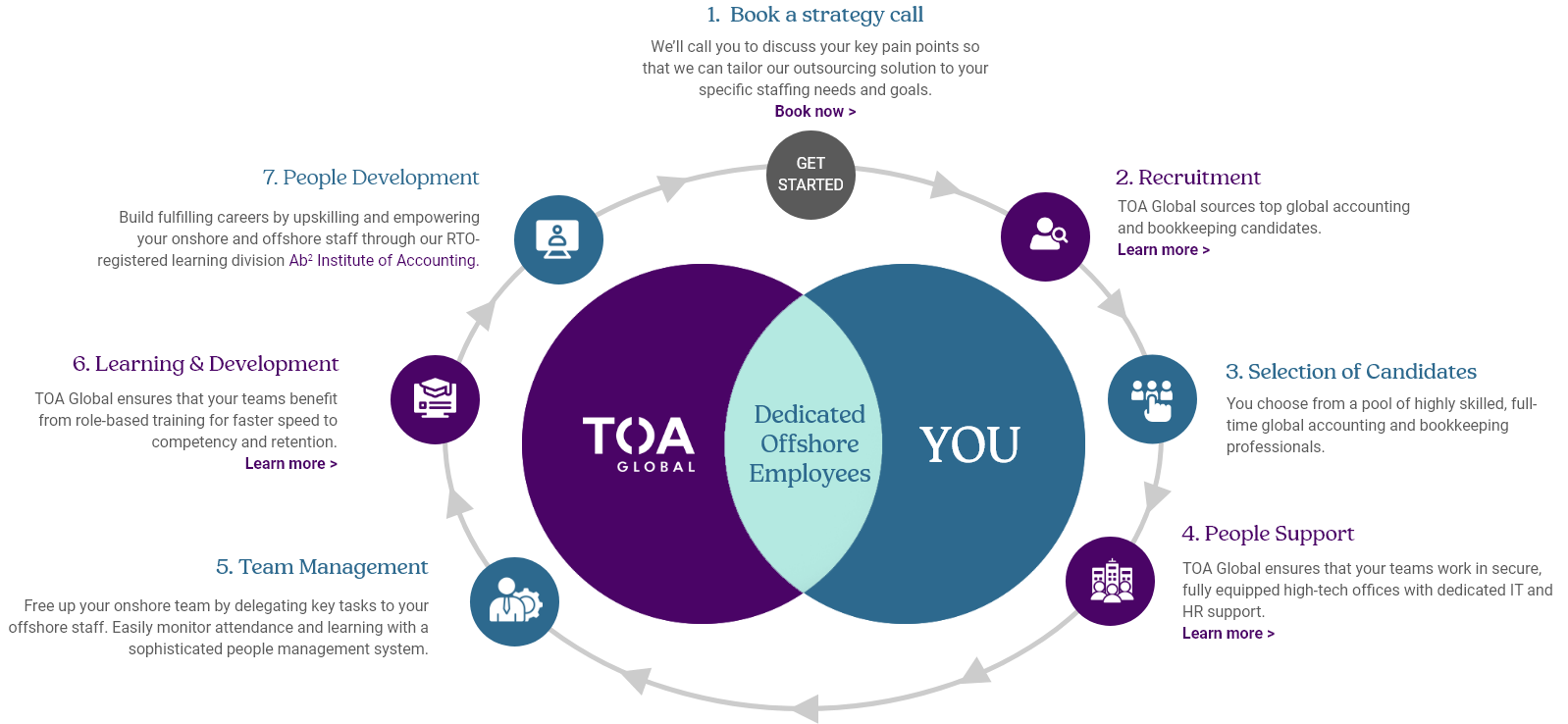

The TOA Global Difference

Build a flexible, scalable outsourced accounting team to align with your firm now and as you grow

Crush the Talent Crisis

Outsmart your competitors by adding highly skilled accounting professionals to your firm faster.

Permanently increase your firm’s capacity with a dedicated outsourced accounting team in weeks, not months.

Focus on Growth

Give your team the freedom to focus on delivering strategic growth for your firm rather than drowning in non-essential busy work.

Prioritize critical tasks essential to your firm’s long-term success while your outsourced accounting team manages routine tasks.

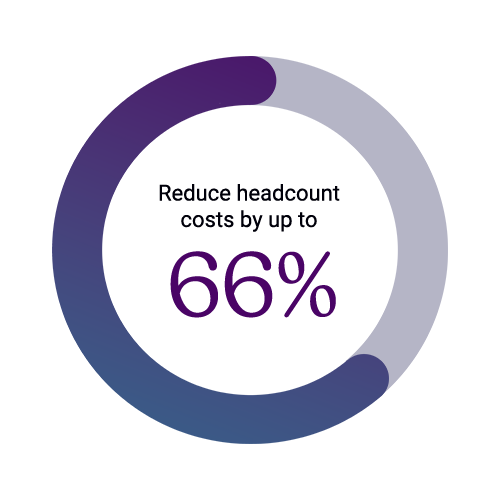

Save Thousands on Staff

Reduce headcount costs by up to 66% to increase your firm’s profitability while adding more capacity to service new clients.Access top-tier outsourced accounting talent to complement your existing team for far less than hiring equivalent local team members.

Boost Client Experience

Position your firm as an industry leader by delivering the experience your clients deserve with enhanced response times.

Leverage the power of an outsourced accounting team to build more efficient workflows and accelerate turnaround times for clients.

Elevate your firm’s success with the global leader in outsourced accounting services

Discover how our accounting outsourcing services will enable your firm to secure the right talent and simplify retention, training, and growth:

Elevate your firm’s success with the global leader in outsourced accounting services

Discover how our accounting outsourcing services will enable your firm to secure the right talent and simplify retention, training, and growth:

The TOA Global Difference

Accounting outsourcing services designed for US accounting firms

Exclusively accounting talent

TOA Global is celebrating 10+ years dedicated to serving the US accounting and bookkeeping industry with elite accounting outsourcing services.Trust the industry leader in outsourced accounting talent to add highly skilled team members to your firm in less time.

Learn more >

Each role carefully shaped for your firm

Empower your new team with role-specific training and career development through our Registered Training Organization, the Ab² Institute of Accounting.Choose the accounting outsourcing partner dedicated to training, growing, and retaining elite talent for your firm.

Learn more >

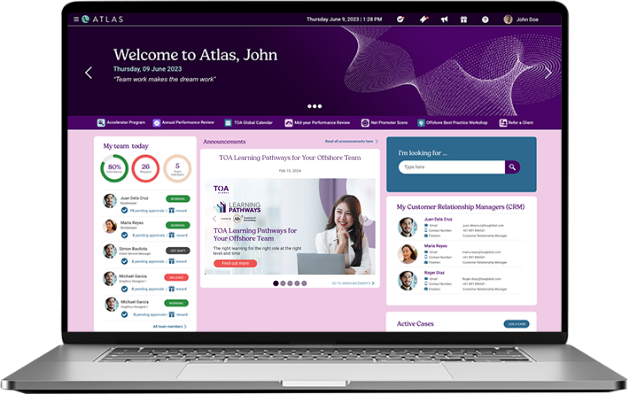

Dedicated support when you need it

Access dedicated client support 24/6, including live chat and knowledge base articles. Team management, oversight, and engagement tools are available through a custom-made people management platform.

Guarantee your outsourced accounting team’s success with custom-made tools designed for distributed global teams.

Learn more >

Enterprise-grade security for total confidence

Protect your firm’s reputation and data with enterprise-grade security to guard against cyberattacks and keep sensitive information safe. Access advanced security platforms and training focused on keeping your firm’s information secure.Ensure that your clients’ sensitive information and data are always secure with the leader in accounting outsourcing services.

Learn more >

1,190+

International Clients

4,180+

Elite Team Members

480+

Local Support

24/7

Enterprise Grade Security

Explore Our State-of-the-Art Workspaces & Facilities

Book Your Free Strategy Session

Partner with industry experts who understand your unique challenges and goals

Industry Insights

BLOG

Email Etiquette Rules for Accountants: Is Your Inbox Costing You Billable Hours?

Key Takeaways Clear, concise emails free up time for higher-value work. With the average employee spending 11 hours a week on email, small improvements in how you communicate can lead to significant time savings. Practice proper email etiquette to keep your inbox manageable. Clear subject lines, brief bodies, and correct use of the CC/BCC fields prevent miscommunication. Setting boundaries around response times also protects your focus time. Consider delegating inbox management to an executive assistant. An EA who can triage emails and handle administrative tasks lets firm owners focus on billable work while maintaining formal communication. We hope this blog finds you well. Or as well as when a similar line landed in your inbox. Like with many business emails, you probably skimmed past it to get to the actual message. That’s time saved, and accountants don’t always have time to spare. Research by Slack and OnePoll shows that the average employee spends almost 11 hours a week drafting emails, each taking 5.5 minutes. For accounting firms, email volumes likely spike during tax season, when client questions and document requests flood in. If you’re a firm owner, your hourly rate makes emailing one of your business’ most expensive tasks. That’s

WEBINAR

Elevating Advisory Services: The Impact of Small Business Lending in Accounting Firms

Could small business lending spark the next “gold rush” for accounting firms? ON DEMAND WEBINAR Elevating Advisory Services: The Impact of Small Business Lending in Accounting Firms Could small business lending spark the next “gold rush” for accounting firms? Embedded finance saw a meteoric rise in 2021, raking in $4.2 billion in revenue. Financially driven sectors like retail and insurance are integrating embedded finance to diversify their services and explore new revenue streams. Small business lending offers a natural starting point for accounting firms to delve into embedded finance, leveraging their deep understanding of their clients’ business models and financial behavior. Hear from Sasha Yablonovsky, CEO of Loanspark, and Shirley Koss of TOA Global as they discuss how accountants can successfully implement business lending services into their practice and become the go-to financial partners to clients. Key Takeaways Exploring the role of business lending in today’s embedded financial ecosystem The unique advantages business lending offers to modern accounting firms A comparative look: business lending for large firms vs. small and medium businesses Integrating business lending services into comprehensive client advisory strategies How global talent empowers accounting firms to deliver enhanced advisory services How incorporating global talent can position your firm for growth Sasha Yablonovsky CEO and Co-founder, Loanspark Sasha is

PODCAST

RISHI RAM: How the TOA Global Accelerator Program helped build an offshore team

Rishi Ram, partner at Optima Accountants, talks to us about setting up his offshore team, how he went about the offshoring process, and hiring a candidate from the TOA Global Accelerator Program.

Moving your Firm Forward

Sign up for our newsletter and get regular developments in talent acquisition, people management and training for accounting firms.